DeFi, or Decentralized Finance, is a broad notion that refers to monetary providers hosted on and supported by a blockchain.

They use cryptocurrencies to function and get rid of intermediaries, comparable to monetary establishments or governments, to conduct transactions.

Anybody with admission to a decentralized community, so is the thought, can borrow/lend cash, get insurance coverage, make worldwide funds, or earn on decentralized exchanges (DEX).

What Is DEX?

A decentralized alternate is a platform the place individuals can commerce cryptocurrencies amongst themselves with none interference from a financial institution, dealer, or fee service of any type.

It gives full management over one’s price range by permitting customers to purchase and promote crypto in a totally automated method.

All DEXs—like Hyperliquid, Raydium, or UniSwap—sit on three main parts: blockchain know-how, sensible contracts, and suitable crypto wallets like Belief Pockets.

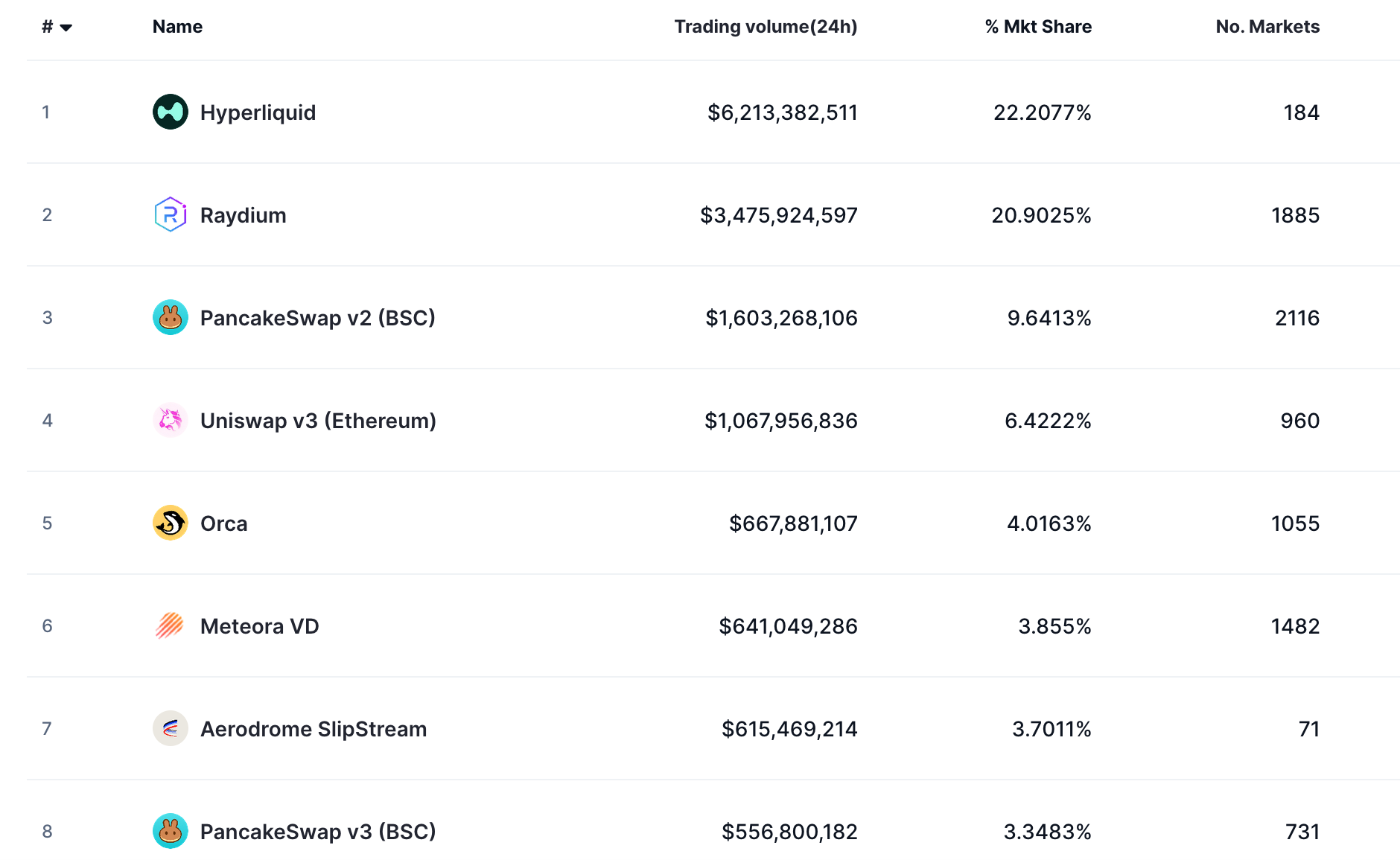

DEXs are booming. For instance, the 24-hour buying and selling quantity of the Hyperliquid alternate platform contains greater than $4.5 billion, whereas the typical each day buying and selling quantity throughout all DEXs is round $4.93 billion, up from $4 billion in 2023.

Prime Cryptocurrency Decentralized Exchanges, CoinMarketCap

How Does DEX Work?

In contrast to Coinbase or every other kind of centralized alternate, DEXs don’t allow you to commerce between fiat and cryptocurrency. They are going to solely allow you to swap one cryptocurrency for an additional. Nonetheless, loads of DEXs additionally permit superior buying and selling choices comparable to margin buying and selling or putting restrict orders.

One other essential facet is that, throughout the centralized exchanges, buying and selling is maintained via an “order e-book,” calculating costs primarily based on present purchase and promote gives—similar to inventory markets like Nasdaq.

In distinction, decentralized exchanges depend upon sensible contracts. They use algorithms to set costs of cryptocurrencies, all whereas counting on so-called “liquidity swimming pools” the place traders can lock in cash to earn rewards whereas serving to drive trades.

Whereas centralized exchanges report transactions in their very own system, DEX transactions occur straight on the blockchain, making them extra open and protected.

What Are the Potential Advantages of Constructing a DEX?

Making a decentralized alternate platform gives a lot potential, particularly on the subject of creating wealth.

