Accounting is evolving, and AI is main the cost. With the AI accounting market set to hit $26.66 billion by 2029, instruments like ChatGPT are reworking the best way accountants work.

However ChatGPT’s entry and common acceptance have put the highlight on AI. Whereas there may be pleasure, consultants have additionally highlighted issues.

The most typical concern amongst accounting professionals is whether or not ChatGPT will change accounting jobs. The reply isn’t any—ChatGPT ought to be seen as an assistant, not a substitute. Let’s learn how.

How can ChatGPT assist accountants?

ChatGPT permits accountants to give attention to higher-level strategic work by automating tedious duties. By utilizing it correctly with human oversight for accuracy and nuanced decision-making, ChatGPT can considerably increase your accounting effectivity with out compromising high quality.

💡

In contrast to in style opinion, ChatGPT is not right here to switch accountants—it is right here to tackle the grunt work so you may give attention to what issues: driving monetary insights and constructing consumer relationships.

ChatGPT could be a helpful device for accountants. It may –

- Enhance productiveness by automating repetitive each day duties

- Help in creating funds plans

- Put together consumer assembly agendas

- Automating consumer communication

- Categorizing fields in monetary paperwork

- Offering helpful insights from paperwork

- Analyze monetary traits

- Help with promoting for accounting companies

- Assist payroll processing

- Streamlining compliance duties

- Increase fraud detection

– all with larger effectivity!

For instance, ChatGPT can course of 1000’s of transactions in just some minutes, making it simpler to establish monetary traits.

It may spotlight patterns akin to a 15% rise in operational prices or a 10% dip in gross sales, permitting you to identify potential points shortly. Such a data-driven strategy can result in as much as 20% enchancment in monetary forecasting accuracy by serving to you make extra knowledgeable and well timed selections with larger precision and pace.

Accounting GPT mannequin of ChatGPT

ChatGPT Accounting refers to a custom-made ChatGPT mannequin that’s tailor-made for particular accounting duties. It isn’t a definite product launched by OpenAI beneath that identify. As per ChatGPT Accounting itself:

- ChatGPT Accounting is educated to grasp accounting requirements (e.g., IFRS, GAAP), monetary assertion evaluation, auditing practices, tax laws, and different industry-specific monetary ideas and insurance policies.

- It’s particularly helpful for professionals searching for assist with particular areas like monetary reporting, value accounting, funding value determinations, budgeting, tax filings, and even worldwide accounting variations.

How ought to accounting companies and accountants use ChatGPT?

Whereas ChatGPT is famously identified for its content material creation, accountants and accounting companies can use it to spice up productiveness and day-to-day efficiencies in some ways.

