Solana is a high-speed blockchain recognized for its low transaction charges. With a theoretical velocity of as much as 65k transactions per second and a sensible velocity of a number of thousand, it turns into a critical competitor to Ethereum and Bitcoin and a choose platform for merchants trying to maximize earnings.

Nonetheless, like another blockchain platform, Solana is characterised by instability and market fluctuations. With out satisfactory response time, alternatives for worthwhile offers can disappear within the blink of a watch.

Many merchants have already adopted crypto buying and selling bots, and for a variety of buying and selling methods, automated buying and selling software program has change into not simply a bonus however a naked minimal.

On this information, we are going to give you a transparent plan for Solana customized crypto buying and selling bot growth, overlaying all levels, from technique definition to growth, testing, and deployment.

What Is a Solana Buying and selling Bot?

In easy phrases, a Solana buying and selling bot is an automatic software program program designed to execute purchase and promote orders on the Solana blockchain based mostly on sure predefined guidelines or algorithms.

Fairly than executing a commerce manually, it observes market conditions, appears to be like into value actions, and straight communicates with the decentralized exchanges (DEXs) developed on Solana, for instance, Raydium, Serum, or Jupiter.

What makes buying and selling bots on the Solana platform significantly efficient is the community itself.

Solana has extremely quick affirmation speeds of transactions and minimal charges that allow the bot to carry out many trades per day with the flexibility to reply instantly to market adjustments whereas minimizing any losses ensuing from slippage or community congestion.

Moreover, in at the moment’s Solana ecosystem, many bots are constructed with options tailored to present market realities. They observe new token launches on Pump.enjoyable, apply rug pull filters to keep away from suspicious or low-quality property, and use Jito tricks to improve the possibilities that time-sensitive transactions are processed shortly.

These capabilities are particularly essential for methods that depend upon quick execution and early market entry.

