Cryptocurrencies have drawn a number of curiosity because the launch of Bitcoin in 2009, and lots of nations now acknowledge cryptocurrency buying and selling as a authorized sector. Nevertheless, regulatory approaches range: some nations are nonetheless creating clear frameworks, whereas others, like China and Egypt, have imposed bans.

Regardless of this, the curiosity in cryptocurrencies continues to develop, with extra people and companies exploring how one can commerce them successfully.

A cryptocurrency pockets is likely one of the most vital instruments for dealing with digital property. It permits customers to retailer numerous kinds of cryptocurrencies, monitor balances, and conduct transactions. This text will cowl the fundamentals of crypto wallets, how they operate, and why cryptocurrency regulation is essential immediately.

What Is a Crypto Pockets?

A crypto pockets comprises knowledge about digital currencies, very similar to a traditional pockets does with money. It manages cryptographic keys required for asset operations or authenticates customers to entry platform companies. Moreover, it collects knowledge associated to person addresses, together with asset balances, transaction historical past, and extra.

Crypto wallets simplify blockchain knowledge by displaying solely the knowledge related to the person’s addresses. Non-public keys are very important on this course of, as they have to be securely saved. Public keys and addresses are derived from non-public keys, and solely the proprietor can signal transactions utilizing these addresses earlier than they’re added to the blockchain.

The recipient of funds follows the same course of, utilizing their non-public keys to handle property. These operations collectively type a blockchain. Whereas many cryptocurrencies have distinctive blockchains, quite a few crypto property make the most of present blockchains from different currencies.

Crypto Pockets Sorts and Classes

Crypto wallets are available in numerous sorts and classes. They differ by accessibility, degree of safety, how customers retailer their keys, and even the kind of cryptocurrency they settle for.

Paper wallets, cell wallets, and {hardware} wallets are among the many various kinds of crypto wallets. Every sort meets a variety of person wants by offering various levels of ease and safety. When customers select crypto wallets listed here are the principle sorts they’ll take into account.

Multi-Forex Cryptocurrency Wallets

Multi-currency cryptocurrency wallets are specialised purposes or units designed to retailer, ship, and obtain totally different cryptocurrencies inside a single platform. Their primary goal is to simplify the administration of digital property by eliminating the necessity for a number of separate wallets for every cryptocurrency.

Within the blockchain world, every cryptocurrency operates by itself know-how, and with out multi-currency wallets, customers must set up separate crypto apps to handle every kind of token. This isn’t solely inconvenient but in addition will increase the dangers of dropping knowledge or funds as a result of having to memorize a number of passwords and seed phrases.

Decentralized Finance Wallets

Decentralized finance wallets are specialised instruments that enable customers to work together with DeFi platforms with out intermediaries. They supply entry to options akin to staking, lending, liquidity farming, and buying and selling on decentralized exchanges (DEX).

DeFi wallets work straight with blockchains and hook up with decentralized purposes (dApps) by way of Web3 know-how, permitting property to be managed straight in a browser or cell pockets program.

Nevertheless, safety relies on the person: they signal transactions themselves and management their funds, however there’s a danger of asset loss when interacting with unreliable platforms.

The principle options of DeFi wallets embody staking, which is available in two sorts: conventional staking (freezing tokens to assist a community akin to Ethereum 2.0) and DeFi staking (putting property in sensible contracts to generate income).

Customers can borrow towards collateral or lend their property by way of DeFi protocols (akin to Aave and Compound). Liquidity farming permits incomes by lending tokens to swimming pools of decentralized exchanges akin to Uniswap or PancakeSwap, nevertheless it comes with dangers, together with impermanent losses.

Extra options of DeFi wallets embody token alternate by way of built-in DEX companies and NFT assist. Nevertheless, not all wallets enable NFT buying and selling – specialised platforms akin to OpenSea or Magic Eden are extra usually used for this goal.

