If you happen to select high-volume, well-vetted swimming pools with incentives, properly handle impermanent loss, and diversify your positions, offering liquidity may be a lovely supply of passive revenue within the DeFi ecosystem. Nonetheless, it’s not with out threat: it’s essential perceive the mechanisms, fastidiously choose your positions, and carefully monitor them.

DeFi describes monetary companies created on and operated by way of blockchain. It’s an already impactful market (with a complete quantity of $14.0 billion) that stands behind lending and borrowing platforms, decentralized exchanges, staking, and, after all, buying and selling.

However on the earth of DeFi, to assist buying and selling exercise, the ecosystem depends on liquidity swimming pools. With out swimming pools of tokens locked in sensible contracts, DEXs (decentralized exchanges) would lack the depth and responsiveness wanted for affordable swaps.

Complete Worth Locked (TVL) in liquidity swimming pools has grown 12 months by 12 months as extra people imagine in decentralized markets and understand the value of offering market liquidity with a view to attain minimal slippage, environment friendly value discovery, and fixed buying and selling.

What Are Liquidity Swimming pools: Definition & Goal

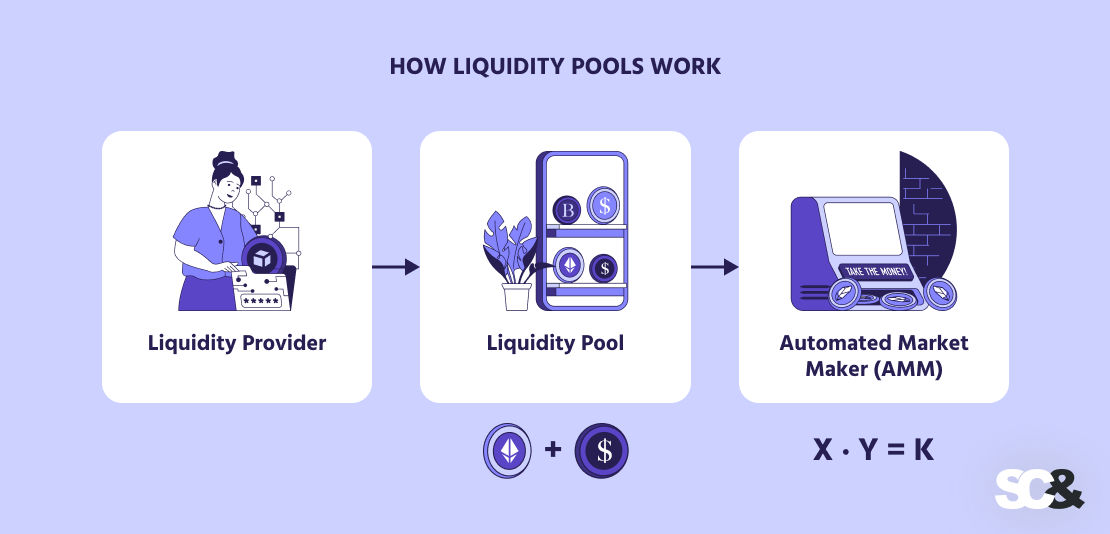

Liquidity swimming pools are one of many foundational innovations of decentralized finance (DeFi). In easy phrases, a liquidity pool consists of crypto tokens locked inside a sensible contract that enables customers to commerce, lend, or borrow belongings with no need intermediaries or order books.

In centralized exchanges (Binance or Coinbase), trades happen when a purchaser’s order meets a vendor’s order. However within the decentralized area, there’s no central authority to handle the matching course of.

As a substitute, liquidity swimming pools change order books with a pool of tokens which can be all the time obtainable for buying and selling. Costs are routinely decided by mathematical formulation referred to as Automated Market Makers (AMMs) — just like the well-known x · y = ok mannequin pioneered by Uniswap.

Individuals who provide tokens to those swimming pools are referred to as liquidity suppliers (LPs). They deposit their belongings (in pairs, resembling ETH and USDC) right into a pool for others to commerce towards.

Every commerce within the pool generates charges, a portion of which works to LPs. Basically, they act as market makers, offering liquidity in change for rewards.

Liquidity swimming pools, by the best way, energy far more than mere token swaps. In addition they function the spine for yield farming, decentralized lending, artificial asset creation, and cross-chain liquidity transfers — making them an indispensable part of practically each DeFi protocol in the present day.

Key Ideas & Mechanics

Now that we’ve coated what decentralized liquidity swimming pools are, let’s speak about how they really work and what key ideas it is best to know earlier than getting began with one.

LP Tokens (Share Illustration)

Whenever you deposit tokens right into a liquidity pool, you get LP tokens in return that symbolize your share of the pool. Whenever you determine to withdraw your cash, you’ll swap out your LP tokens in your share of the pool belongings, in addition to for any buying and selling charges you earned within the course of.