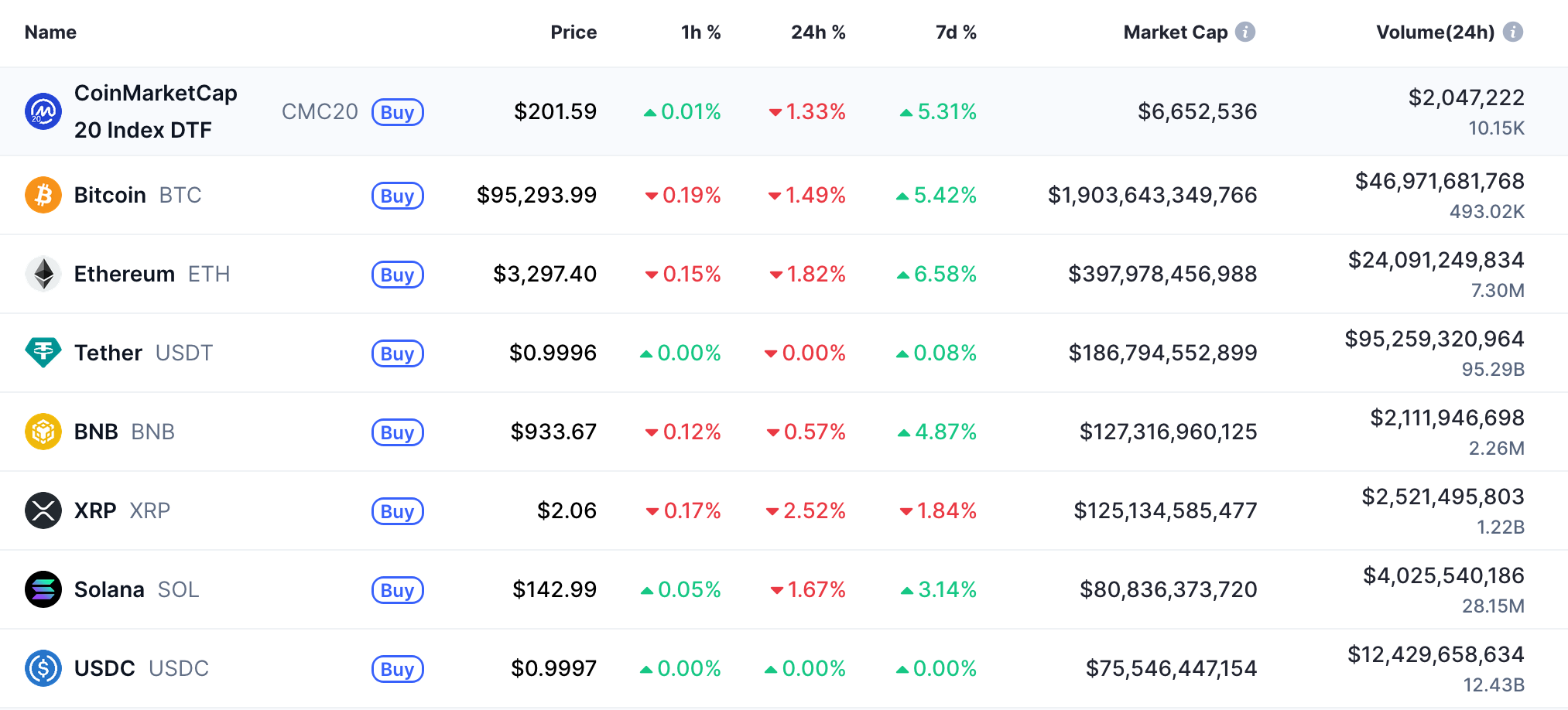

Solana’s Place Amongst Different Blockchain Platforms, CoinMarketCap

How Solana Buying and selling Bots Work

To work precisely as they’re supposed to, Solana buying and selling bots comply with a steady cycle of knowledge assortment, evaluation, and execution. But, due to Solana’s excessive throughput and low latency, this whole course of can occur inside milliseconds.

Knowledge Assortment

The bot continually gathers on-chain and market information, reminiscent of token costs, order e-book depth, liquidity ranges, and up to date transactions. This information is normally fetched by way of Solana RPC endpoints or real-time WebSocket connections.

For instance, a bot might subscribe to cost updates from a Raydium pool or watch new token mints and swaps as they seem on-chain. Utilizing WebSockets or Geyser streams permits the bot to obtain updates immediately as an alternative of counting on slower polling.

Sign Era

When the information is collected, the bot analyzes it to find out whether or not market circumstances match the chosen technique. This typically includes technical indicators reminiscent of shifting averages for development detection, ADX for development power, or ATR for volatility measurement.

As an example, a momentum bot would possibly generate a purchase sign when a short-term shifting common crosses above a long-term one, whereas an arbitrage bot compares costs throughout a number of DEXs to detect worthwhile discrepancies.

Commerce Execution

As soon as a sign happens, the bot constructs and submits transactions to the blockchain, partaking with DEX sensible contracts on platforms like Serum, Raydium, or Jupiter, a course of made attainable by Solana sensible contract growth.

Quick RPC endpoints are essential at this stage, as even small delays can result in missed alternatives or elevated slippage, particularly in high-frequency buying and selling or scalping methods.

Danger Administration

To guard capital, the bot applies predefined threat controls to each commerce. This consists of stop-loss and take-profit ranges, limits on place dimension, and guidelines that stop overexposure to a single asset or market situation.

For instance, a bot might mechanically shut a place if the value drops by a sure share or pause buying and selling fully after a sequence of losses. These safeguards assist make sure that automation reduces threat relatively than amplifying it.

| Benefit | Profit |

| Low charges | Helps frequent, cost-efficient trades |

| Quick execution | Reduces slippage |

| Excessive throughput | Permits superior methods |

| On-chain execution | Improves visibility |

| Actual-time information | Quicker response to market adjustments |

| Scalability | Handles a number of markets without delay |

Benefits of Solana Buying and selling Bots

Varieties of Solana Buying and selling Bots

In accordance with on-chain information, bots working on the Solana community have collectively generated greater than $1 billion in income.