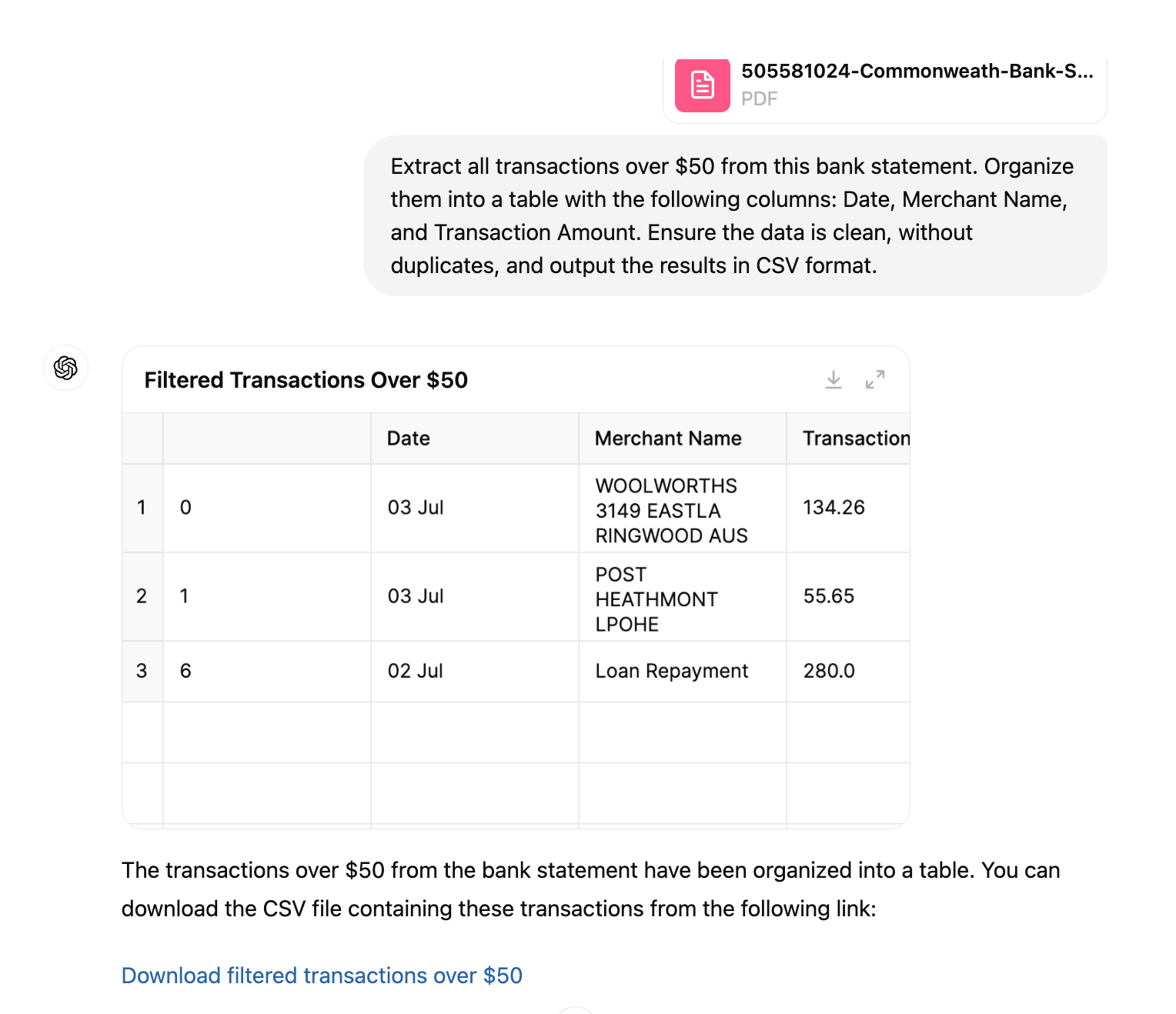

Bookkeeping, information entry, and information extraction

These are the important thing areas the place ChatGPT can considerably help accounting companies.

ChatGPT can shortly extract related data from unstructured paperwork akin to PDFs, financial institution statements, and invoices by automating repetitive duties like categorizing transactions, inputting information from invoices, and managing receipts.

ChatGPT helps arrange the info into structured codecs like spreadsheets or CSV information, lowering handbook work by almost 80%. This boosts productiveness and minimizes errors in day-to-day operations.

💡

Immediate instance: Extract all transactions over $50 from this financial institution assertion. Arrange them right into a desk with the next columns: Date, Service provider Title, and Transaction Quantity. Guarantee the info is clear, with out duplicates, and output the ends in CSV format.

Taxation and auditing

💡

– Gary Hemming, Proprietor & Finance Director, ABC Finance

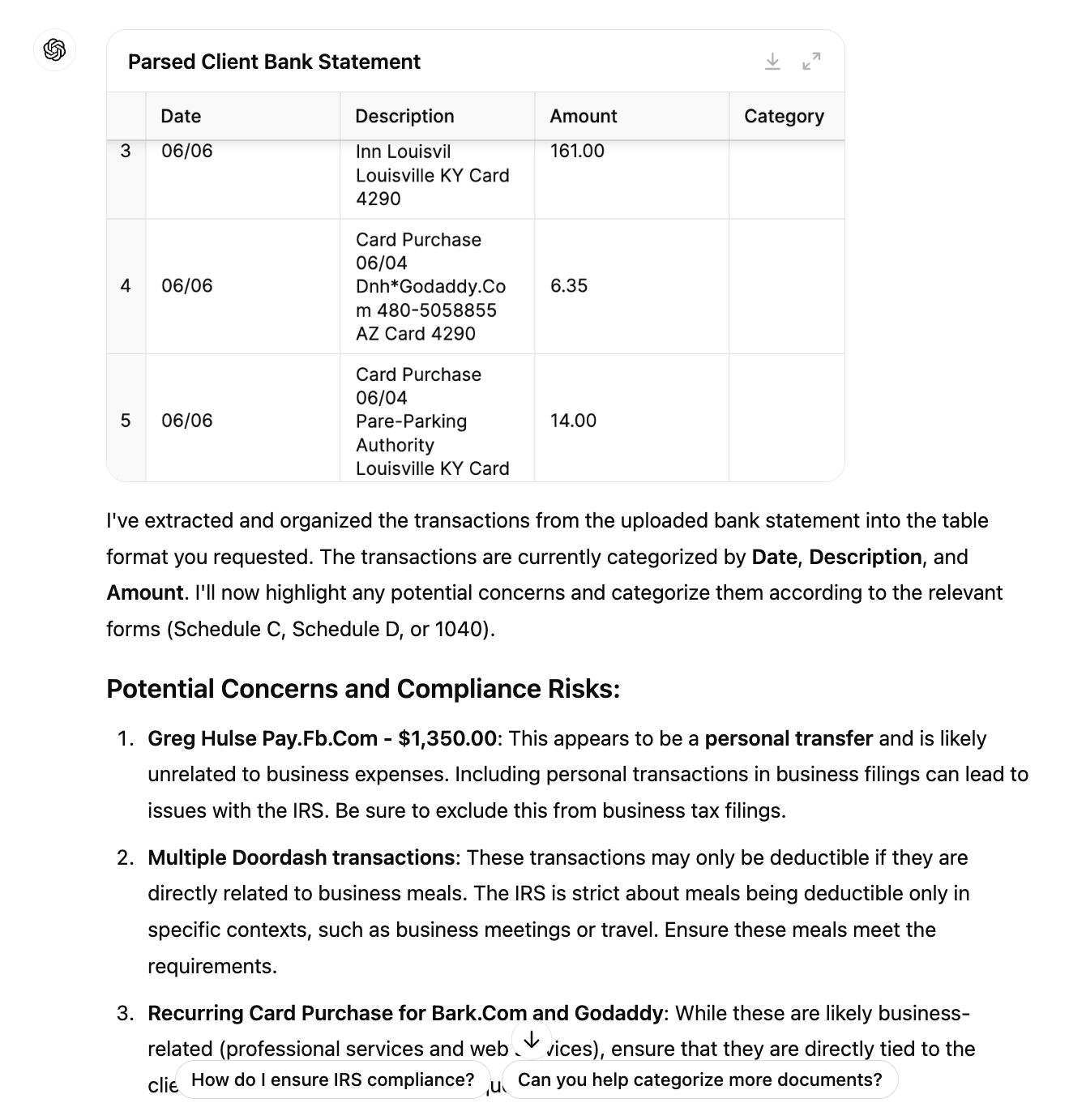

Taxation

ChatGPT 4.0 can summarize complicated tax legal guidelines, generate tax submitting drafts, and even counsel potential tax-saving methods based mostly on the monetary information offered (offered you give specifics about your necessities).

