Vendor payments are a essential a part of AP workflows – the ultimate doc in an AP course of that specifies how a lot it’s essential pay a vendor for a purchase order. Getting a vendor invoice fee proper is vital – to make sure correct funds, forestall fraud, and streamline AP workflows.

Nonetheless, even a easy vendor invoice fee requires a number of checks and approvals earlier than it may be processed. Probably the most efficient strategies to validate vendor payments is 3-way matching.

On this weblog, we’ll discover how one can implement a 3-way matching course of for Buy Orders (POs), vendor payments, and receipts, proper inside Oracle NetSuite.

Whether or not you’re new to 3-way matching or seeking to automate it additional in NetSuite, this information offers a step-by-step overview to take advantage of this highly effective characteristic.

What’s 3-Approach Matching in NetSuite?

In its commonest implementation, 3-way matching is a course of that matches three main paperwork to validate a transaction:

- Buy Order (PO): The preliminary request despatched to the seller specifying the products or providers and their prices.

- Receipt: Affirmation that items or providers had been obtained as specified.

- Vendor Invoice: The bill obtained from the seller requesting fee.

The objective of 3-way matching is to make sure that the amount, value, and phrases on the seller invoice match these on the PO and receipt. NetSuite’s 3-way matching helps companies catch errors or discrepancies earlier than processing fee, lowering the possibilities of overpayments or fraud.

The three-way match can be generalised to any 3 paperwork that won’t strictly be the above examples. In some instances, you may additionally look to do a 4-way match – this features a high quality facet to the delivered items (and it’s essential then verify how lots of the delivered items are of acceptable high quality).

Why Use 3-Approach Matching?

Inside accounts payable, 3-way matching is a robust software to:

- Improve Accuracy: By cross-checking POs, receipts, and vendor payments, you make sure that the billed quantity matches what was ordered and obtained.

- Cut back Fraud: Forestall fraudulent transactions by guaranteeing vendor payments match precise receipts and buy orders.

- Streamline Workflows: Automate the pointless back-and-forth that sometimes comes with buy approvals, and scale back guide validation by implementing automated matching guidelines in NetSuite.

For AP departments, this course of minimizes errors and prevents pricey errors in bill processing.

How Does 3-Approach Matching Work in NetSuite?

NetSuite’s 3-way matching performance is straightforward to arrange and use. This is a simplified breakdown of the method:

1. Create a Buy Order

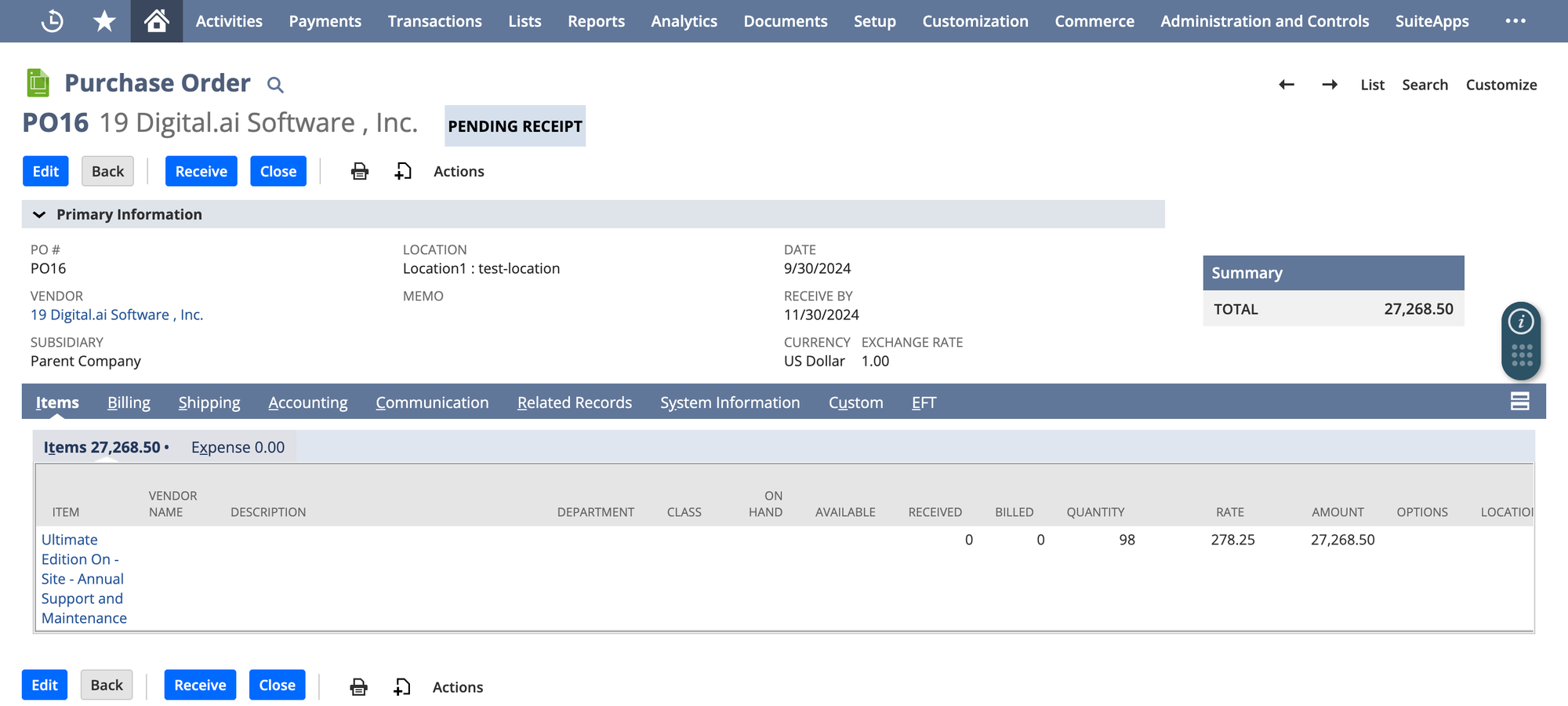

- In NetSuite, generate a Buy Order (PO) detailing the products or providers required. This doc consists of merchandise particulars, portions, costs, and any phrases agreed upon with the seller.

- Automating PO Approvals: To streamline the PO approval course of, NetSuite permits multi-level approval workflows, which may also help guarantee accuracy at this stage.

2. Obtain Items or Companies

- When items arrive, file a Receipt in NetSuite. This receipt confirms that you just’ve obtained the ordered objects.

- Partial Receipts: In instances the place solely a part of the order arrives, NetSuite permits partial receipts, which may be useful for big or staggered shipments.