Thus, DeFi wallets are a common device for managing digital property, however for his or her protected use, you will need to perceive the mechanisms of DeFi merchandise and punctiliously select platforms for interplay.

NFT Wallets

NFT wallets are specialised instruments that allow customers to handle their non-mutualizable tokens. They supply safe non-public key storage and interplay with the blockchain. NFTs are distinct digital property with various values, like art work, collectibles, or in-game supplies.

NFTs require wallets that assist tokenization requirements, akin to ERC-721 and ERC-1155 on the Ethereum blockchain, BEP-721 and BEP-1155 on the Binance Sensible Chain, Metaplex on Solana, or Circulate NFT Customary on the Circulate blockchain. These requirements outline how NFTs are created, transmitted, and saved on the community.

NFT wallets don’t retailer the tokens themselves however solely handle entry to them by way of non-public keys. In non-custodial wallets, akin to MetaMask or Belief Pockets, the person has whole management over their keys, making them safer.

Custodial options, akin to wallets on centralized exchanges, retailer keys on the supplier aspect, which is much less safe. With NFT wallets, you may hook up with marketplaces akin to OpenSea, Rarible, Magic Eden, or LooksRare by way of Web3 integration. This lets you view, switch, or promote your NFTs.

Custodial and Non-custodial Wallets

This characteristic defines how a person needs to retailer their keys. The wallets the place customers entrust their keys to 3rd events or custodians are often known as “custodial wallets”. Custodians are chargeable for storing cryptographic keys and funds and supply an interface for customers to deal with crypto.

This sort of pockets is usually web-based, so customers can entry their wallets by way of a cellphone or an online browser by signing into their accounts. In case a person forgets their password, all they should do is simply bear in mind a restoration phrase or comply with one other easy restoration process offered by the custodial service.

Non-custodial crypto wallets work fairly otherwise – customers take full accountability for his or her private and non-private keys to stay safe. Dropping a pockets or forgetting a password means dropping digital cash. On the identical time, customers don’t must refer to 3rd events for managing their keys, as a substitute, they use particular software program that generates private and non-private keys for them. Subsequently, these wallets are thought-about safer than the custodial ones.

Typically, those that solely begin utilizing crypto wallets want a custodial form of pockets. Customers don’t must hassle with storing their non-public keys, can rapidly entry their wallets, and carry out transactions extra seamlessly. In the meantime, non-custodial wallets might be safer because the homeowners of crypto property handle their keys themselves.

Scorching Wallets

Though sizzling wallets are extra handy for frequent transactions since they’re all the time on-line, they aren’t as protected as chilly wallets. They are perfect for on a regular basis use, akin to buying and selling on crypto exchanges or paying for items and companies.

Examples of sizzling wallets embody cell cryptocurrency pockets app akin to Belief Pockets and MetaMask, in addition to net wallets akin to Coinbase and Binance. Scorching wallets’ major advantages are their ease of use and fast entry to funds. Nevertheless, as a result of non-public keys are stored on-line, they’re inclined to hacker assaults.

Chilly Wallets

Chilly wallets are safer for preserving cryptocurrency as a result of they aren’t on-line. They’re used for long-term storage and are very best for individuals who need to defend massive sums from cyberattacks. Paper wallets, the place non-public keys are printed on paper and stored in a protected place, and wallets like Ledger and Trezor are examples of chilly wallets.

The principle benefit of chilly wallets is that they maximize safety towards hacking, as they aren’t dependent on the web. Nevertheless, as a result of transactions want importing keys right into a digital pockets or connecting to a tool, they’re much less sensible for frequent transactions.

Cellular/Desktop, Internet-Based mostly, or {Hardware} Wallets

Cellular/desktop, web-based, or {hardware} crypto wallets decide software program purposes and units customers make the most of to entry them.

Internet-based wallets might be accessed from a cell phone or a pc by way of an online browser. They don’t require putting in any cryptocurrency software. Most web-based wallets are custodial, although not too long ago there have been non-custodial choices.