Incomes Charges

Each time a consumer swaps tokens by way of a pool, they pay a small buying and selling fee (e.g., 0.3%). That charge doesn’t go to the platform — it’s divided between all of the liquidity suppliers. So, the extra trades that occur in a pool and the bigger your share, the extra you earn.

Impermanent Loss

Some of the essential issues to know is impermanent loss. It occurs when the costs of the tokens in your pool change in comparison with if you first added them.

As a result of AMMs routinely rebalance the pool, you would possibly find yourself with extra of 1 token and fewer of the opposite — and that may typically go away you with much less worth than in the event you had simply held the tokens individually.

The loss is “impermanent” within the sense that it could disappear if costs return to the place they began, but it surely turns into everlasting the second you withdraw.

For instance:

- Suppose you deposit 1 ETH and 1,000 USDC (ETH = 1,000 USDC) right into a 50/50 pool.

- If ETH doubles in value to 2,000 USDC, arbitrage adjusts the pool in order that you find yourself with ~0.707 ETH + ~1,414 USDC, value ~$2,828 whole.

- However in the event you had held 1 ETH + 1,000 USDC, the full could be $3,000.

- That ~$172 distinction is an impermanent loss.

Single-Sided vs. Twin Token Provision

Historically, swimming pools require you to deposit two tokens of comparable worth (resembling ETH and USDC). That is referred to as dual-token provision.

Some newer platforms, nonetheless, now present single-sided staking, the place you may stake one kind of token alone. These swimming pools deal with the pairing on their very own, making the method less complicated, although typically with barely completely different dangers or rewards.

Varieties of Liquidity Swimming pools & AMM Fashions

Not all liquidity swimming pools work the identical approach. Totally different DeFi platforms use completely different AMM fashions. Understanding these fashions means that you can select swimming pools most applicable in your objectives and threat tolerance.

Fixed Product (x · y = ok): The Basic Mannequin

Fixed product is the commonest AMM components, urged by Uniswap. It retains the product of two token reserves (x and y) equal to a relentless worth (ok).

Merely put, when one token is bought, the worth adjusts routinely in accordance with how a lot is remaining within the pool. This is a perfect mannequin for many pairs of tokens, however it would result in better value slippage when there are huge trades or there’s little liquidity.

StableSwap: Low Slippage for Steady Belongings

Utilized by Curve Finance, this mannequin is ideal for buying and selling belongings that keep shut to one another in value, resembling stablecoins (USDC, USDT, DAI). The components reduces slippage and impermanent loss, which makes it excellent for steady or pegged tokens.

You’ll not get wild yields right here, however the returns are regular and the danger is visibly decrease.

Concentrated Liquidity (Uniswap v3 fashion)

Popularized by Uniswap v3, concentrated liquidity lets LPs select particular value ranges the place they need to present liquidity as a substitute of spreading it throughout all costs.

This sort will increase capital effectivity, that means you may earn extra with much less capital, but when the worth strikes exterior your chosen vary, your funds will cease producing revenue till the worth returns to regular ranges.

Multi-Asset Swimming pools: Past Token Pairs

Some platforms (for example, Balancer) permit greater than two tokens in a pool (for instance, 80% ETH + 10% WBTC + 10% USDC). These multi-token swimming pools present extra diversification in portfolio administration.

LPs can maintain completely different weights of tokens as a substitute of the identical 50/50 share, adjusting their publicity to the market.

Artificial or Spinoff Swimming pools

Some swimming pools use artificial belongings — tokens that symbolize different belongings or mirror their worth (e.g., artificial USD or wrapped Bitcoin). These swimming pools permit customers to commerce derivatives or achieve publicity to belongings from different blockchains, with extra potential for yield but in addition increased threat.

What Makes a Liquidity Pool “Good”?

With 1000’s of liquidity swimming pools obtainable throughout completely different blockchains, they aren’t all value your whereas — or your tokens. A “good” liquidity pool provides a stability between profitability, security, and value. Right here’s what to take a look at earlier than deciding the place to place your funds.

Liquidity & Depth

The whole worth locked exhibits the full quantity of funds in a pool. Bigger TVL typically means deeper liquidity, which reduces slippage — the worth motion that occurs when giant trades transfer the market.

Deep swimming pools are extra steady, whereas shallow ones can create excessive value swings and better threat for LPs.

Buying and selling Quantity & Charge Yield

A pool that’s actively traded generates extra charge revenue for its suppliers. The most effective swimming pools mix robust liquidity with regular buying and selling quantity.

