Think about turning your often-overlooked accounts payable (AP) division right into a strategic powerhouse. Whereas companies concentrate on optimizing each nook of their operations, AP usually stays neglected regardless of its untapped potential.

The way forward for accounts payable lies in AP automation, which may flip this conventional back-office perform right into a key driver of progress.

As companies face growing monetary pressures, the fashionable AP workforce should evolve past handbook duties. Within the new period of accounts payable— each bill processed ought to be a step in direction of long-term success.

AP automation: A panorama of alternative

Constructing on accounts payable‘s evolving position, the AP automation market affords a variety of options to fulfill this new strategic crucial.

These instruments transcend easy digitization, providing complete platforms that automate bill processing, streamline approvals, and optimize fee workflows.

Discovering the best vendor will be overwhelming with so many gamers within the AP automation market. This overview highlights vital suppliers providing options to streamline workflows, optimize funds, and enhance effectivity.

From AI-driven platforms to full-service automation, these prime AP automation distributors assist organizations future-proof processes and unlock priceless assets.

| AP Resolution | Market Section | Worth Proposition | G2 Ranking* |

|---|---|---|---|

| Nanonets | Midmarket + Enterprise | AI-powered bill OCR automation with customizable workflows | 4.8/5 |

| Tipalti | Midmarket + Enterprise | World funds automation with tax compliance | 4.5/5 |

| AvidXchange | Midmarket + Enterprise | Paperless processing with intensive system compatibility | 4.3/5 |

| Stampli | Midmarket | Consumer-friendly interface with real-time collaboration for fast bill approvals | 4.6/5 |

| MineralTree | SMB + Midmarket | Full AP automation with ERP integration and fraud safety | 4.5/5 |

| BILL AP/AR | SMB | Straightforward-to-use AP automation for funds and vendor administration | 4.4/5 |

| Basware | Enterprise | Scalable AP and procurement automation for international operations | 4.3/5 |

| SAP Concur | Enterprise | Complete spend administration built-in with ERP methods | 4.0/5 |

| NetSuite | Midmarket + Enterprise | All-in-one ERP with automated AP workflows and detailed monetary analytics | 4.4/5 |

| Coupa | Midmarket + Enterprise | Procurement and AP automation with real-time spend visibility | 4.2/5 |

| Beanworks | SMB + Midmarket | Streamlined bill approvals with accounting integration | 4.5/5 |

| Melio | SMB | Versatile fee choices with automated reconciliation | 4.5/5 |

*G2 rankings are as of 18th October, 2024

Need the entire information to reworking your AP perform?

Challenges with present accounts payable processes

Because the accounts payable (generally known as “AP” or “payables”) course of evolves, organizations are caught between the promise of full automation and the truth of what present options provide.

AI-powered, end-to-end AP methods are supposed to simplify every part from procurement to fee, eradicating the necessity for handbook work. Nevertheless, most current instruments solely automate sure components, leaving companies to cope with handbook workarounds or additional software program. This creates many inefficiencies and challenges.

Let’s take a better take a look at a few of the widespread points companies face with these partial options.

Integration complexity and overreliance on consultants

A significant problem in AP automation is integrating numerous instruments for various duties.

Many companies depend on a number of methods for OCR knowledge seize, bill processing, approvals, and fee reconciliation, which makes the method prolonged, costly, and extremely inefficient.

For instance:

💡

They overcame this by adopting Nanonets’ unified AP automation resolution, which streamlined workflows and achieved 90% automation in bill processing. This considerably lowered the necessity for handbook intervention and allowed for quicker, extra correct processing.

Many firms face comparable challenges. They depend on specialised abilities or consultants for customized integrations, which will increase complexity and prices. Such firms additionally must spend closely on third-party implementations because the AP supplier fails to undertake to fashionable improvements and challenges.

The way forward for AP lies in seamless, built-in platforms that get rid of the necessity for disjointed methods and reliance on exterior consultants.

