Arbitrage continues to be one of the simple but best strategies of constructing income in monetary markets, and the identical applies to the crypto market.

With hundreds of tokens and common fluctuations in provide and demand, the alternatives for promising offers not solely persist however are literally rising in 2025.

Ethereum has all the time been one of the vital ecosystems for arbitrage owing to its excessive liquidity, in depth community of decentralized exchanges (DEXs), and extremely energetic developer neighborhood.

However is Ethereum nonetheless price becoming a member of for arbitrage functions? The quick reply: sure. Though the market has toughened, the event of Layer 2 (L2) protocols, cross-chain bridges, and custom-made arbitrage bots continues to offer new avenues for merchants and companies desirous to earn on market inefficiencies.

Some Info on Ethereum Ecosystem Buying and selling Exercise

What Is an Ethereum Arbitrage Bot?

Blockchain arbitrage is defined because the act of benefiting from value discrepancies of the identical asset on totally different markets, protocols, or networks.

So, an Ethereum arbitrage bot is automated software program that independently seems to be for interesting value disparities, however inside the Ethereum ecosystem.

In distinction to guide buying and selling, the place worthwhile alternatives are often gone by the point a dealer can react, a bot can monitor, choose, and act in seconds or milliseconds.

For instance, if ETH is at $1,600 on one cryptocurrency change and $1,605 on one other, the bot should buy on the cheaper value instantly and promote on the dearer value for a small revenue.

In comparison with crypto buying and selling bots produced for different blockchains, Ethereum bots have just a few distinctive attributes:

- They have to rigorously oversee gasoline charges, which might make or break a commerce.

- They straight work together with good contracts and due to this fact want safe Web3 integration.

- They face harsh competitors in Ethereum’s energetic mempool, and thus pace and execution methods matter.

How an Ethereum Arbitrage Bot Works

The Ethereum bot, by the use of fundamental logic and goal, is just about like different crypto arbitrage bots. Nonetheless, as it’s made particularly for Ethereum, it nonetheless retains some peculiarities that set it other than different bots that work on different blockchains.

Bot Structure

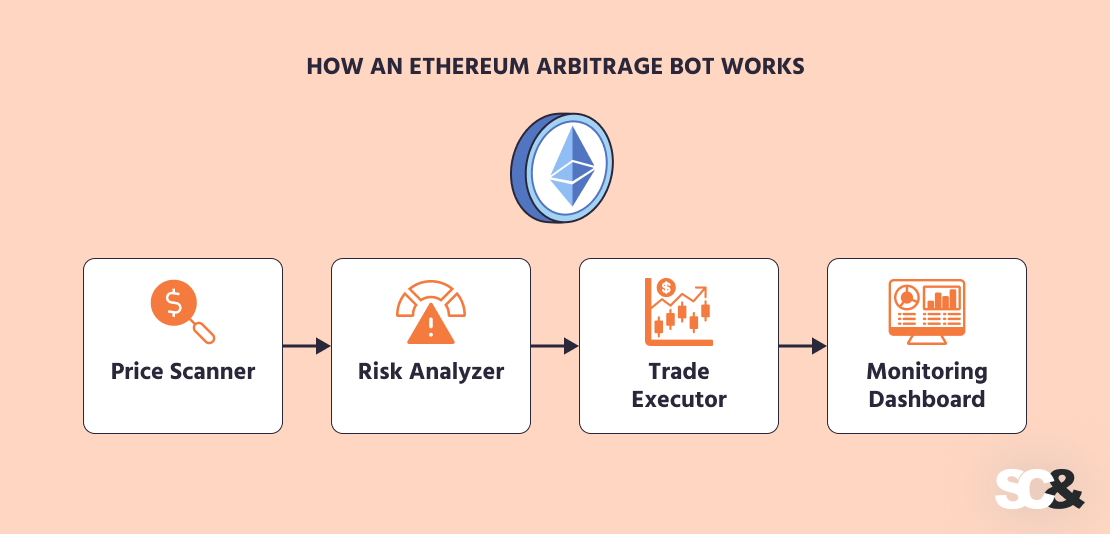

Typically, Ethereum arbitrage cryptocurrency bots consist of 4 predominant components:

- Market Knowledge Collector – extracts related costs from CEXs (centralized exchanges), DEXs, or Ethereum nodes.