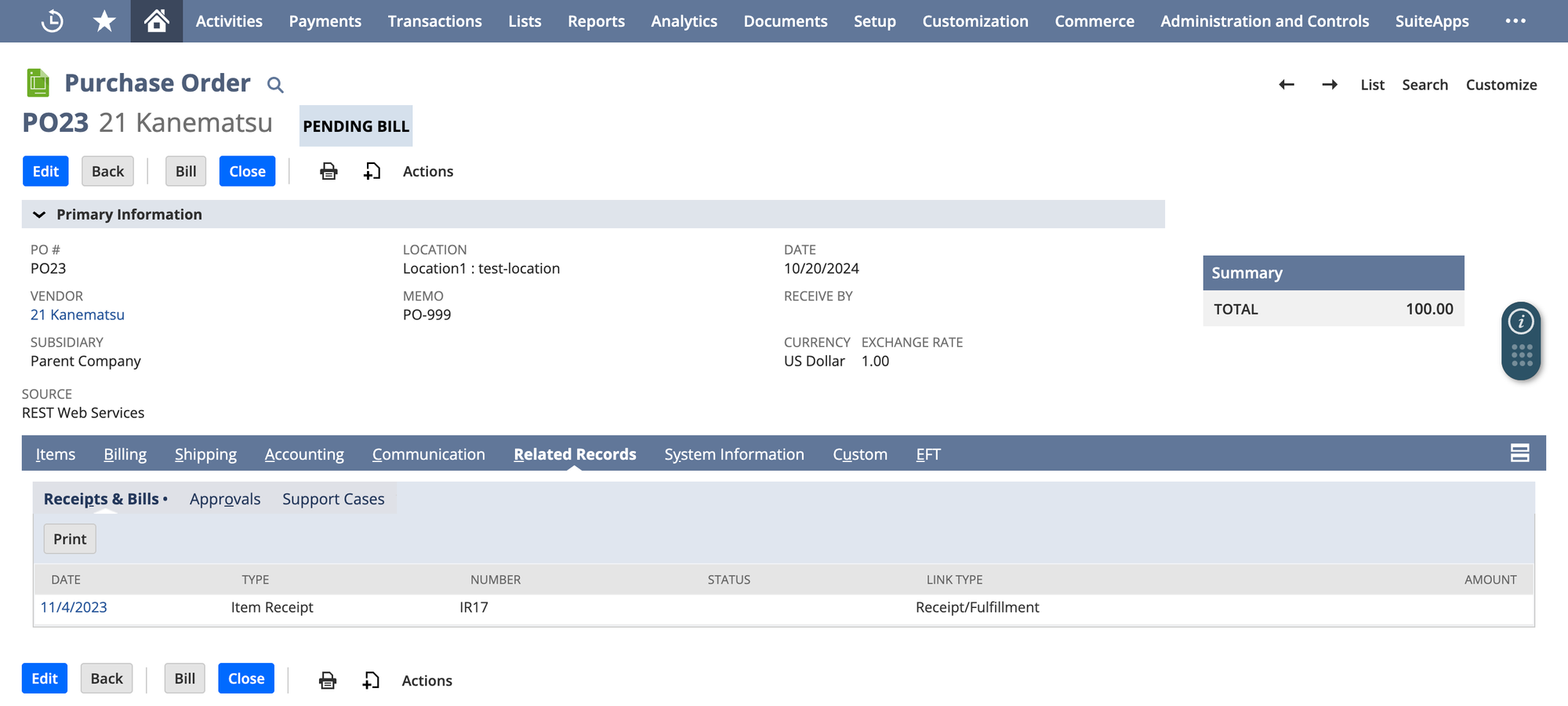

3. Obtain the Vendor Invoice

- The seller sends a Invoice for the objects delivered. The invoice is entered in NetSuite as a vendor invoice, capturing all particulars wanted for fee.