However Solana buying and selling bots are usually created round a selected execution mannequin and information circulate. For this reason there are various subclasses of bots.

Every kind counts on completely different on-chain alerts, latency necessities, and interplay patterns with Solana packages and DEX sensible contracts.

Sniper Bots

Sniper bots concentrate on ultra-fast execution triggered by on-chain occasions reminiscent of new token mints, liquidity pool creation, or the primary swap in a newly deployed market.

Technically, these bots subscribe to blockchain information utilizing WebSocket or Geyser streams to detect program logs and account state adjustments.

When an occasion is detected, the bot immediately constructs and indicators a transaction, typically utilizing prebuilt directions and prioritized charges to outpace competing merchants.

Arbitrage Bots

Arbitrage bots evaluate costs, liquidity depth, and swap routes at a number of Solana DEXs. They combine value feeds from Raydium, Serum, Orca, or Jupiter and calculate potential revenue after accounting for charges and slippage.

Extra superior bots carry out multi-hop or triangular arbitrage by chaining a number of swaps right into a single transaction. To cut back execution threat, these bots typically use atomic transactions, guaranteeing that both all exchanges are efficiently accomplished or all the transaction is canceled.

Grid Bots

Grid bots divide a given value vary into a number of ranges and place purchase and promote orders at every degree.

On the Solana community, this usually includes managing a number of open orders on order book-based decentralized exchanges like Serum, or simulating restrict orders on automated market makers (AMMs).

The bot watches executed orders by way of account updates and dynamically rebalances the grid as costs change.

DCA Bots

A DCA bot mechanically buys (or sells) a set quantity of a token at common intervals, it doesn’t matter what the value is at that second. This spreads out the funding over time, lowering the influence of short-term value swings and avoiding the danger of making an attempt to “time the market.”

TWAP and VWAP Bots

TWAP (Time-Weighted Common Worth) and VWAP (Quantity-Weighted Common Worth) bots execute giant orders steadily as an alternative of unexpectedly to forestall the commerce from shifting the market an excessive amount of and assist get a greater total value degree.

As an example, as an alternative of shopping for 10,000 SOL in a single transaction, a TWAP bot would possibly purchase 1,000 SOL each hour for 10 hours.

VWAP bots are related, however as an alternative of dividing trades purely by time, they alter based mostly on market quantity. The bot appears to be like at how a lot buying and selling exercise is going on and executes extra when liquidity is excessive and fewer when the market is skinny.

Copy Buying and selling Bots

Copy buying and selling bots monitor particular pockets addresses or sensible contract interactions on Solana. Utilizing transaction subscriptions or account change listeners, the bot detects trades made by tracked wallets and replicates them proportionally.

Step-by-Step Information to Constructing a Solana Buying and selling Bot

Digging into the Solana trading-bot area will present you that it’s already abounding with ready-made options (Trojan, Photon, Axiom Commerce, GMGN AI, BullX NEO, and so on).

So why not reap the benefits of it? In actuality, present instruments in the marketplace are sometimes too fundamental to work effectively on this market. Customized bots can do extra superior issues like monitoring quantity spikes, analyzing traits, reacting to social sentiment, and so forth.

Sure, blockchain growth providers take a little bit of effort, however when you’ve obtained your individual setup, you’re not caught counting on generic alerts that everybody else is utilizing.

1. Outline Your Technique

The method begins with specifying clear buying and selling beliefs and constraints. This consists of revenue targets, acceptable drawdowns, place sizing guidelines, and cease circumstances.

At this stage, the primary technique is chosen, reminiscent of arbitrage, momentum, grid technique, value averaging, or sniper buying and selling, in addition to the market alerts that may provoke trades.