It may additionally help in making ready paperwork for compliance checks by summarizing related tax laws shortly, making certain that companies stay up to date with ever-changing legal guidelines.

Tax legal guidelines change regularly. Somewhat than spending time studying and understanding them periodically, ChatGPT can shorten the educational curve by serving to you perceive adjustments.

💡

Immediate instance: “I’m an accountant working with a consumer based mostly in [client’s location]. I need assistance analyzing their financial institution assertion for tax submitting functions. Please analyze all transactions and spotlight any potential IRS audit triggers, suspicious private bills, or compliance dangers. Arrange the transactions right into a copyable desk with columns for Date, Service provider Title, and Transaction Quantity. Categorize the transactions in line with their relevance for Schedule C, Schedule D, and 1040 filings.

Auditing

ChatGPT could be a helpful device for accountants within the auditing course of. It may help in creating audit checklists, plans, templates, and stories, making certain that each one vital steps, akin to inner management opinions, threat evaluation, and compliance checks, are coated effectively.

ChatGPT may assist analyze massive information units, flagging uncommon transactions or discrepancies which will require additional investigation.

Moreover, it could possibly draft and automate audit documentation, saving time and lowering handbook errors. By integrating ChatGPT into the audit course of, accountants can streamline audit planning, improve accuracy, and give attention to higher-value duties akin to strategic evaluation and threat administration.

💡

Reconcile the overall ledger with the financial institution statements, confirm the accuracy of economic stories, establish any tax compliance points, and assess the corporate’s inner controls. Spotlight any monetary dangers and supply suggestions for enchancment.”