- Arbitrage Engine – crosses costs and uncovers worthwhile choices.

- Execution Layer – executes trades, usually making all elements of the commerce occur atomically.

- Monitoring Dashboard – watches efficiency, sends indicators, and offers management to the dealer.

By and huge, such a modular format permits flexibility, so bot builders can add new exchanges, regulate algorithms, or tweak execution with out overhauling the bot.

Worth Scanning

The bot’s intelligence comes from its scanning algorithms. Some merely examine costs on two exchanges, whereas others observe a number of token pairs for extra advanced prospects, like triangular arbitrage.

Ethereum bots in DeFi are in a position to learn good contracts straight utilizing Web3 libraries. In an effort to seize alternatives quick, they usually work in parallel, hold value information prepared in reminiscence, and even attempt to guess short-term value strikes.

Execution

Timing of execution in crypto arbitrage is of utmost significance. Upon discovering a deal, the bot:

- Executes trades atomically so both all elements succeed or none do.

- Makes use of personal transaction channels (i.e., Flashbots) to keep away from front-running.

- Scores gasoline charges to maintain prices lower than income.

Some superior bots additionally use easy machine studying to resolve whether or not a commerce is price making primarily based on the present community standing.

Ethereum-Particular Instruments

Ethereum crypto bots depend on blockchain-native instruments:

- Web3 libraries (Web3.js, Web3.py) to work together with nodes and good contracts.

- EVM (Ethereum Digital Machine), the place transactions are run.

- GraphQL endpoints to question blockchain information effectively.

- RPC and WebSocket connections for quick, real-time communication.

These applied sciences enable the bot to scan costs, calculate income, and execute trades in a rush earlier than they’re misplaced.

Applied sciences and Instruments Behind Automated Buying and selling

To make an Ethereum arbitrage buying and selling bot, builders require the right combination of programming languages, blockchain companies, and change APIs. Because the bot’s success will depend on how shortly it may well spot and commerce, what you develop it with issues rather a lot.

Programming Languages

- Python – nice for testing methods and connecting to change APIs.

- Node.js – well-suited for reside information streams and WebSocket connections.

- Golang or Rust – usually used when pace and low latency are the priority.

Many bots mix all of those: Python for evaluation, Node.js for dealing with information, and Go or Rust for the quickest elements of the execution.

Blockchain Instruments

These instruments assist bots spot revenue alternatives and achieve trades with out delays:

- Flashbots – allow bots to submit personal Ethereum transactions to keep away from being front-run.

- Blocknative – helps observe the mempool so bots can see how transactions are lining up.

- QuickNode (and related suppliers) – give quick and dependable entry to Ethereum and Layer 2 networks.

Change Connections

In an effort to be worthwhile, a bot will usually connect with each decentralized and centralized markets:

- CEXs: Binance, Kraken, Coinbase, and so on., give in depth liquidity and reside order books.

- DEXs: Uniswap, Curve, SushiSwap, and Balancer are well-known Ethereum platforms the place value variations are prone to occur.

By combining CEXs and DEXs, bots get extra probabilities to catch worthwhile trades.

Actual Challenges and Limitations of ETH Buying and selling Bot

Blockchain buying and selling software program may be just about worthwhile, however the actuality is way from uncomplicated. The market is extremely aggressive, and plenty of technical and monetary limitations can reduce into attainable beneficial properties.

Let’s begin with competitors. There are millions of merchants and bots watching the identical markets, many with seasoned groups and infrastructure behind them. Due to this, value discrepancies shut in seconds, giving barely any time to react.

One other drawback is how trades in Ethereum are settled. When a commerce remains to be unconfirmed, it goes into the mempool, the place everybody can view it.

It’s due to this fact attainable for different bots to repeat the commerce and have it executed first by paying a bigger gasoline charge, which is named front-running. In that scenario, the unique commerce can fail and even lead to a loss.

Gasoline charges are an issue in and of themselves. Ethereum charges change shortly relying on community utilization. A commerce that appears worthwhile at first look can very simply be rendered unprofitable as soon as the gasoline charge is included. As a consequence of this, bots must continuously calculate if the unfold is sufficiently big to cowl charges.