2. Select Your Growth Supplier

Making a buying and selling bot for Solana includes complicated steps that may be carried out by knowledgeable developer, reminiscent of SCAND, an organization offering full-cycle providers. First, the developer selects the know-how stack for crucial components of the system, transaction logic, and analytics or backtesting.

Then, they arrange the event atmosphere, putting in the Solana SDK, configuring wallets, and connecting to Devnet or Testnet for safe testing, utilizing atmosphere variables that simulate manufacturing circumstances.

Subsequent, the developer integrates market information and APIs to acquire real-time costs, liquidity data, and historic information.

Lastly, they create the bot’s logic and execution modules, changing methods into alerts utilizing indicators, executing orders on DEXs, and making use of threat administration mechanisms reminiscent of stop-losses and place limits.

3. Testing and Backtesting

Earlier than deployment, the bot ought to all the time bear testing at a number of ranges. Unit assessments confirm particular person parts, whereas backtesting evaluates the technique’s effectiveness utilizing historic Solana information.

Buying and selling on the testnet, in flip, simulates actual buying and selling circumstances with out monetary threat, serving to pinpoint logical errors, time-to-execution points, or surprising habits.

4. Deployment and Monitoring

The ultimate step is deployment to a manufacturing atmosphere. Once more, the event supplier deploys the bot to a manufacturing atmosphere utilizing a secure non-public RPC supplier and units up monitoring methods to observe efficiency, transaction success charges, and error logs.

Additionally they configure alerts to detect irregular habits and supply updates to maintain compatibility with the Solana community and protocol adjustments.

Widespread Challenges & Greatest Practices

Growing and working Solana buying and selling bots typically hides a number of technical and operational obstacles that require cautious planning.

The primary downside to suppose over is wait time. Many methods depend upon responding inside milliseconds. Gradual RPC endpoints, community delays, or weak transaction building could cause bots to overlook trades or perform them at worse costs.

To deal with such a problem, the perfect observe is to make use of non-public or high-performance RPC suppliers, depend on WebSocket or Geyser streams as an alternative of polling, and optimize transactions forward of time.

The second downside, however under no circumstances much less essential, is dependability. Solana markets change extraordinarily quick, and bots that digest stale or imprecise information can breed incorrect alerts.

On this state of affairs, the simplest resolution could be to make use of real-time information feeds, test costs towards the information on the blockchain, and implement logic that may deal with short-term value discrepancies and/or asynchronous issues with RPC requests.

Instruments and Libraries for Solana Bots

Constructing a totally useful buying and selling bot for Solana requires a mix of blockchain libraries, infrastructure providers, and real-time information instruments.

- @solana/web3.js: That is the first JavaScript/TypeScript SDK for interacting with the Solana blockchain. It’s used for managing wallets, creating and signing transactions, subscribing to account adjustments, and interacting with Solana packages. Most Solana bots use this library to construct transactions and execute operations on the community.

- RPC Infrastructure (Chainstack, QuickNode, non-public RPCs): RPC endpoints act like a gateway between the bot and the Solana community. Public RPCs would work nice for growth and testing, however manufacturing bots normally depend on non-public RPC suppliers to downsize latency and improve request charge limits.

- WebSocket and Geyser Plugins: WebSocket connections allow real-time subscriptions to account updates, value adjustments, and transaction occasions, eradicating the necessity for fixed polling. Geyser plugins present even sooner entry by streaming information straight from Solana validators, which is especially helpful for sniper bots, arbitrage bots, and memecoin bots that depend upon instant market alerts.

- DeFi and Market Knowledge API: APIs (e.g., Jupiter v6, Jupiter Aggregator, Bitquery) not solely simplify entry to aggregated value information, swap routes, liquidity data, and historic market information, but additionally scale back growth complexity and assist bots make higher buying and selling choices on DEXs.