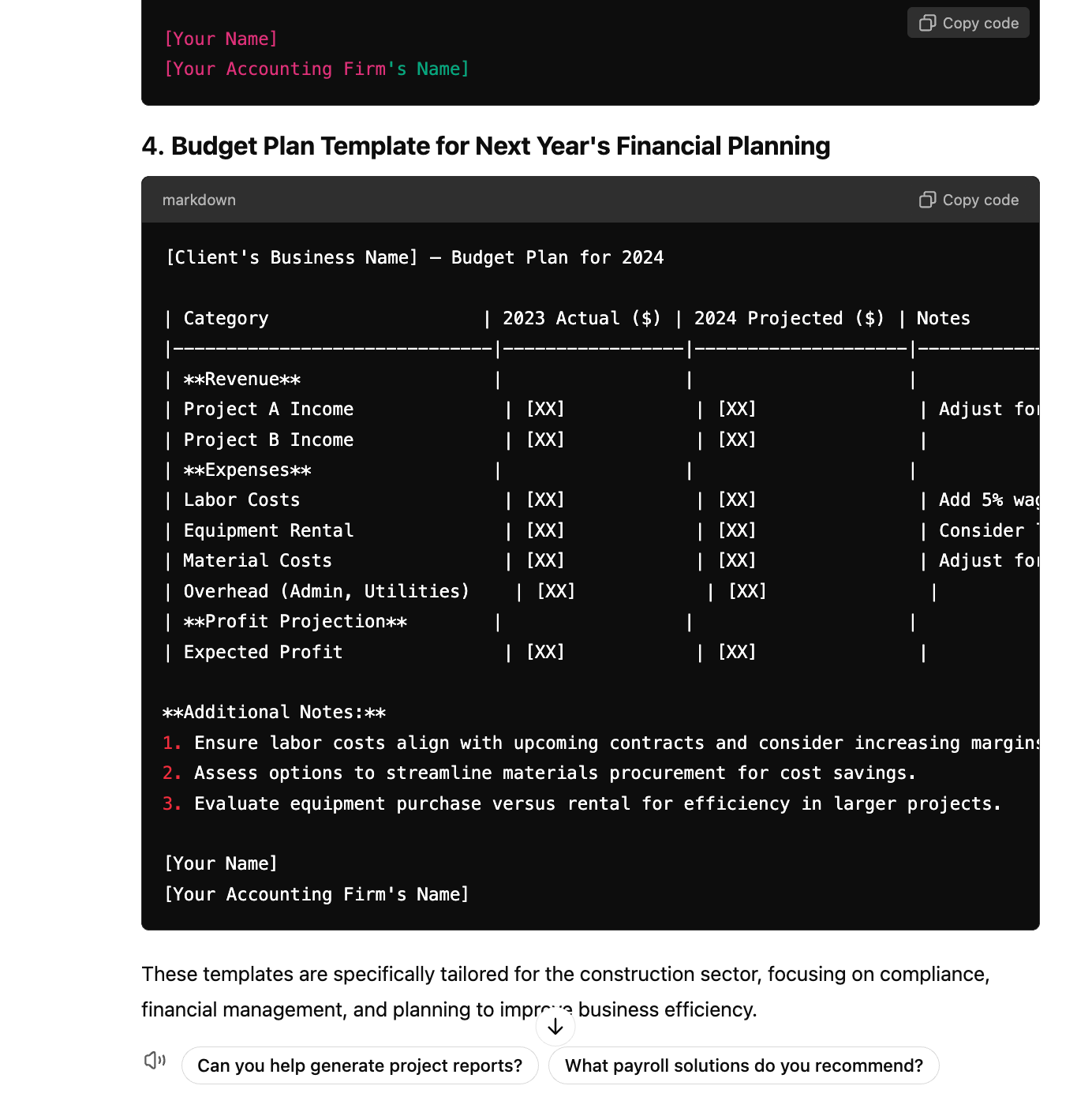

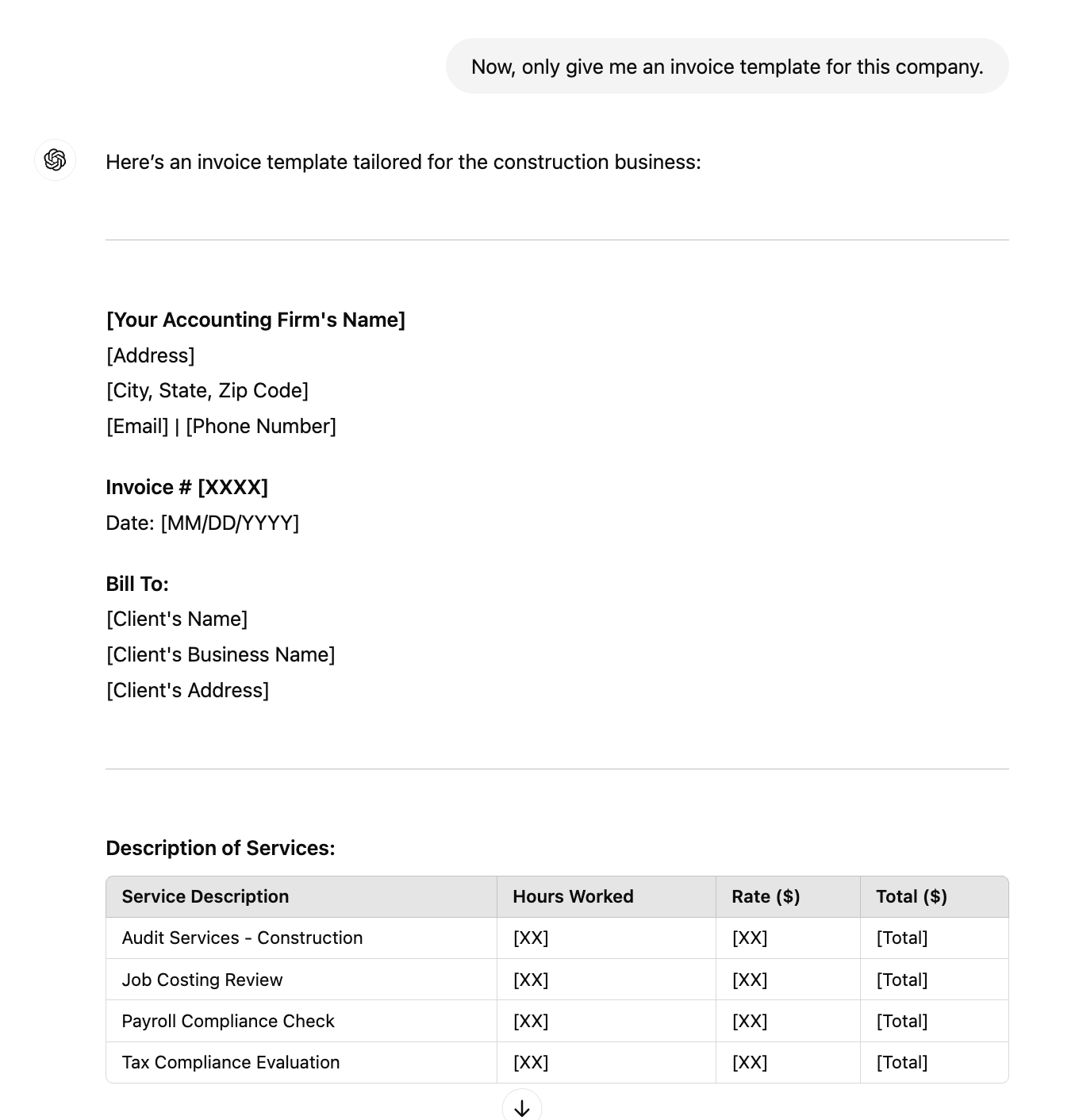

Creating task-oriented templates

ChatGPT can assist accountants and accounting companies by producing quite a few templates for routine duties, streamlining workflows, and saving them appreciable time. It may create custom-made codecs per your {industry} and firm necessities, akin to invoices, consumer emails, funds plans, monetary stories, and so forth.

For instance, accountants can use bill templates to shortly generate consumer payments or a funds plan template to supply monetary projections for purchasers. Listed here are just a few templates that may be useful:

- Bill and cost reminder templates

- Shopper onboarding guidelines

- Shopper e-mail template for tax season reminders

- Finances plan template

- Monetary assertion summaries

- Audit guidelines template

- Revenue and Loss (PnL) templates

These templates could be custom-made and reused, making certain effectivity and accuracy throughout a number of accounting duties.

For greatest outcomes: Preserve the prompts particular. Typically, this may occasionally current a problem. So, the easiest way to sort out this could be to interrupt up your duties into steps and prompts and refine the questions based mostly on the outcomes.

💡

Please guarantee these templates are tailor-made for the [industry] sector, with a give attention to key compliance areas. Additionally, suggest any automation instruments that might streamline the audit course of.”

💡

Immediate instance: Create a template for an bill with fields for consumer identify, date, service description, charges, and complete quantity due.