Restricted or nonexistent stock administration and PO matching

Many AP platforms lack strong stock administration or item-level PO matching. This forces companies to manually reconcile POs with invoices, slowing the method and growing errors. It additionally creates a spot in automating the complete procure-to-pay cycle.

Automated methods that help 2-way or 3-way matching are vital for verifying that invoices match POs and items acquired, lowering the danger of overpayment or fraud. As an example, 3-way matching ensures that invoices, POs, and receipts are cross-checked earlier than fee, bettering accuracy and compliance.

If you happen to’re contemplating adopting an automatic AP resolution, search for instruments that supply seamless PO matching capabilities to keep away from handbook reconciliation and guarantee a smoother, extra correct fee course of.

Reliance on handbook methods of working

Many AP groups nonetheless must depend on handbook entry for bill coding and knowledge enrichment, which will increase the danger of errors and slows down the method. With out AI-driven instruments, these platforms cannot routinely apply the proper common ledger codes or detect discrepancies in bill knowledge.

This lack of intelligence in current methods ends in inefficiencies, making it tougher for AP groups to maintain up with excessive bill volumes and keep accuracy.

💡

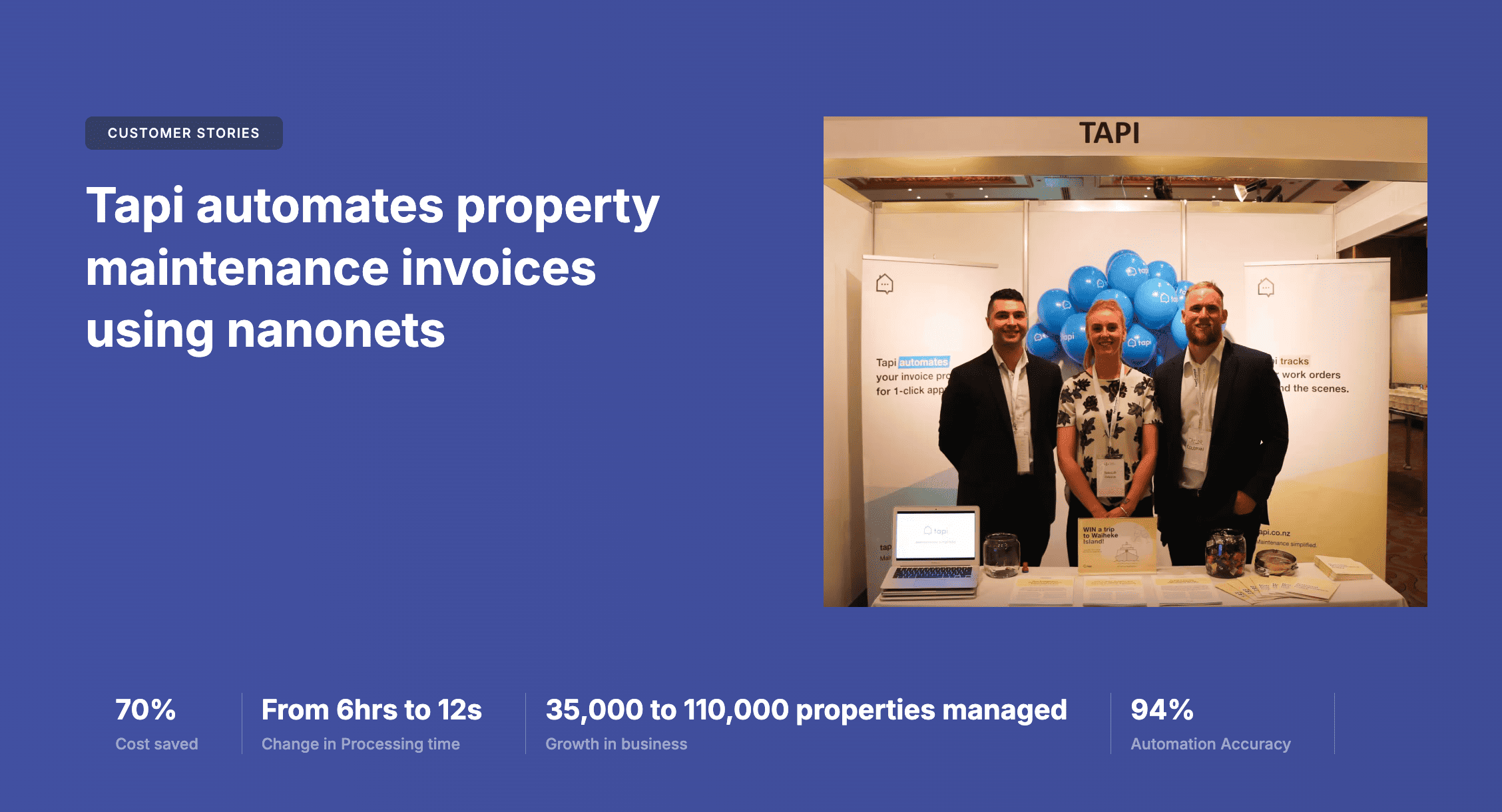

By adopting Nanonets, Tapi lowered prices by 70%, and bill processing time dropped to simply 12 seconds, vastly enhancing their effectivity and buyer expertise.

Restricted approval routing customization and poor exception dealing with

💡

So, now we have now an automatic workflow system that streamlines the invoice-approval course of. It assigns invoices by due dates and quantities so crucial payments are paid first, preserving money circulate wholesome. It actually cuts the purple tape and permits us to higher allocate our funds.”

– Thomas Franklin, CEO, Swapped

Approval routing is commonly an enormous problem for AP groups, particularly in companies with advanced workflows. Managing bill exceptions with out clever automation is handbook and time-consuming.

For instance, mismatches between a purchase order order (PO) and an bill usually want handbook overview, inflicting delays and inefficiencies.

Conventional methods provide inflexible approval processes that sluggish bill approvals and create bottlenecks, resulting in delays and errors. These methods lack AI capabilities for automated exception dealing with, resulting in elevated intervention from AP groups.