Cellular/ desktop wallets require downloading and putting in software program apps on a pc or smartphone. This software program have to be appropriate with the units’ working programs. Subsequently, there may be a variety of wallets out there for Linux, Home windows, Mac, iOS, and Android. Any such pockets is best secured than their web-based analogs and most frequently is non-custodial.

{Hardware} wallets are particular units used for storing keys offline. When customers signal transactions in {hardware} crypto wallets, they don’t must ship their keys wherever and the method of signing occurs on the gadget inside a restricted time-frame, making it extra proof against hacker makes an attempt.

Cryptocurrency Regulation: Why Is It So Essential?

Whereas some customers are readily investigating the world of Bitcoin, Ethereum, and Tether, others are involved in regards to the excessive dangers concerned and poor legislation laws. Because of this, some nations have began engaged on authorized frameworks that might adapt crypto markets to their financial system. The US, most European nations, India, and Australia are amongst them.

For instance, the US authorities has already taken essential steps towards crypto laws. A cryptocurrency alternate within the US is authorized and controlled by the Financial institution Secrecy Act (BSA). Nevertheless, the authorized framework isn’t constant but, and yearly extra legal guidelines seem to control digital foreign money buying and selling.

Among the many current ones was proposed by FinCEN. This regulation requires amassing knowledge on cryptocurrency exchanges and wallets and is anticipated to be enforced by fall 2022.

Why are laws in crypto buying and selling obligatory and the way can this profit the world of digital foreign money alternate? Listed here are the principle causes.

Elevated Investor Safety

Although blockchain applied sciences have proved to be of excessive safety, there are frequent makes an attempt of assaults on crypto pockets software program. This primarily occurs as a result of customers’ poor understanding of how crypto wallets work, e.g. hackers can lure their non-public keys out and steal cash from wallets or implement different safety threats. Other than that, there could emerge some hidden dangers akin to a crypto platform going bankrupt or being hacked.

Prevention of Cash Laundering and Tax Evasion

As blockchain supplies some degree of anonymity to its customers, it attracts unlawful funds that flip common cash into “soiled” ones. If crypto platforms confirm the identities of the commerce individuals by know-your-customer (KYC) and know-your-business (KYB) procedures, management their supply of funds and monitor their transactions, offers, and operations, it’s a lot simpler for governments to stop unlawful cash transfers by such platforms, or makes an attempt of tax evasion of their nations.

Growing Affect on the International Financial system

Blockchain know-how and foreign money buying and selling are continually creating. There are new kinds of funds and currencies, and the variety of customers is repeatedly rising. All this has extra affect on the worldwide economic system.

For instance, there emerged a brand new kind of foreign money – stablecoins. These cash are pegged to different property, normally of well-known status and worth, akin to fiat cash like US {dollars} or different valuables like gold. Not too long ago stablecoins have began to have a deeper impact on economies, e.g. FitchFatings warns that stablecoins can enhance dangers in a short-term credit score market.

Phishing

Some of the usually occurring and sneaky threats that customers of Bitcoin wallets encounter is phishing. Think about visiting a web site that appears like your most popular pockets or alternate, solely to search out it to be a rip-off. Attackers produce just about excellent replicas of the true factor on false pages, and whenever you enter your knowledge—passwords, seed phrases, non-public keys—they wind up within the fingers of the frauds.

At all times test the web site handle, use solely licensed apps, and bear in mind to activate two-factor authentication that will help you keep undercover. These easy measures can save your life financial savings.

Malware

Malware is just like cybercriminals who can get onto your laptop and take your seed phrases or non-public keys. One mistake – obtain a suspicious file or set up an untrusted app – and your funds might be in danger. To guard your self, use high quality antivirus software program, replace your working system usually, and watch out about what you obtain from the web. Bear in mind, your safety is in your fingers, and it by no means hurts to be additional cautious.