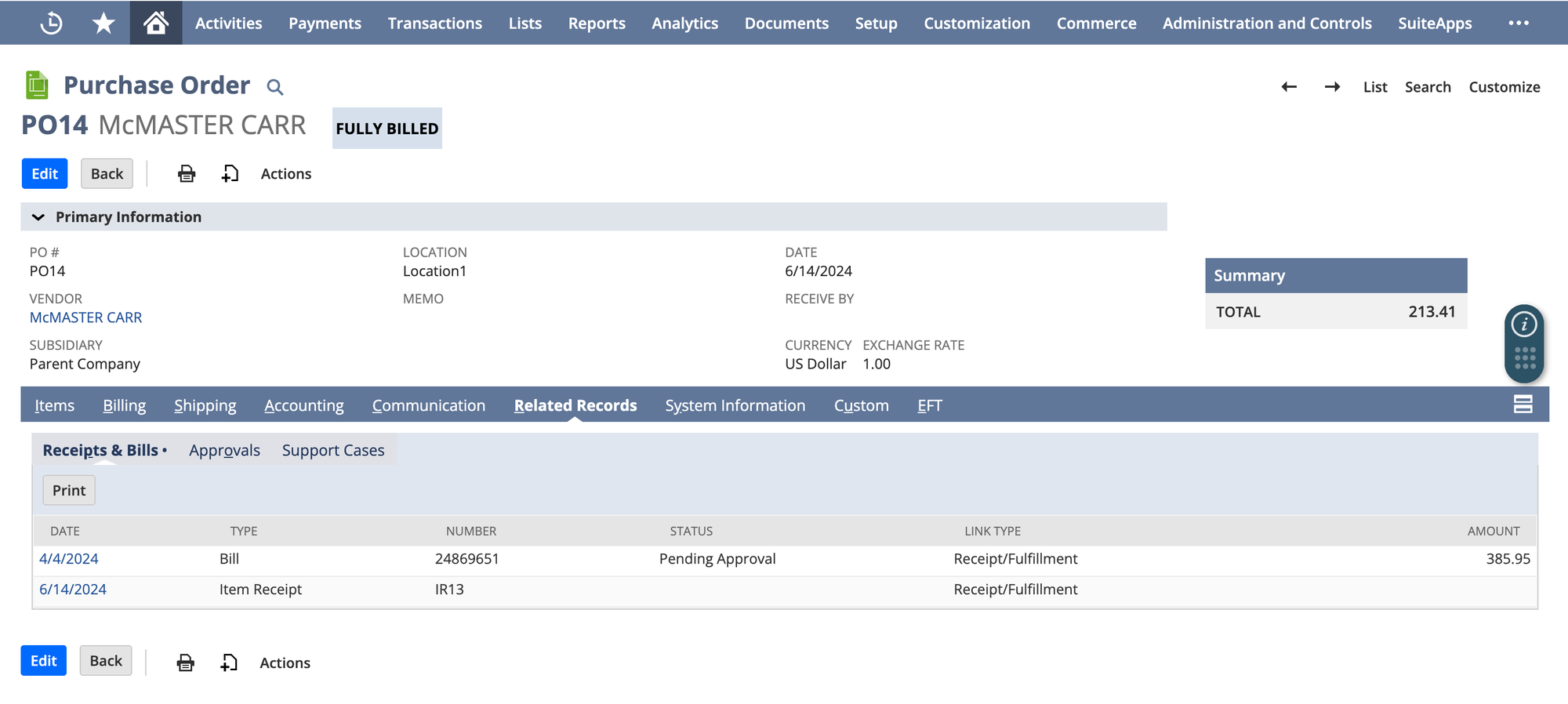

- Matching Standards: For the 3-way match to be legitimate, NetSuite checks if the PO, receipt, and vendor invoice knowledge match primarily based on amount, value, and line objects.

4. Execute the 3-Approach Match Validation

- NetSuite mechanically validates that the small print on the PO, receipt, and vendor invoice are constant. If discrepancies are discovered (e.g., increased portions on the invoice than obtained), the system flags these for assessment.

- Approval Guidelines: If a mismatch is recognized, approval workflows may be triggered. For instance, if the seller invoice exceeds the PO quantity by greater than a set threshold, a supervisor’s approval could also be required.

It is a simplified model of the method – in precise follow every of the above steps has a number of complexities that can come up when implementing this in a manufacturing situation.

To get a flavour of how you can implement matching in manufacturing NetSuite environments, you possibly can learn our weblog on matching POs to Vendor Payments in NetSuite.

How To Set Up 3-Approach Matching in NetSuite

To implement 3-way matching in NetSuite, comply with these steps:

Step 1: Configure Matching Guidelines

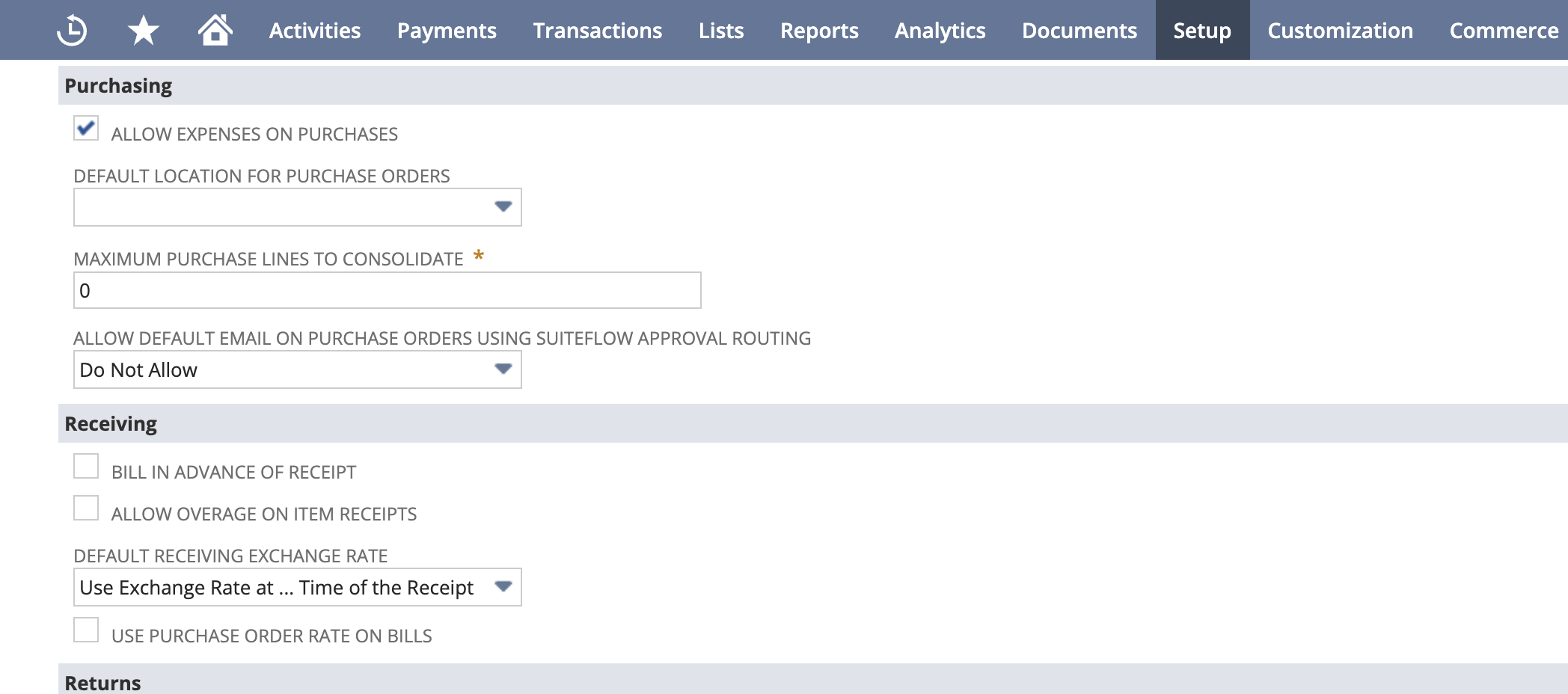

- Go to Setup > Accounting > Accounting Preferences.

- Beneath the Buying/Receiving tab, configure guidelines for 3-way matching. Outline how NetSuite ought to deal with discrepancies, comparable to setting tolerance ranges for value or amount variations.

Step 2: Allow PO Matching Preferences

- In Vendor Invoice Preferences, you possibly can allow settings like Use Buy Order Price on Payments, and Invoice prematurely of Receipt – these settings mean you can customise the 3-way match workflow in NetSuite when linking POs to receipts and payments.

- Set Tolerance Ranges: Outline allowable tolerances for amount and value discrepancies. NetSuite will solely flag payments that exceed these tolerances.

Step 3: Set Up Approval Workflows

- Use SuiteFlow to configure approval workflows. You’ll be able to create automated workflows that set off critiques for vendor payments with discrepancies.

- Automated Notifications: Arrange alerts for discrepancies. For instance, if an bill exceeds the PO price by greater than 5%, an e mail alert can notify the AP supervisor.

Step 4: Testing the 3-Approach Match

- Earlier than implementing 3-way matching on reside transactions, check it on just a few pattern transactions. Test if NetSuite accurately flags mismatches and triggers approval workflows.

Step 5: Practice Your Group

- Make sure that the buying, receiving, and AP groups perceive the 3-way matching guidelines and workflows in NetSuite. Present coaching on how you can resolve mismatches.