💡

“We lowered our handbook workload by 90% utilizing Nanonets’ automated workflows.” – Blissful Jewelers

Adopting versatile approval routing by automated workflows will assist AP groups handle excessive bill volumes extra effectively, lowering errors and bettering monetary oversight.

Cross-border multi-currency transactions

The way forward for AP automation will concentrate on simplifying advanced, cross-border transactions.

Managing totally different currencies, tax rules, and compliance guidelines throughout international locations will be overwhelming for AP groups, however AI-driven automation may help. These methods can routinely deal with real-time forex conversions, validate taxes, and scale back handbook errors.

For instance, Nanonets’ two- and three-way matching options evaluate invoices with buy orders and receipts, making the fee course of quicker and extra correct with out the necessity for handbook checks.

Nanonets automates multi-currency reconciliation by syncing straight with ERP methods. With AI-powered instruments like these, AP groups can streamline international transactions, guaranteeing funds are processed precisely and on time.

Key applied sciences in future AP processes

The way forward for AP lies in clever automation, but adoption usually faces hesitation.

Considerations about complexity and job safety can overshadow these applied sciences’ transformative potential. Nevertheless, AI and associated instruments help human capabilities somewhat than exchange them.

Let’s take a look on the key accounts payable automation applied sciences that AP groups should discover and undertake:

AI-driven bill processing

Automated bill processing, pushed by AI, can considerably remodel a company by addressing inefficiencies in conventional strategies.

AI-powered instruments streamline the payables course of from begin to end, automating the seize of invoices, matching them towards buy orders and supply notes, routing them for approval, and recording transactions inside accounting methods—all in just a few clicks.

💡

Nanonets has enabled companies to scale back bill processing instances by 60% and reduce prices dramatically, demonstrating the potential of AI-driven automation to enhance effectivity, accuracy, and price financial savings.

💡

One important problem in AP is managing knowledge accuracy and handbook errors. By implementing AI-driven instruments for knowledge administration, I’ve improved payment-collection effectivity by 54%. This method ensures that knowledge errors are at a minimal, enhancing each accuracy and operational circulate.”