In distinction to centralized exchanges, DEX homeowners might generate income from a wide range of sources: transaction charges, token itemizing, and LPs’ incentivization, plus governance tokens.

A DEX also can generate a substantial income stream by both introducing a local token or charging small charges on trades whereas nonetheless maintaining the charges low for the customers.

One other advantage of DEXs is that they’re proof against censorship, which means they’re extra problematic to close down or management. Anybody with on-line entry and a crypto pockets can participate in buying and selling, which is nice for areas the place basic banking is proscribed.

On high of that, DEXs typically listing a greater diversity of tokens, together with newer or less-known ones that may not be accessible on centralized exchanges, giving merchants extra possibilities to discover completely different initiatives.

What Steps Are Concerned in Creating a Decentralized Change?

More often than not, DEXs are made open-source, which implies that any get together can see precisely how they work. That additionally means builders can take pre-existing code and adapt it to construct up new competing initiatives. However how is the creation course of structured?

Getting Began and Setting Objectives

If you wish to create a DEX, you need to begin the method with preliminary planning and necessities groping, throughout which you’ll stipulate the options your DEX goes to have.

Specifically, it entails deciding on the token to be supported, how the liquidity shall be organized, and what sort of person expertise you wish to present.

Creating the Entrance-Finish and Person Interface

After planning, your efforts should be directed towards the frontend and person interface growth. Your DEX goes to work together with actual customers, and thus, it must be user-friendly and straightforward to navigate.

Selecting the Proper Blockchain for the DEX

Then, you’ll go for the collection of the suitable blockchain. The selection of blockchain would be the base of your DEX that can decide the velocity of the transaction, its safety, and costs.

Whereas Ethereum is a typical selection for most individuals, you would possibly take into account different blockchains comparable to Binance Good Chain or Solana if you’d like decrease charges and quick processing time.

Setting Up Liquidity and Worth-Setting Instruments

Then, the setup of liquidity swimming pools and AMMs must be executed. Liquidity swimming pools are mainly essential in an effort to guarantee that there’s a minimum of a good quantity of liquidity for trades to undergo. AMMs themselves play a giant function in setting costs primarily based on market provide and demand.