Advantages of Automating 3-Approach Matching in NetSuite

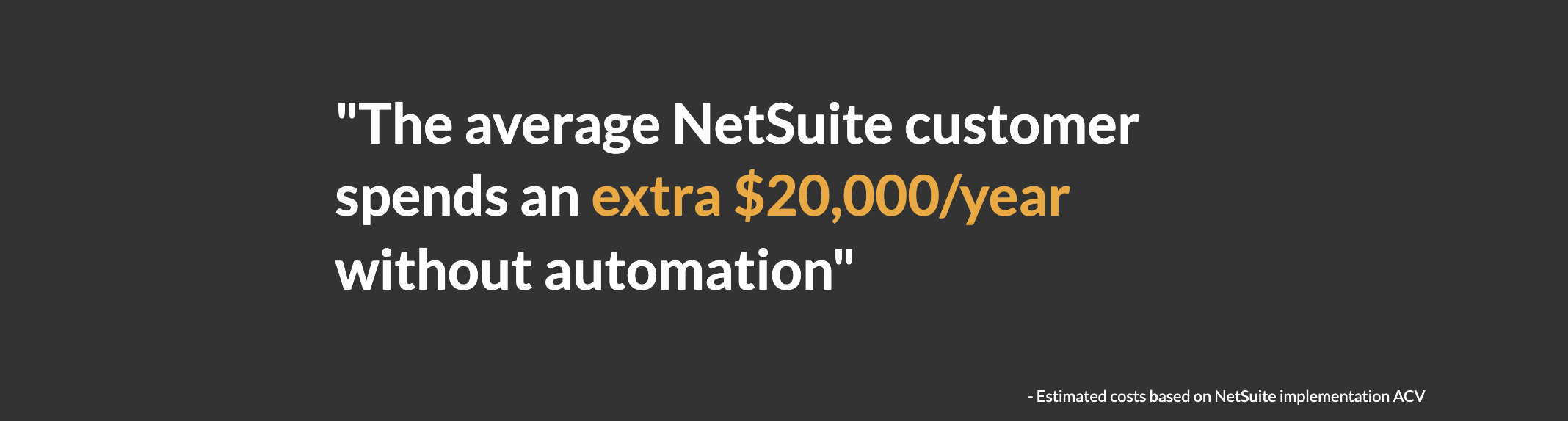

Automating 3-way matching in NetSuite brings a number of benefits (that ultimately lead to huge price financial savings):

- Elevated Effectivity: By automating matching, AP groups save time on guide critiques, permitting them to deal with extra strategic duties.

- Lowered Errors: Automated matching minimizes human error and catches discrepancies instantly.

- Improved Compliance: Constant, correct matching ensures that each one funds adhere to firm insurance policies and regulatory requirements.

- Enhanced Fraud Detection: Flagging mismatches helps establish suspicious transactions, defending the group from potential fraud.

Frequent Points with 3-Approach Matching in NetSuite

Whereas 3-way matching is a helpful course of total, there are just a few challenges that your AP staff may face:

1. Partial Receipts Inflicting Mismatches

- When items are obtained in components, NetSuite could flag a mismatch if the seller invoice doesn’t align with the entire PO amount.

- Answer: Use NetSuite’s partial receiving characteristic, permitting the system to acknowledge partial receipts and match payments accordingly.

2. Worth Variances

- Worth adjustments or fluctuations may cause mismatches if the seller’s invoice doesn’t match the PO’s value.

- Answer: Set a value tolerance degree to permit minor variations with out triggering alerts. For bigger discrepancies, create workflows that route invoices for guide assessment.

3. A number of Approvals Delaying Funds

- If approval workflows are too advanced, they’ll delay funds, impacting your vendor relationships negatively.

- Answer: Attempt to steadiness effectivity with the required degree of assessment. For instance, increased variances may require further approvals, whereas minor variances could also be auto-approved.

Integrating NetSuite 3-Approach Matching with AP Automation Options

For companies seeking to additional streamline AP processes, integrating 3-way matching with an AP automation platform in NetSuite gives a complete resolution.

AP automation options like Nanonets present real-time matching capabilities that reduce guide intervention. Right here’s how they improve the 3-way matching course of:

- Actual-Time Validation: Automated options can confirm every transaction in actual time, lowering the necessity for guide matching.

- Superior Reporting: AP automation platforms present detailed experiences and insights on matching accuracy, enabling you to trace mismatches and optimize approval workflows.

- Seamless Integration: By integrating NetSuite’s 3-way matching with an AP automation software, companies can automate the whole invoice-to-payment course of, lowering cycle occasions and bettering AP effectivity.

This is a brief demo that reveals how this may be carried out on a workflow automation platform like Nanonets:

Ultimate Ideas

Implementing 3-way matching in NetSuite is a vital step for any group searching for to enhance AP accuracy, forestall fraud, and optimize workflow effectivity. By organising clear matching guidelines, configuring automated workflows, and integrating with AP automation instruments, you possibly can remodel AP processes and save helpful time and sources.

Whether or not you’re dealing with excessive volumes of invoices or just seeking to enhance management over AP processes, NetSuite’s 3-way matching performance, mixed with AP automation, gives a scalable resolution that adapts to your group’s wants.

Often Requested Questions

Q: Can 3-way matching be personalized for particular distributors in NetSuite?

A: Sure, you possibly can create vendor-specific workflows and tolerance ranges for distributors that ceaselessly differ in value or supply amount.

Q: What occurs if there’s a discrepancy in 3-way matching?

A: If NetSuite detects a discrepancy, it’ll flag the transaction and comply with the approval workflow you’ve configured. AP or buying groups can assessment and resolve the mismatch earlier than continuing.

Q: Does 3-way matching work with providers in addition to items?

A: Sure, NetSuite’s 3-way matching may be utilized to each items and providers. Nonetheless, matching standards could differ barely, particularly if there are not any bodily receipts concerned for providers.