– Ryan T. Murphy, Gross sales Operations Supervisor, Upfront Operations

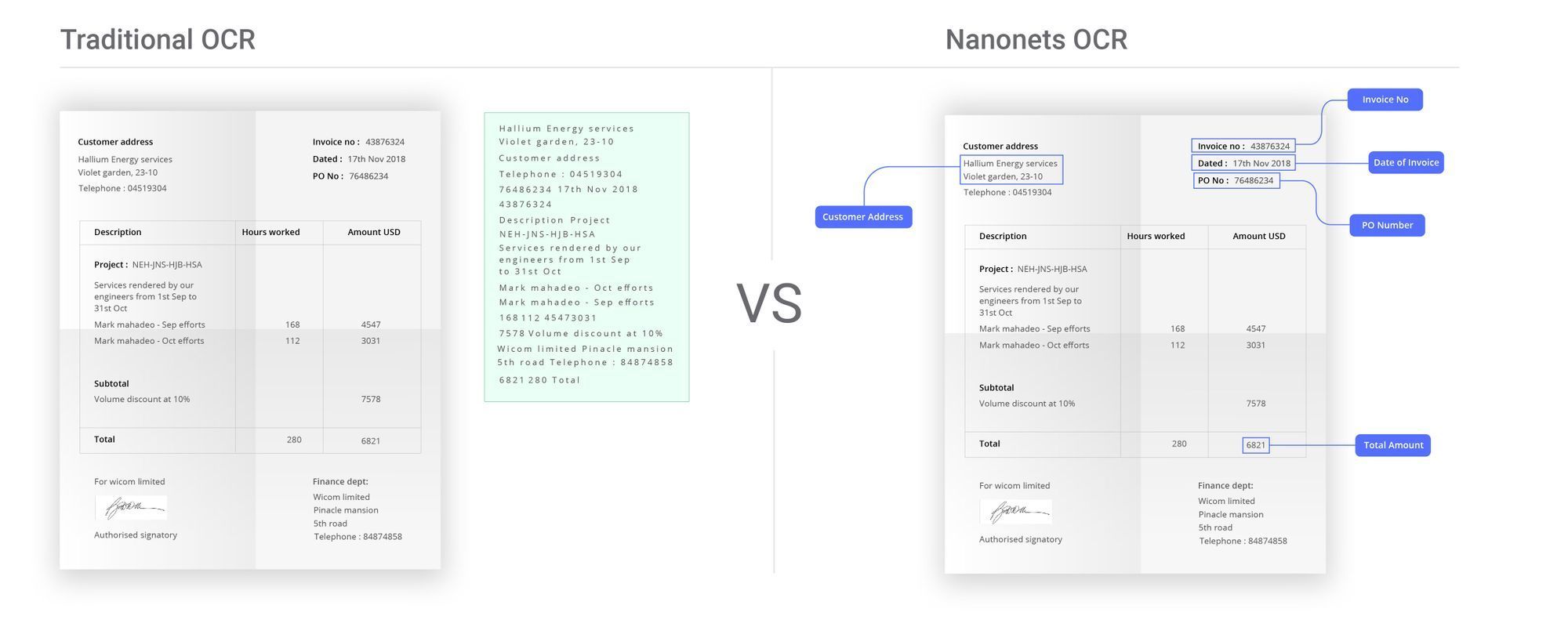

OCR and NLP enabled bill seize

AI-powered OCR and NLP applied sciences have revolutionized bill seize, considerably easing the workload of AP groups by automating the extraction of bill knowledge from scanned paperwork, PDFs, or pictures, no matter format.

This automation eliminates the necessity for handbook knowledge entry, drastically lowering errors and accelerating bill processing instances.

💡

With such instruments, AP groups can concentrate on higher-value duties whereas the system precisely captures vendor particulars, bill numbers, and quantities, streamlining the workflow.