You shall resolve on the structure of such swimming pools and the imposition of AMMs in order that the buying and selling course of stays easygoing.

Delegating the Challenge

When you plan to get a high-performing DEX however lack the in-house experience, you’ll be able to delegate the event challenge to a software program growth firm, comparable to SCAND.

Working with skilled blockchain builders who focus on cryptocurrency alternate growth can guarantee your DEX is constructed with sturdy safety, flawless pockets integration, and scalability in thoughts.

A trusted growth firm also can implement new options, present 24/7 help, and monitor your DEX to regulate to any market circumstances and person calls for.

Creating Good Contracts

Then comes the work on sensible contract growth. Good contracts are the spine of your DEX, as they independently execute transactions and regulate all important operations with no intermediary.

Writing correct contracts and testing them for glitches or vulnerabilities is essential in demonstrating your platform or customers won’t be uncovered to dangers.

Testing and Safety Critiques

Testing and safety audits are the subsequent step. Earlier than launching, each a part of the platform—sensible contracts, UI, and total performance—must be examined.

Safety audits are of excessive significance to acknowledge and resolve any form of vulnerabilities that will jeopardize person funds or the integrity of the platform basically.

Going Reside and Monitoring Your DEX

In spite of everything testing is full and the safety is on level, it’s time to roll out your DEX and start monitoring. A launch signifies the start of operation in your on-line platform, however actually, that is the place the actual work begins since additional common updates and monitoring are wanted to make sure the DEX stays on high of its efficiency.

How Can You Guarantee Safety in Your DEX Platform?

Safety can’t be compromised for any DEX. With no central authority to step in if one thing goes mistaken, customers are absolutely accountable for defending their funds. Some frequent vulnerabilities within the DEX platform embrace:

- Flash mortgage assaults

- Entrance-running assaults

- Reentrancy assaults

- Inadequate liquidity

To remain protected, use {hardware} wallets as a result of they retailer personal keys offline, making them a lot tougher to compromise. For these utilizing software program wallets, in flip, it’s essential to arrange a robust, distinctive password and allow two-factor authentication performance so as to add additional safety.

There are various phishing schemes within the crypto house, so customers should be vigilant. Phishing implies deceiving individuals into offering pockets data by creating faux websites or messages.

That’s why it’s essential to supply clear warnings and security ideas to assist your audience spot and keep away from these scams.

One other robust safety measure is multi-signature wallets, which require a number of approvals earlier than the transaction goes via. This may make it actually onerous for hackers to steal funds, particularly in companies or high-value accounts.

Yet one more necessity is restoration phrase backup. If a person loses entry to a pockets, the backup—ideally saved offline—is assurance that they don’t lose the funds without end.

Encryption additionally performs a outstanding function while you construct a decentralized alternate—if a hacker will get entry to a person’s system, encryption helps assure they’ll’t steal personal keys or private knowledge.

Components That Affect the Success of a Decentralized Crypto Change

The success of a decentralized alternate of cryptocurrency depends on a mixture of components that make or break its functionality to compete with different platforms.

Probably the most important of those is liquidity. With out adequate belongings to commerce, customers shall be dissatisfied with delayed transactions and dangerous costs, and they’re going to transfer to extra established platforms.

To keep away from this, profitable DEXs staff up with liquidity suppliers, use automated market makers, or supply rewards to stimulate customers to produce liquidity. With no regular circulation of belongings, even essentially the most superior platform received’t stand an opportunity.

After all, essentially the most profitable platforms preserve issues easy, providing a clear interface, quick transactions, and straightforward pockets connections.

As a result of DEXs lack the everyday buyer help of centralized exchanges, prospects should be capable to navigate the platform independently. The extra user-oriented and beginner-friendly the expertise, the higher.

As well as, transparency goes a good distance—customers wish to see open-source code, clear governance fashions, and a wholesome, lively group supporting the platform. When people belief a DEX, they’re additionally extra prone to stay lively and commerce there.