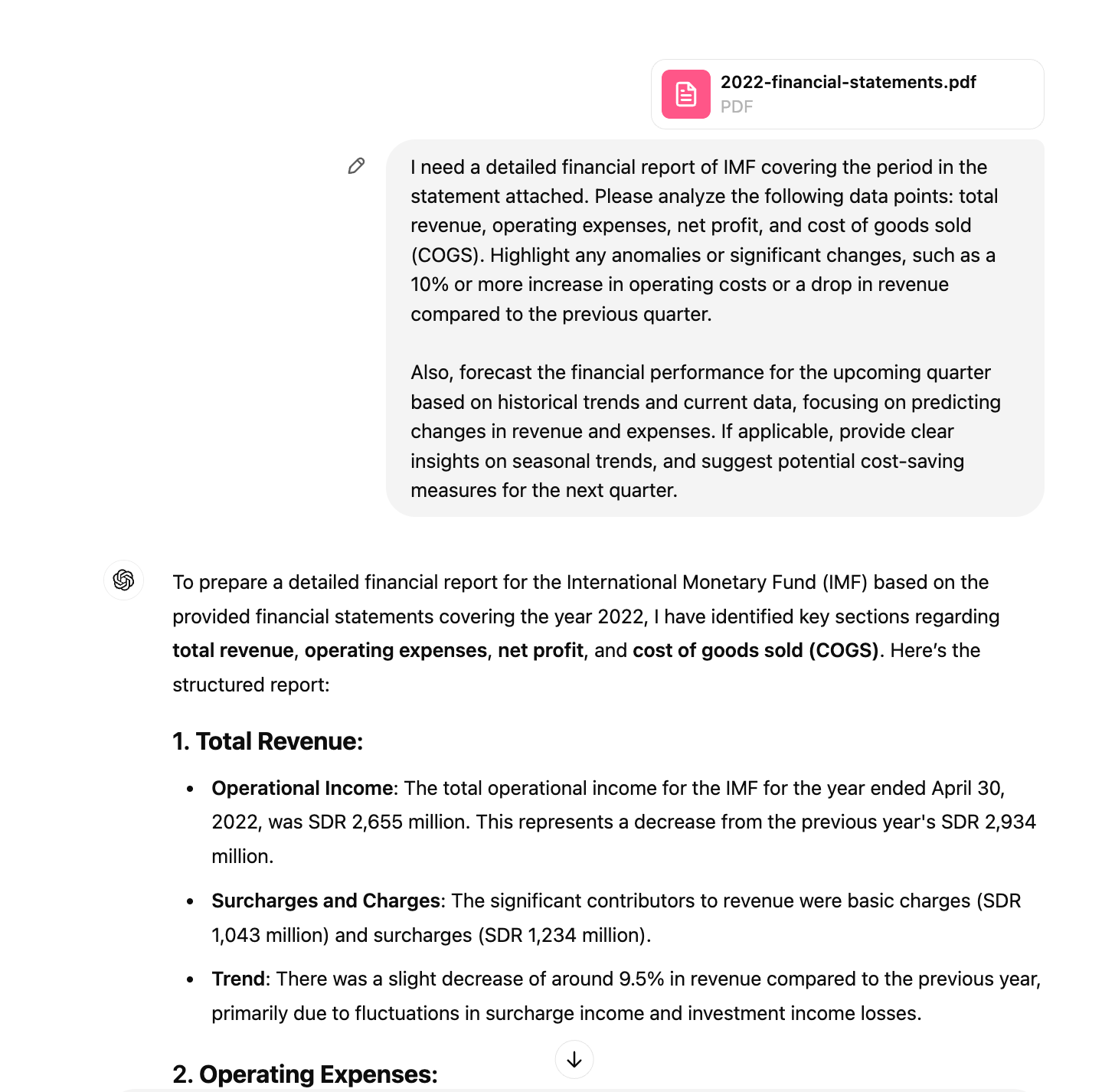

Monetary report era, evaluation, and forecasting

💡

– Abid Salahi, Co-founder & CEO, FinlyWealth

A examine by IBM exhibits that AI instruments can establish traits, predict future gross sales extra precisely, and scale back monetary forecasting errors by as much as 15-20%.

ChatGPT can generate monetary stories, analyze historic information, and forecast future traits by figuring out patterns and anomalies within the accounting {industry}.

For instance, suppose a agency is analyzing quarterly efficiency. In that case, ChatGPT can spotlight a 12% improve in working prices or establish seasonal traits, permitting the accountant to offer extra correct insights and supply extra knowledgeable suggestions.

For greatest outcomes: The immediate ought to specify exactly the kind of report or evaluation wanted, together with time frames and information factors. Present particulars concerning the interval (quarter, 12 months), particular monetary metrics (income, bills), and any areas of focus (e.g., anomalies, traits).

💡

Additionally, forecast the monetary efficiency for the upcoming quarter based mostly on historic traits and present information, specializing in predicting adjustments in income and bills. If relevant, present clear insights on seasonal traits, and counsel potential cost-saving measures for the subsequent quarter.”