Bill templates: AI vs template-based options

Conventional AP methods depend on pre-defined templates to course of invoices, however AI-driven methods be taught and adapt to new codecs, lowering the necessity for fixed updates.

Template-based options require steady handbook changes, whereas AI methods routinely acknowledge new bill constructions, providing higher flexibility and scalability.

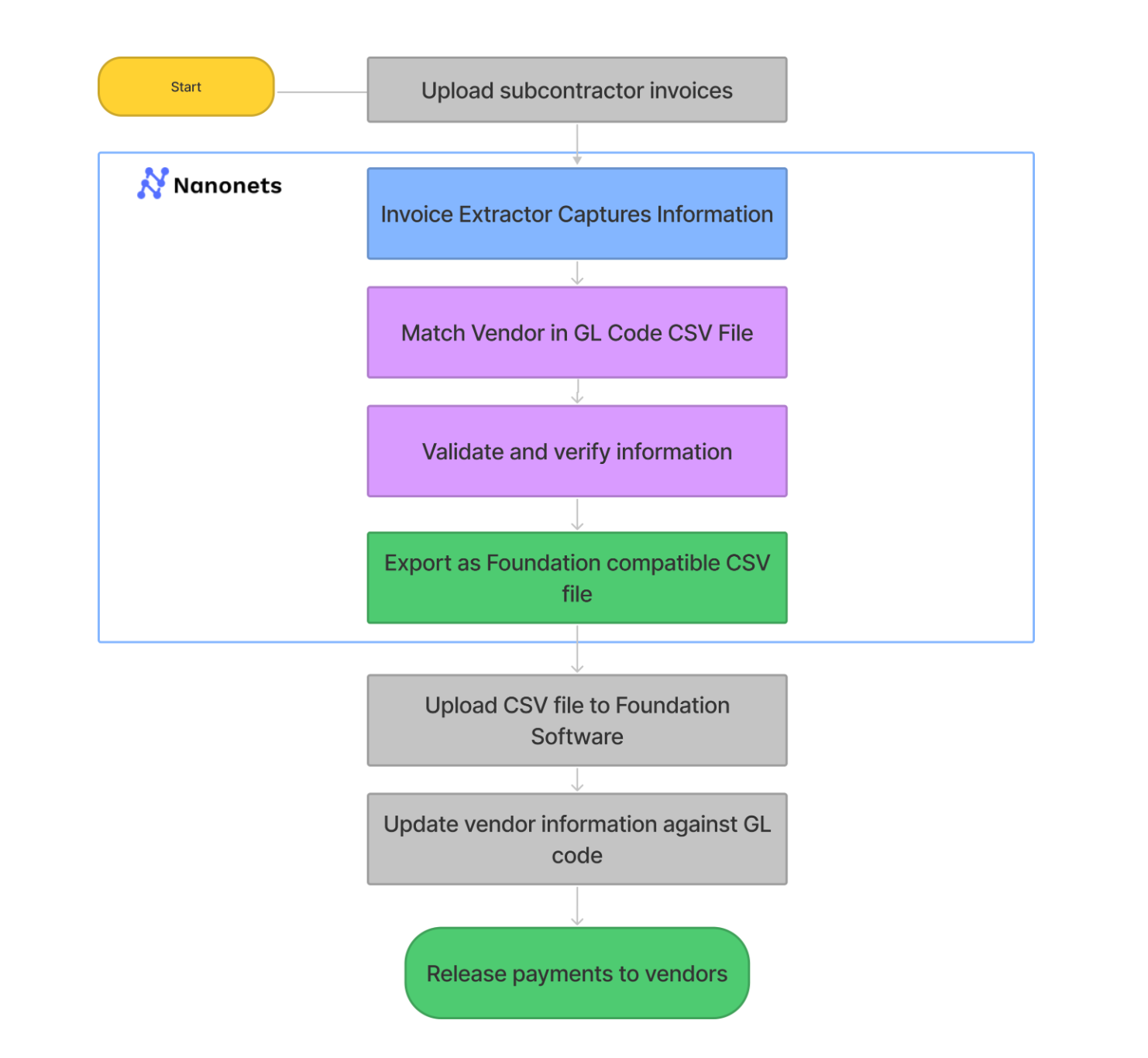

ACM Companies, a Maryland-based remediation contractor, is an instance of a shift from template-based to AI-driven bill processing. Earlier than implementing Nanonets, ACM relied on conventional methods that required steady handbook changes to course of invoices attributable to inflexible templates.