Pace can also be a constraint. A bot should course of data and ship transactions extraordinarily quick so as to win. Even a small lag will outcome within the alternative being taken by one other sooner competitor. That’s the reason profound builders use optimized code, paid RPC nodes, and personal transaction relays.

| Problem | Influence | Answer |

| Market Competitors | Fewer worthwhile alternatives as many bots compete. | Use {custom} methods and monitor a number of exchanges/DEXs. |

| Delays & Entrance-Working | Trades can fail or be overtaken by sooner bots. | Optimize execution pace and contemplate MEV-resistant instruments. |

| Pace Necessities | Bots should execute in milliseconds to remain aggressive. | Use low-latency infrastructure and environment friendly code. |

| Safety Dangers | Vulnerabilities can result in losses or information breaches. | Implement safe coding, audits, and secure key administration. |

| Liquidity & Slippage | Low liquidity can scale back or eradicate income. | Deal with liquid pairs and regulate commerce sizes dynamically. |

| Community & Gasoline Charges | Excessive charges could wipe out beneficial properties. | Monitor charges in real-time and use L2 options when attainable. |

Challenges and Limitations of Utilizing Bots

Prepared-Made Bots vs. Customized Ethereum Buying and selling Bot Improvement

When it’s a matter of utilizing a crypto buying and selling bot, often there are two alternate options: off-the-shelf options or {custom} ones. Each have severe professionals, but cons too.

Off-the-shelf bots are common as a consequence of ease of set up and minimal technical data required. They usually embody simple-to-use dashboards and pre-programmed methods, so merchants can begin testing in virtually no time.

For people or small teams, it’s a cheap methodology of making an attempt arbitrage. The draw back, nonetheless, is that these bots can be found to many merchants. Their methods quickly turn out to be well-known, and markets regulate quick, which implies income often shrink over time.

Customized growth affords higher management. A bot developed in-house or with a crypto arbitrage buying and selling bot growth firm, can swimsuit particular buying and selling methods, be modified to work with particular platforms, and be tuned for efficiency and safety.

Why Select SCAND?

At SCAND, we focus on designing, creating, and supporting arbitrage crypto bots in order that they’ll final lengthy and survive market competitiveness.

Our companies cowl every little thing from preliminary structure planning and change integrations to ongoing efficiency tuning and safety enhancements.

In shut cooperation with prospects, we ensure that each bot just isn’t solely technically sound but in addition well-aligned with the consumer’s enterprise technique.

Potential Instances for B2B Shoppers

For B2B shoppers, SCAND can develop {custom} cryptocurrency bots that open up arbitrage alternatives going far past easy methods.

Hedge funds, for instance, can automate and scale a number of methods without delay, akin to inter-exchange arbitrage on centralized platforms and triangular alternatives on Ethereum DEXs. A SCAND-built bot can course of hundreds of market indicators per second and execute trades sooner than any guide method.

Crypto exchanges can use SCAND-developed bots to handle liquidity, appropriate value variations throughout markets, and hold spreads tight. This ensures smoother buying and selling and makes the platform extra engaging to each retail and institutional customers.

Buying and selling firms getting into DeFi can profit from cross-chain and Layer 2 arbitrage bots constructed by SCAND. These programs can handle a number of networks, optimize gasoline prices, and execute advanced trades with precision — far above what ready-made options enable.

Often Requested Questions (FAQs)

What’s an Ethereum arbitrage bot?

It’s a program that robotically seems to be for value disparities for Ethereum or associated tokens throughout totally different markets and executes trades to make a revenue. It really works a lot sooner than guide buying and selling, performing in seconds or milliseconds.

Why select a {custom} bot over a ready-made one?

Pre-built bots are fast and simple to make use of however are usually not versatile or worthwhile in the long run. Customized bots, in flip, may be programmed for multi-strategy use, connect with chosen exchanges or networks, be optimized for efficiency, and alter because the market adjustments.

Are arbitrage bots dangerous?

Sure. Entrance-running, fluctuating gasoline costs, competing bots, and safety threats are a few of them. A rigorously designed bot with correct security measures, nonetheless, will scale back these dangers.

How can SCAND assist companies?

SCAND builds {custom} Ethereum bots for B2B shoppers, caring for every little thing from technique design and system setup to change and blockchain integrations, monitoring, and additional help. Get in contact with us to e book a session and get extra particulars.