- Python Solana Bot Tooling: Although JavaScript and TypeScript dominate execution logic, Python is usually used for technique analysis, analytics, and backtesting. Python Solana bot setups are particularly helpful for modeling methods earlier than deploying them into manufacturing environments.

- Authentication and Safety Instruments: JWT-based APIs and safe key administration options are sometimes used to guard entry to infrastructure providers and delicate endpoints. Correct authentication ensures that bot operations stay remoted and safe, particularly in multi-environment or crew configurations.

- Growth and monitoring instruments: IDEs reminiscent of VS Code, model management methods reminiscent of Git, and logging or alerting instruments are important for supporting and working bots in a manufacturing atmosphere. Monitoring helps determine failed transactions, RPC points, or anomalous buying and selling habits earlier than they result in losses.

Safety Concerns in Solana Buying and selling Bot Growth

Safety is a fundamental issue of constructing buying and selling bots, as these methods handle actual funds and work together straight with on-chain packages. Defending non-public keys, stopping unauthorized entry, and mitigating operational dangers are important to make sure protected and sound bot operation.

Personal keys ought to by no means be saved in plain textual content or hardcoded into the code. Utilizing {hardware} wallets, encrypted native storage, or safe vaults supplies a robust layer of safety.

For bots that conduct frequent transactions, sizzling wallets with strict limits can be utilized, whereas bigger reserves needs to be saved in chilly wallets to attenuate dangers.

Implementing multi-signature (multi-sig) wallets provides one other layer of safety. By requiring a number of confirmations for high-value transactions, bots scale back the danger of single factors of failure or key compromise.

As well as, automated safety measures reminiscent of stop-loss thresholds, commerce limits, and automated circuit breakers assist stop uncontrolled trades throughout surprising market volatility or software program errors.

Even in decentralized environments like Solana, regulatory compliance stays essential, particularly for bots dealing with consumer funds or giant buying and selling volumes. Monitoring authorized necessities ensures that operations adjust to native rules and keep away from potential penalties.

Solana Buying and selling Bot Growth Tendencies

The buying and selling bots growth course of will stay to be unraveled with the appearance of synthetic intelligence, decentralized structure, and low-latency buying and selling.

Bots will rely closely on AI and ML algorithms for technique adaptation, sample recognition, and optimizing commerce timing.

Sooner or later, buying and selling bots will even not depend on a single server or management level. Because of decentralized administration, monitoring, decision-making, and commerce execution will probably be unfold throughout a number of parts or areas.

Having RPC servers situated near the Solana community, together with well-optimized infrastructure, will enable bots to ship transactions and obtain information a lot sooner.

This velocity is particularly essential for sniping and arbitrage methods, the place reacting even milliseconds earlier can decide whether or not a commerce is profitable.

On the similar time, modular frameworks will simplify bot growth. As an alternative of creating the whole lot from scratch, builders will be capable of mix ready-made modules for buying and selling methods, threat administration, and execution logic, which hastens growth and reduces errors.

Often Requested Questions (FAQs)

What precisely is a Solana buying and selling bot?

It’s a program that trades on Solana for you. As an alternative of clicking “purchase” or “promote” your self, the bot watches the market, follows the metrics you set, and executes trades mechanically, even if you’re offline.

Do I actually need a personal RPC to run one?

For studying and testing, public RPCs normally work nice. However for actual buying and selling on mainnet, a personal RPC is strongly advisable. It’s sooner and extra secure, which issues quite a bit for methods the place velocity makes a distinction.

Which programming language ought to I exploit for a Solana bot?

There’s no single most suitable option. Rust is used when velocity actually issues, TypeScript working on Node.js with @solana/web3.js is fashionable for constructing the bot itself, and Python is commonly used for testing concepts or backtesting. Many bots use multiple language.

Can I take a look at my bot earlier than utilizing actual cash?

Sure, and you must. You’ll be able to take a look at your technique utilizing previous market information or run the bot on Solana’s take a look at networks to see the way it behaves with out risking actual funds.