💡

ACM saved 90% of its time on handbook knowledge entry, making its AP processes way more environment friendly.

Automating 3-way matching

AI-based automation enhances the 3-way matching course of by cross-referencing invoices, buy orders, and supply receipts in real-time. This ensures that each element, resembling portions and costs, matches throughout paperwork earlier than processing funds, lowering discrepancies and delays.

💡

By automating these duties, Tapi lowered their AP prices by 70%, highlighting how AI-driven 3-way matching can enhance accuracy, velocity, and effectivity for high-volume AP groups.

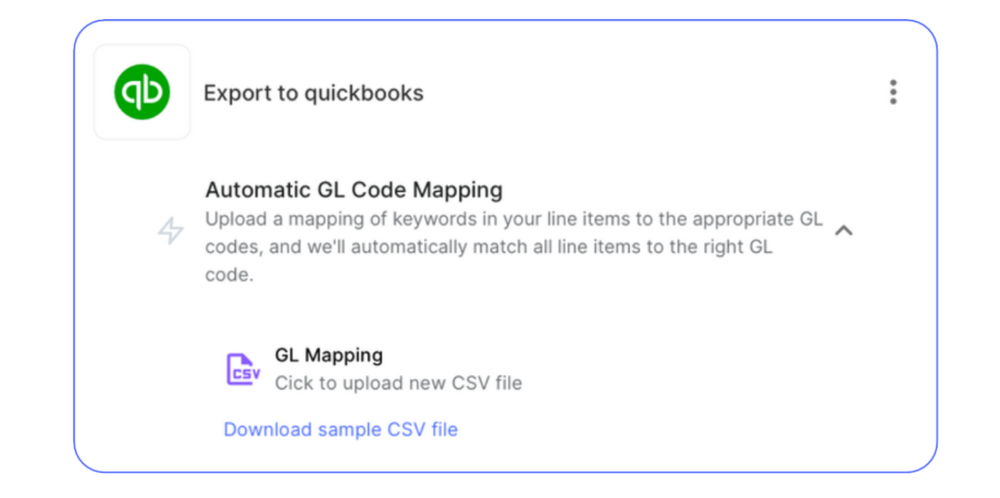

Machine studying for GL coding

Handbook GL coding is usually a time-consuming and error-prone course of, particularly for AP groups coping with massive volumes of invoices. Historically, AP workers manually assign common ledger (GL) codes primarily based on bill knowledge, usually resulting in inconsistencies and delays in monetary reporting.

Research present that firms utilizing automated GL coding can course of greater than 18,649 invoices per full-time worker yearly, in comparison with simply 8,689 for these nonetheless counting on handbook strategies.

This shift to automation ends in important time financial savings and price reductions.

💡

ACM achieved a 90% discount in handbook knowledge entry, which not solely streamlined their AP operations but additionally considerably improved the accuracy of their monetary reporting.

Here is the workflow that Nanonets carried out for ACM:

Adopting machine studying for GL coding empowers AP groups to function with greater effectivity, scale back operational prices, and keep extra correct monetary data.

Robotic Course of Automation (RPA) for multistep workflows

Based mostly on pre-set guidelines, RPA streamlines AP processes by automating multi-step workflows, resembling bill receipt, approval routing, and vendor funds. This eliminates handbook intervention, improves accuracy, and reduces bill processing instances.

💡

Automating duties primarily based on worth thresholds lowered delays and improved effectivity, permitting the workforce to deal with excessive bill volumes with out additional workers. Giant invoices had been despatched for senior administration approval, whereas smaller ones had been auto-approved.