Cryptocurrency Pockets Safety

Cryptocurrencies are a significant device for safeguarding and managing digital property, however their degree of safety is straight influenced by person habits and safety protocols. As a result of cryptocurrencies are decentralized and can’t be restored within the occasion of loss or theft, pockets safety is essential. Let’s take a look at fundamental safety strategies and the significance of backup and restoration.

Safety Strategies

- Two-Issue Authentication (2FA): Some of the fashionable methods for enhancing safety is that this one. The person should present a second issue of id, akin to a bodily key, an authenticator app (like Authy or Google Authenticator), or a code from an SMS, with a purpose to entry the pockets or full transactions. Even when attackers know the password, they’ll have a significantly harder time accessing the pockets.

- Multi-signature: With multi-signature know-how, a transaction have to be verified by a number of events. As an illustration, two or extra units or customers could must signal a switch. That is significantly helpful for company wallets or collaborative asset administration because it reduces the probability of cash theft even when one of many keys is stolen.

- Information encryption: Many wallets use encryption to guard non-public keys and seed phrases. This means that even when an attacker good points entry to the gadget, they are going to be unable to decode the information except they know the password or PIN.

- {Hardware} wallets: Wallets akin to Ledger or Trezor retailer non-public keys offline, making them just about invulnerable to hacking assaults over the web. They’re thought-about one of many most secure methods to retailer cryptocurrencies.

Backup and Restore

- Seed-phrase: You should utilize a seed phrase, generally referred to as a mnemonic phrase, which is a set of 12 or 24 syllables, to retrieve your pockets within the occasion that your gadget is misplaced or your knowledge is corrupted. It’s important to write down this phrase down and put it aside in a safe location as a substitute of on digital storage to minimize the probability of hacking.

- Backup: Some wallets allow you to backup your knowledge, which might be stored on {hardware} crypto wallets or exterior media like USB drives. Within the occasion that you simply misplace your major gadget, this affords an extra diploma of safety.

- Take a look at transactions: To make sure your pockets is functioning accurately, it’s preferable to do a check transaction with a small sum of cash earlier than transferring bigger sums. This aids in confirming the accuracy of the information entered as properly.