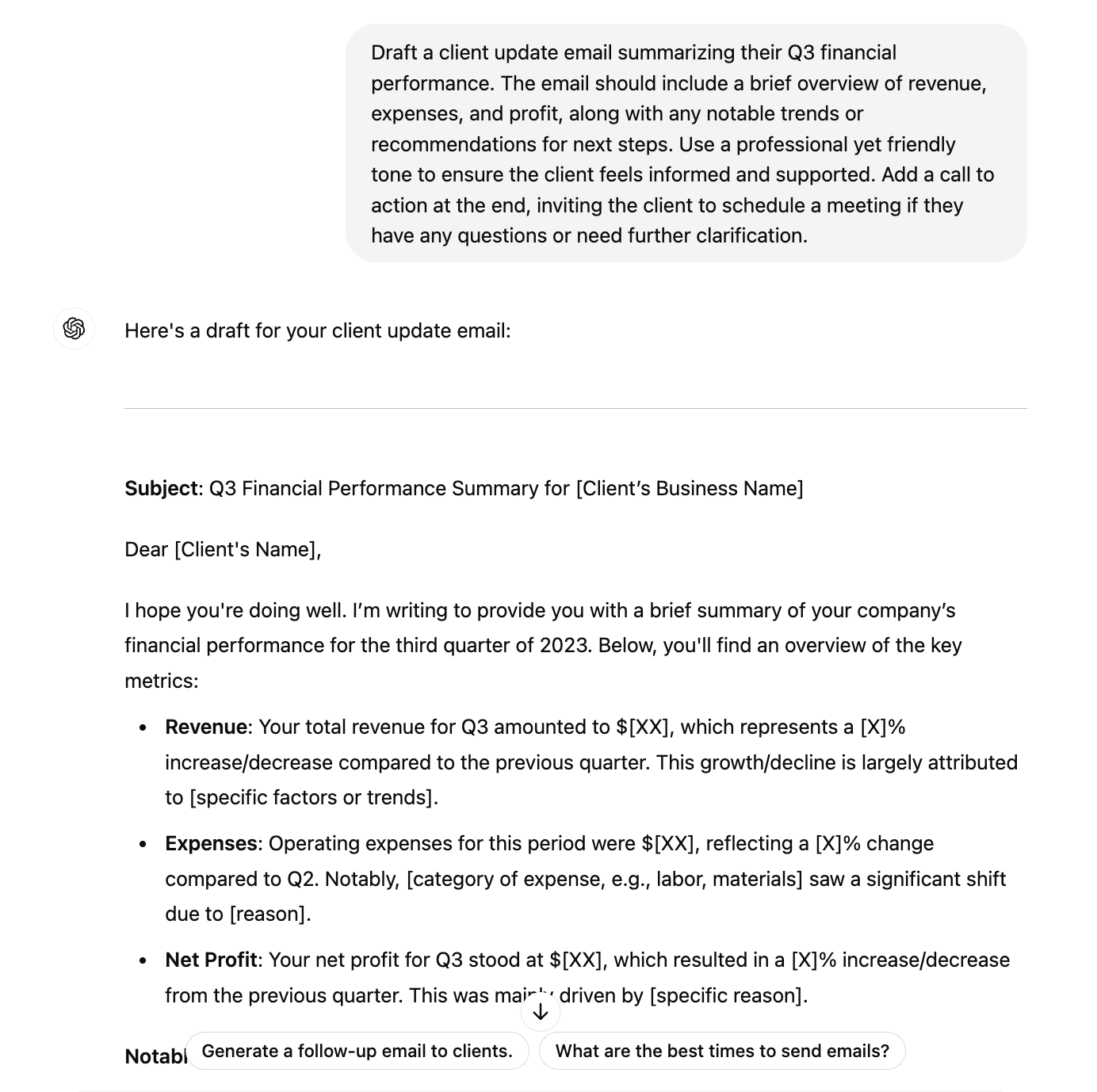

Shopper communication and relationship administration

Efficient communication with purchasers is essential for accounting companies, and ChatGPT can assist by automating emails, consumer follow-ups, and report sharing. Utilizing AI to enhance customer support and communication can result in a 25% improve in consumer satisfaction and a 30% discount in response occasions.

Accountants can use ChatGPT to routinely generate and ship a abstract e-mail to purchasers after their monetary statements are ready, retaining purchasers within the loop with out requiring handbook effort from the accountant.

For greatest outcomes: Embrace particular particulars on the content material and tone of consumer communications. You may also ask ChatGPT to undertake a persona. Specify the content material (e.g., monetary replace, service reminder) and tone (e.g., skilled, pleasant).

💡

Immediate instance: Draft a consumer replace e-mail summarizing their Q3 monetary efficiency. The e-mail ought to embrace a short overview of income, bills, and revenue, together with any notable traits or suggestions for subsequent steps. Use knowledgeable but pleasant tone to make sure the consumer feels knowledgeable and supported. Add a name to motion on the finish, inviting the consumer to schedule a gathering if they’ve any questions or want additional clarification.

ChatGPT vs. conventional accounting software program

ChatGPT is an LLM (massive language mannequin) device that facilitates information processing, automation, and communication by way of pure language prompts.

Conversely, conventional accounting software program is purpose-built for duties like bookkeeping, payroll, and monetary reporting.

Whereas ChatGPT excels in dealing with unstructured information and drafting communications, accounting software program gives exact, real-time monetary administration instruments.

Whereas evaluating ChatGPT with conventional accounting software program, it is vital to grasp their distinctive strengths and the way they complement one another.

| Characteristic | ChatGPT | Conventional Accounting Software program |

|---|---|---|

| Function | Automation, information processing, communication | Bookkeeping, payroll, invoicing, reporting |

| Price | Free or subscription-based | Subscription or one-time, sometimes larger |

| Information Entry | Extracts from unstructured inputs | Structured, template-based |

| Automation | Repetitive duties (e.g., information extraction) | Transaction logging, tax calculations |

| Accuracy | Varies with immediate high quality | Constantly correct |

| Studying Curve | Simple with immediate data | Person-friendly, wants accounting data |

| Information Evaluation | Insights by way of prompts | In-depth, requires setup |

| Customization | Extremely customizable by way of prompts | Restricted, with superior settings |

| Complexity Dealing with | Handles easy duties | Manages complicated duties, wants setup |

| Compliance | Not at all times compliant | Will be custom-made for compliance |

| Safety | Privateness issues, cautious use | Constructed-in safety features |

| Person Interplay | Conversational, AI-driven | Menu-driven with predefined capabilities |

| Collaboration | Drafts emails, aids communication | Integrates with CRM, ERP |

Ideas to make use of Chat GPT for accounting successfully

Begin small, validate outcomes

Start with small, routine duties and at all times double-check ChatGPT’s output. Conduct pilot exams earlier than full integration. For complicated duties like tax calculations, cross-check AI-generated stories with uncooked information to make sure accuracy.