Upskilling for the AI future: How AP groups can get forward

Because the monetary panorama quickly evolves, AP groups face growing strain to turn into future-ready. The times of handbook knowledge entry and fundamental bill processing are shortly fading.

AP professionals should embrace AI, automation, and data-driven decision-making to remain aggressive and contribute strategically to their firms.

These rising applied sciences aren’t simply tendencies; they’re important instruments that can redefine how AP groups function—enabling quicker, extra correct processing, lowering errors, and bettering general effectivity.

Being future-ready isn’t nearly preserving tempo; it’s about main the way in which in effectivity, compliance, and monetary optimization. To realize this, AP groups should proactively develop abilities that transcend conventional roles. Let’s discover the core abilities AP groups want:

Studying Synthetic Intelligence (AI) for AP duties

AI in AP isn’t nearly automating repetitive duties; it may additionally scale back errors and enhance effectivity by routinely matching invoices with buy orders (POs) and flagging discrepancies.

💡

AP groups ought to perceive easy methods to shortly configure these fashions to adapt to particular use circumstances, lowering the training curve and rushing up implementation.

Utilizing Machine Studying (ML) for predictive AP insights

ML may help predict fee patterns, optimize money circulate, and enhance budgeting accuracy.

💡

Instruments like Tipalti use ML fashions to establish seasonal tendencies or forecast fee schedules. Utilizing Nanonets, AP groups can flag duplicate invoices and likewise detect fraud quicker.

AP professionals ought to concentrate on studying to interpret ML outputs from such instruments, resembling detecting discrepancies in fee patterns, to deal with potential points and keep money circulate well being preemptively.

Leveraging knowledge analytics for strategic AP decision-making

Analytics instruments like Energy BI and Tableau allow AP groups to visualise KPIs resembling bill cycle instances, vendor efficiency, and processing prices.

As an example, making a dashboard that tracks real-time fee approvals and bottlenecks may help AP groups establish inefficiencies and implement cost-saving measures. AP professionals ought to apply constructing such dashboards and deciphering tendencies to make strategic selections that improve their efficiency.

Utilizing low-code and no-code platforms for personalization

Sooner or later, extra non-technical AP professionals or “citizen builders” will discover low-code and no-code platforms for automating accounts payable processes, making it simpler for groups to construct customized options with minimal coding.

💡

Microsoft Energy Apps, Mendix, Appian, OutSystems, and Zoho Creator are at present widespread no-code/low-code instruments.

These platforms use drag-and-drop interfaces, pre-built templates, and visible workflows to automate bill approvals, knowledge seize, and fee reconciliation processes.

Extra such platforms are anticipated to turn into widespread for AP workflows with altering enterprise wants and compliance necessities. These platforms may have prebuilt APIs and connectors that may seamlessly combine with current ERP methods, databases, and fee platforms.

Adopting mobile-friendly AP options

Distant work and cell workflows are rising tendencies in AP automation. AP groups ought to get aware of cell options that enable bill approvals, fee monitoring, and knowledge entry on the go to extend productiveness and responsiveness even when working remotely.

These options will embody self-service vendor portals, enabling suppliers to submit invoices, verify fee statuses, and handle account particulars straight. AP groups can obtain prompt alerts for bill approvals, fee standing updates, and vendor communication, guaranteeing they keep knowledgeable and might act swiftly to stop delays.

Constructing a tradition of innovation and steady studying in AP departments

Constructing a tradition of steady studying is significant for AP groups to harness the advantages of AI and associated applied sciences absolutely. Encouraging a progress and innovation mindset permits groups to maintain tempo with quickly altering technological calls for.

💡

Corporations like Amazon and PwC have led the cost by investing in workforce upskilling initiatives targeted on AI capabilities.

By fostering collaboration on AI-related initiatives and offering alternatives for hands-on studying, organizations can empower AP professionals to drive innovation.

Emphasizing steady studying will assist companies keep agile and future-proof in a tech-driven panorama.

Trying to remodel your AP processes with automated bill processing? Discover Nanonets AP automation.