The right way to Select a Pockets: Comparability of Standard Choices

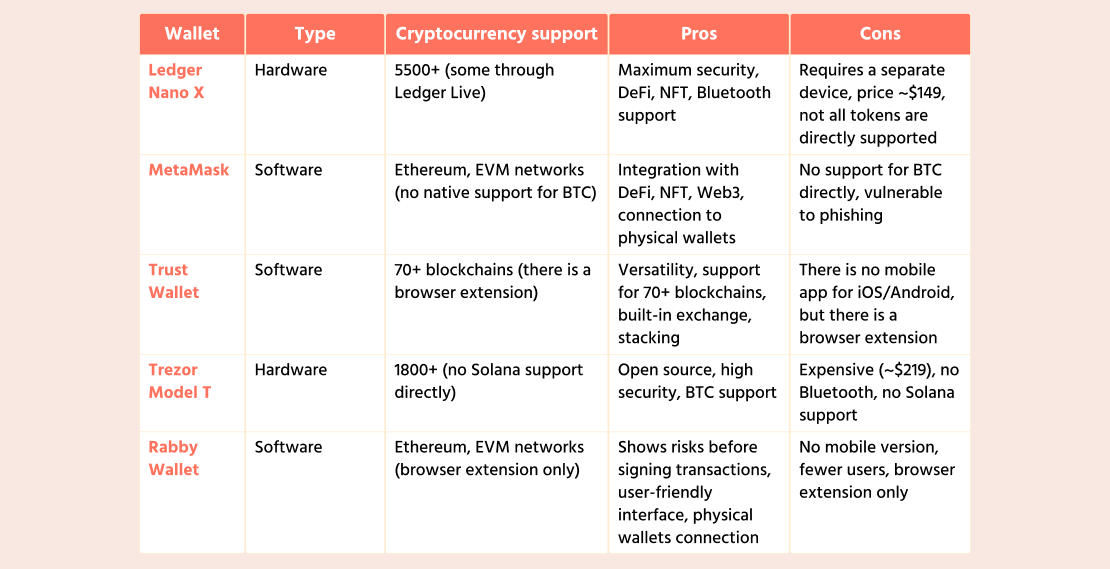

If you find yourself fascinated with creating your individual cryptocurrency pockets, you will need to take note of profitable examples which have already gained the belief of customers. The desk beneath summarizes fashionable wallets.

This desk supplies an summary of world crypto wallets which might be fashionable amongst customers all over the world.

The right way to Develop a Crypto Pockets App

When contemplating crypto pockets software program growth, it’s essential to grasp the options of a crypto pockets that improve person expertise and safety. These embody assist for a number of cryptocurrencies, safe key storage, and integration with blockchain know-how.

If you wish to create a cryptocurrency pockets, we give you Crypto Pockets White-label Resolution. It’s a white-label answer for corporations searching for to offer their prospects with the most effective cryptocurrency expertise.

The cryptocurrency pockets growth course of entails a number of phases, from MVP growth to product launch and assist. For profitable growth, you will need to assemble a professional pockets growth firm, which can embody blockchain pockets builders, frontend and backend specialists, testers, and challenge managers.

When designing wallets, it is usually essential to think about the kinds of wallets that will likely be supported. For instance, cell wallets are handy for customers who need to handle property from their telephones, whereas paper wallets present offline storage of keys in bodily type.

Numerous strategies akin to knowledge encryption, two-factor authentication (2FA), and integration with {hardware} modules are used to safe your pockets. As well as, you will need to take into account authorized points akin to KYC (Know Your Buyer) and AML (Anti-Cash Laundering) compliance, in addition to the safety of customers’ private knowledge in accordance with GDPR.

Crypto Pockets App Improvement Price

The event price of a crypto pockets relies on many elements, such because the complexity of the performance, the selection of platform (cell cryptocurrency app, net pockets, or {hardware} answer), the scale of the app, and the extent of safety. For instance, integration with {hardware} crypto wallets or multi-signature assist could enhance the general price however will considerably improve safety.

While you resolve to create a crypto pockets app, partnering with a dependable app growth firm can assist streamline the method and make sure that your pockets app should meet all safety and usefulness requirements. The price to develop a crypto pockets begins at 20,000 and may go as much as 100,000, relying on the performance. Including advanced options akin to staking can additional enhance the general price of growth by 20–30%. Nevertheless, the price of creating a pockets might be diminished by utilizing open-source options akin to MyEtherWallet.

To make sure that the pockets is user-friendly, take into account integrating options like pockets utilizing the QR code for straightforward transactions. Moreover, launching your Bitcoin pockets app on the app retailer can assist attain a wider viewers and contribute to the success of your crypto pockets.

In case you are creating a cryptocurrency pockets app or creating a Bitcoin pockets, it’s essential to account for growth price and the elements that affect it. As an illustration, an app with a fundamental characteristic set could price you round $20,000, whereas extra superior options can considerably enhance the general price.

Conclusion

Whereas some governments are indecisive about whether or not to legalize cryptocurrencies of their nations and others even ban them, crypto buying and selling is gaining reputation at a breakneck pace. Within the close to future, digital foreign money buying and selling will grow to be an integral a part of the worldwide economic system, but many governments are already contemplating how one can modify their laws to undertake it.

At the moment, many startups are experimenting with blockchain and actively investing within the crypto pockets growth course of, looking for essentially the most expert builders for that. SCAND has intensive expertise in working with blockchain app growth options. Take the lead within the crypto market and create a crypto pockets with a growth group of pros from SCAND.