At all times evaluate outputs for accuracy, particularly in accounting. Cross-check key figures and details with unique sources to keep away from errors. Be alert for neglected information factors, akin to {industry} benchmarks or tax legal guidelines. Use your experience to fill in gaps or refine your immediate.

Human evaluate is vital to catching errors, as ChatGPT might misread context.

Here is an fascinating quick video I discovered that might enable you to get began with ChatGPT:

Automate repetitive duties first

💡

– Julie Ginn, Vice President International Income Advertising, Aprimo

The easiest way to optimize ChatGPT is to make use of it to deal with repetitive accounting duties and depend on your experience to interpret the outcomes.

For instance, accountants who use Excel can profit from ChatGPT’s capacity to counsel formulation and automate information entry. This may automate mundane duties like transaction categorization, money stream forecasting with formulation, and evaluating two lists of transactions for reconciliation.

You may also use ChatGPT to automate bill era with templates. It may draft consumer follow-ups, akin to tax reminders and cost notices, and prevent time whereas sustaining professionalism.

Use ChatGPT as a collaborative companion and never a one-stop-solution

ChatGPT is a strong device, however making use of your vital considering to its outcomes is important. Deal with it as a collaborator by participating in a back-and-forth dialog, like how you’ll have a dialog with a know-it-all information.

Leverage your area data for greatest use. Use industry-specific jargon to make sure that ChatGPT produces outcomes related to your specialised accounting area.

Cut up complicated duties into less complicated subtasks. For longer stories, give ChatGPT time to course of and “suppose” by way of the paperwork. In truth, you may even ask the mannequin to take time earlier than speeding by way of the conclusion.

Begin with broader prompts and refine the output by tweaking them to get extra exact outcomes. Tailor ChatGPT’s responses to suit your particular wants. For example, if producing a monetary report abstract, modify it to replicate your consumer’s distinctive circumstances.

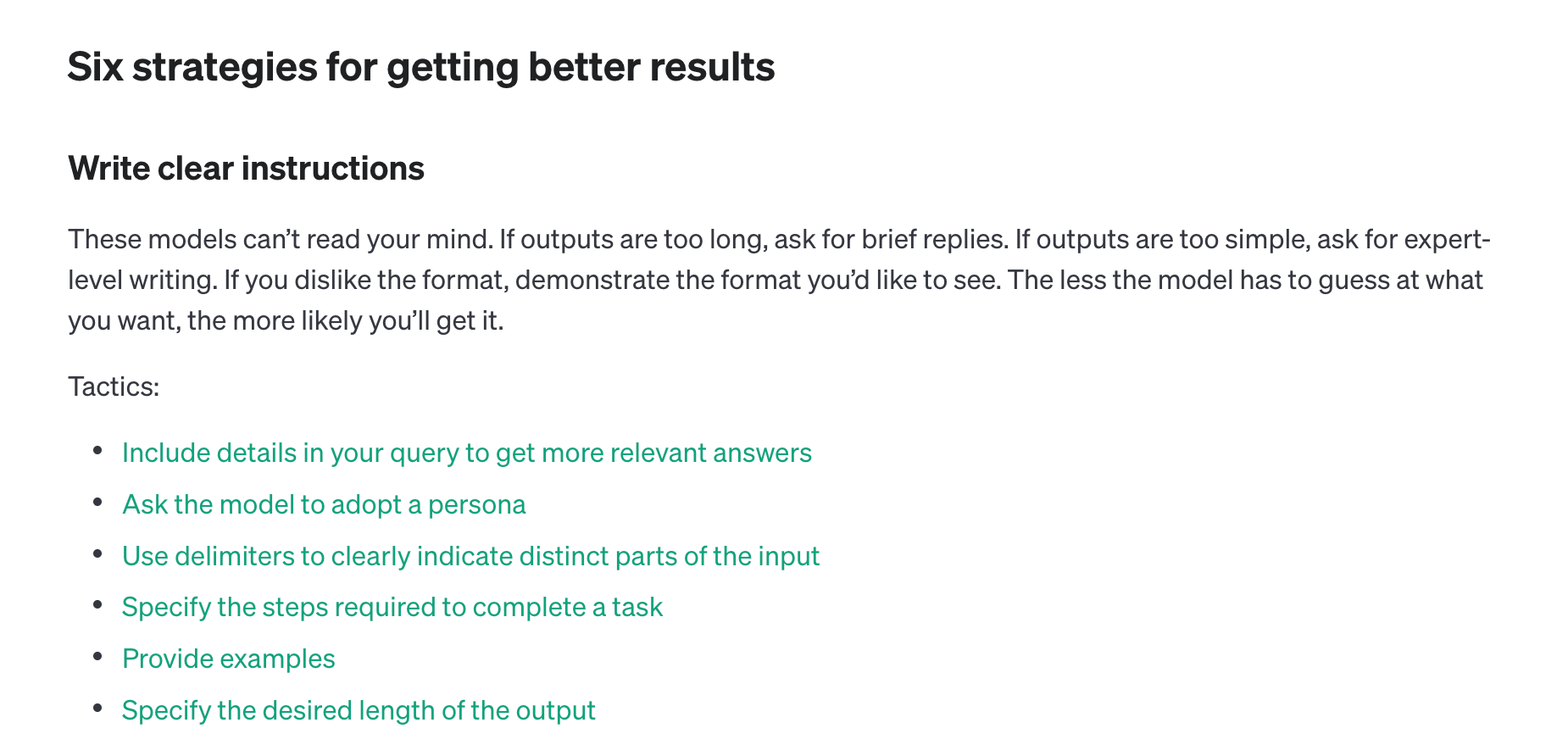

Grasp immediate engineering

Immediate engineering is important for leveraging ChatGPT successfully for accounting workflows. The higher the immediate, the extra correct the output.