However safety isn’t the one factor that retains a DEX related—the crypto house strikes quick, and platforms that adapt to new developments—like layer-2 scaling, cross-chain buying and selling, or distinctive DeFi performance—have a significantly better shot at long-term success.

DEXs that convey one thing contemporary to the desk, comparable to decrease fuel charges or unique liquidity options, possess a big benefit over rivals.

How Do You Construct a DEX That Competes with Established Platforms like Uniswap?

It’s not easy to beat the giants like Uniswap, however in the event you play your playing cards proper, then your DEX can get a fame as effectively. The key is to face out by offering one thing that others should not.

Perhaps it’s decrease charges, unique token listings, or professional-grade buying and selling instruments—no matter it might be, you will need to have one thing that may make people keen to make the change. In case your platform feels similar to each different DEX on the market, it’s going to be powerful to get traction.

But good options alone should not adequate if nobody is conscious of them. That’s the place intelligent advertising steps in. Referral applications, token incentives, and partnerships with different DeFi initiatives can be utilized to draw merchants and liquidity suppliers.

Apart from that, social media and influencer collaborations can present your platform with the thrill it deserves. The extra people hear about your DEX, the extra keen they’ll be to check it out.

And let’s not overlook to remain forward of DeFi tendencies—in the event you combine yield farming, staking, or governance tokens, you’ll give customers extra causes to stay round.

Merchants are always trying to find the most recent and best, so in case your DEX gives contemporary, thrilling options, it has a significantly better shot at gaining long-term traction.

What Are the Challenges in Making a Decentralized Change?

Constructing a profitable DEX isn’t all the time a bit of cake. From technical roadblocks of blockchain growth to regulatory complications and difficult competitors, there’s so much to determine.

First, the tech facet of issues can get fairly sophisticated. DEXs depend on sensible contracts, which suggests any bugs or vulnerabilities can result in critical safety dangers. On high of that, points like gradual transactions, excessive fuel charges, and community congestion can frustrate customers in the event that they’re not dealt with correctly.

That’s why having a well-equipped growth staff and a strategic tech stack is a should. You’ll want to make sure that your platform runs equally effectively regardless of the circumstances are, stays safe, and might scale as extra customers be a part of.

Then, there’s the entire regulatory grey space. Whereas DEXs don’t have a government, that doesn’t imply they’re fully off the radar.

Governments are nonetheless negotiating methods to regulate crypto buying and selling, and new guidelines may pop up at any time. Staying knowledgeable and ensuring your platform doesn’t run into authorized bother is vital to avoiding any main complications down the street.

And naturally, there’s competitors. The DeFi house is filled with new platforms which can be launching on a regular basis, which suggests standing out is an issue. Providing low charges, robust liquidity incentives, and distinctive options may help, however it doesn’t cease there.

Retaining customers engaged with a easy expertise, steady updates, and robust group help is what actually makes a distinction in the long term.

FAQs

What’s a decentralized alternate, and the way does it differ from different exchanges?

A decentralized alternate permits customers to commerce straight with each other with out the presence of a centralized authority. DEXs present larger management over belongings, higher privateness, and decrease vulnerability to hacking in comparison with conventional exchanges.

What are the key parts required for decentralized alternate growth?

The key parts for alternate growth are blockchain infrastructure, sensible contracts, liquidity swimming pools, and automatic market makers (AMMs). Collectively, they type a decentralized and automatic buying and selling ecosystem.

How do sensible contracts work in a decentralized alternate?

Good contracts facilitate trustless, automated user-to-user transactions. Good contracts perform trades, handle liquidity, and carry out different processes on the DEX with out utilizing intermediaries.

What steps are concerned within the DEX growth course of?

The steps within the growth course of embrace planning and requirement gathering, deciding on the suitable blockchain, incorporating liquidity swimming pools and AMMs, and securing the platform.

How can I create a decentralized alternate that pulls liquidity suppliers?

Incentivize liquidity suppliers with aggressive rewards, e.g., a share of transaction charges or preferential token listings. A sound liquidity mannequin and the flexibility to listing a lot of tokens also can entice suppliers to your platform.