With LLMs changing into more and more vital in private {and professional} settings, extra so than smartphones for some, immediate engineering is now a sought-after ability.

Put money into studying immediate engineering to enhance ChatGPT’s accuracy. Tailoring prompts ensures extra exact and dependable outcomes for accounting duties.

Mix ChatGPT with different instruments for the very best outcomes

Maximize ChatGPT’s effectiveness by utilizing it together with conventional accounting software program like Quickbooks or Xero for duties like report era, information extraction, and consumer administration.

ChatGPT is superb for drafting, brainstorming, and automating communication whereas accounting software program ensures exact, real-time monetary information administration.

Limitations of utilizing ChatGPT

Whereas ChatGPT excels at automating routine duties, it nonetheless faces key limitations, significantly in complicated monetary decision-making.

Consultants emphasize that ChatGPT ought to be a supporting device slightly than a standalone decision-maker. Beneath are some key challenges when utilizing ChatGPT in accounting:

Lack of contextual understanding and human perception

ChatGPT can analyze information and acknowledge patterns however lacks the human instinct wanted for complicated selections.

For instance, whereas it could possibly analyze historic inventory information, it could possibly’t predict future market traits or present strategic funding recommendation. It additionally struggles with exterior components like financial shifts or regulatory adjustments, which might impression monetary outcomes.

ChatGPT might miss nuanced adjustments in requirements like IFRS or GAAP for compliance, resulting in inaccurate monetary stories.

Issue processing complicated monetary paperwork

ChatGPT struggles with extracting information from complicated, detailed paperwork akin to monetary statements and invoices, particularly if scanned or handwritten. Whereas it handles typed information effectively, its accuracy drops considerably with poorly formatted or unstructured information.

Instruments like Nanonets, with superior OCR capabilities, supply extra dependable options and deal with such paperwork with as much as 99% accuracy.

Free vs. paid variations

The free model of ChatGPT (based mostly on GPT-3.5) is ample for primary duties however lacks the capabilities wanted for superior monetary evaluation and real-time information entry.

ChatGPT Plus (GPT-4) because the paid model gives enhanced efficiency, akin to higher information interpretation and extra exact responses. Accountants dealing with complicated duties can think about paid choices or discover different specialised LLM APIs like Nanonets API for doc extraction or Claude by Anthropic for safe information dealing with.

Moral issues and information privateness dangers

Utilizing ChatGPT to course of delicate monetary paperwork raises issues over information privateness and bias. Since it’s educated on huge web information, societal biases might affect its outputs.

Accountants should consider ChatGPT’s responses critically, making certain accuracy and neutrality and avoiding inputting delicate consumer information. Even with authorized agreements in place, the chance of knowledge misuse persists.

Dependence on historic information (pre-September 2021)

The free model of ChatGPT depends on information from earlier than September 2021, making it outdated for latest adjustments in tax legal guidelines or market situations.

Nevertheless, the paid model could be browsed on the Web to offer extra up-to-date data, making it extra appropriate for duties requiring present information. Accountants should select the model based mostly on the relevance and accuracy of the info wanted.

Conclusion

As this space evolves, ChatGPT and AI for accountants will broaden past routine duties, providing much more superior capabilities akin to real-time monetary forecasting and decision-making help. Nevertheless, with these evolving capabilities come new challenges, together with making certain information privateness, sustaining up-to-date data, and navigating AI’s limitations in dealing with complicated monetary eventualities.

The way forward for accounting lies in hanging the best steadiness between AI help and human experience. Whereas ChatGPT can automate and improve effectivity in lots of areas, accountants should at all times apply vital considering, {industry} data, and personalised insights. The secret’s to leverage AI as a supportive device that enhances, slightly than replaces, the judgment and experience of accounting professionals.

Continuously Requested Questions (FAQs)

Is ChatGPT dependable for monetary duties?

ChatGPT can help with routine monetary duties like organizing information or producing stories. Nonetheless, it shouldn’t be used for vital monetary selections on account of its accuracy limitations and lack of real-time updates. At all times evaluate AI-generated outputs for errors and guarantee compliance with the most recent laws.

How are accountants utilizing ChatGPT with Excel?

Accountants are utilizing ChatGPT with Excel to automate duties like information entry, producing monetary stories, and creating formulation.

ChatGPT can help in writing complicated Excel formulation, organizing information, and even extracting data from unstructured sources into spreadsheet codecs, saving time and lowering handbook effort. Moreover, it helps troubleshoot method errors and optimize workflows inside Excel.

How do I practice ChatGPT for particular duties?

You possibly can “practice” ChatGPT utilizing clear, structured prompts detailing your process and desired outcomes. Present reference textual content and particular directions in your queries for extra correct outcomes.

Moreover, in ChatGPT 4.0 (paid model), you can too attempt mannequin distillation, which lets you leverage the outputs of a giant mannequin to fine-tune a smaller mannequin, enabling it to realize comparable efficiency on a particular process. This course of can considerably scale back value and latency, as smaller fashions are sometimes extra environment friendly.

What different LLM fashions are you able to counsel as alternate options to ChatGPT?

There are a number of choices in case you are searching for alternate options to ChatGPT.

Common LLM choices embrace Google’s Bard, which integrates nicely with Google instruments, and Claude by Anthropic, identified for robust moral AI practices and dealing with delicate information securely. Moreover, Microsoft Azure OpenAI supplies strong integration with enterprise-level functions, and IBM Watson gives highly effective pure language processing tailor-made for industries like finance.

In contrast to different conventional LLMs, Nanonets excels in doc information extraction, which is especially helpful for accountants dealing with complicated monetary paperwork like invoices and receipts.