Every swap within the pool incurs a small charge (typically between 0.05% and 0.3%), which will get distributed amongst LPs. The extra buying and selling quantity in a pool, the upper your reward.

Rewards & Incentives

Many DeFi protocols entice crypto liquidity suppliers by providing further rewards, resembling governance tokens or bonus emissions, along with buying and selling charges.

Nonetheless, it’s essential to examine the emissions schedule — sure rewards taper over time or require you to lock up your cash for longer durations.

Threat Elements

Liquidity swimming pools carry a number of dangers you shouldn’t ignore:

- Impermanent loss: Occurs when token costs transfer aside.

- Sensible contract threat: Bugs within the pool’s code can result in hacks or exploits.

- Token threat: If one of many tokens loses worth or depegs (like a stablecoin breaking its peg), you may undergo heavy losses.

- Market volatility: The extra unstable the belongings, the upper the potential reward — and the upper the danger.

Capital Effectivity & Flexibility

Some AMMs, like Uniswap v3 or Curve, allow you to focus liquidity on particular value ranges, growing capital effectivity (incomes extra with much less capital). Others permit versatile pool weights or automated rebalancing to assist preserve your required publicity with out fixed handbook changes.

Usability & Accessibility

No matter how profitable the pool is, if it’s not simple to make use of, it doesn’t matter. Search for platforms with:

- Low fuel charges or availability on Layer 2 networks.

- Easy and totally supportive interfaces that make it simple to deposit and withdraw.

- Cross-chain performance, the place you may change liquidity between ecosystems with out complicated bridging.

Prime Liquidity Swimming pools / Platforms to Take into account

Let’s have a look at some well-known crypto exchanges to higher perceive how cryptocurrency liquidity swimming pools work. This listing is drawn up primarily based on energy, yield potential, and threat profile:

Uniswap (Ethereum / Layer 2s / v3 and newer)

Uniswap stays some of the standard decentralized exchanges for liquidity provision. It offered the fixed product mannequin (x·y = ok) and later moved on to concentrated liquidity with Uniswap v3, which gave suppliers better management of their capital effectivity.

- Execs: Mature ecosystem, excessive liquidity, loads of yield pairs; with concentrated liquidity, it’s extra capital-efficient.

- Dangers: Gasoline value on Ethereum, vary threat if value strikes exterior your band.

Curve Finance

Curve is suited to pegged and steady belongings resembling USDC, USDT, and DAI. Its StableSwap protocol minimizes slippage and impermanent loss, and therefore it’s most applicable for traders in search of low-risk and steady yield.

- Execs: Extraordinarily low stablecoin pool slippage, very low impermanent loss.

- Dangers: Decrease yields until augmented with additional incentives.

Balancer

Balancer has robust assist for multi-asset and customizable pool constructions. It means that you can create swimming pools with as much as eight tokens and assign customized weights (e.g., 80/20 as a substitute of fifty/50), which makes it excellent for customers who need to construct portfolio-like liquidity methods.

- Execs: Versatile weightings, a number of tokens per pool, good diversification alternatives.

- Dangers: Extra complicated mechanics, doubtlessly thinner liquidity in area of interest swimming pools.

PancakeSwap / BNB Chain swimming pools

As the highest DEX on BNB Sensible Chain (BSC), PancakeSwap provides quick, low-cost buying and selling and all kinds of farming alternatives. Its excessive liquidity and uncomplicated interface make it among the best platforms for novices.

- Execs: Decrease fuel prices, many incentive packages, good for BNB ecosystem customers.

- Dangers: Larger token threat, much less mature safety document for some tasks.

How one can Select the Proper Pool for You

Choosing the proper liquidity pool is a trade-off between threat and achieve. Though excessive APYs could also be tempting, the most effective plan of action is to match your decisions along with your objectives and threat tolerance.

Begin by assessing your threat tolerance. Low-volatility stablecoin swimming pools like USDC, DAI, or USDT yield constant returns with minimal impermanent loss, however riskier buying and selling pairs like ETH/USDC or BTC/ETH can yield increased charges on the expense of better threat.

Subsequent, diversify each between swimming pools and platforms to cut back the publicity within the occasion of a token or protocol failure. For instance, break up your funds between a stablecoin pool on Curve, an ETH pool on Uniswap, and a small portion in a yield farm for further incentives.

Additionally, start with a small funding and watch efficiency. Use analytics instruments like DefiLlama, Zapper, or Uniswap Information to trace TVL, buying and selling quantity, and charges.

Examine the platform’s safety and popularity. Established protocols, resembling Uniswap, Curve, and Balancer, supply audits and energetic communities, whereas newer swimming pools may be riskier.

Lastly, put together an exit technique. Don’t be afraid of withdrawing when situations change, and be prepared to maneuver funds to better-performing swimming pools.

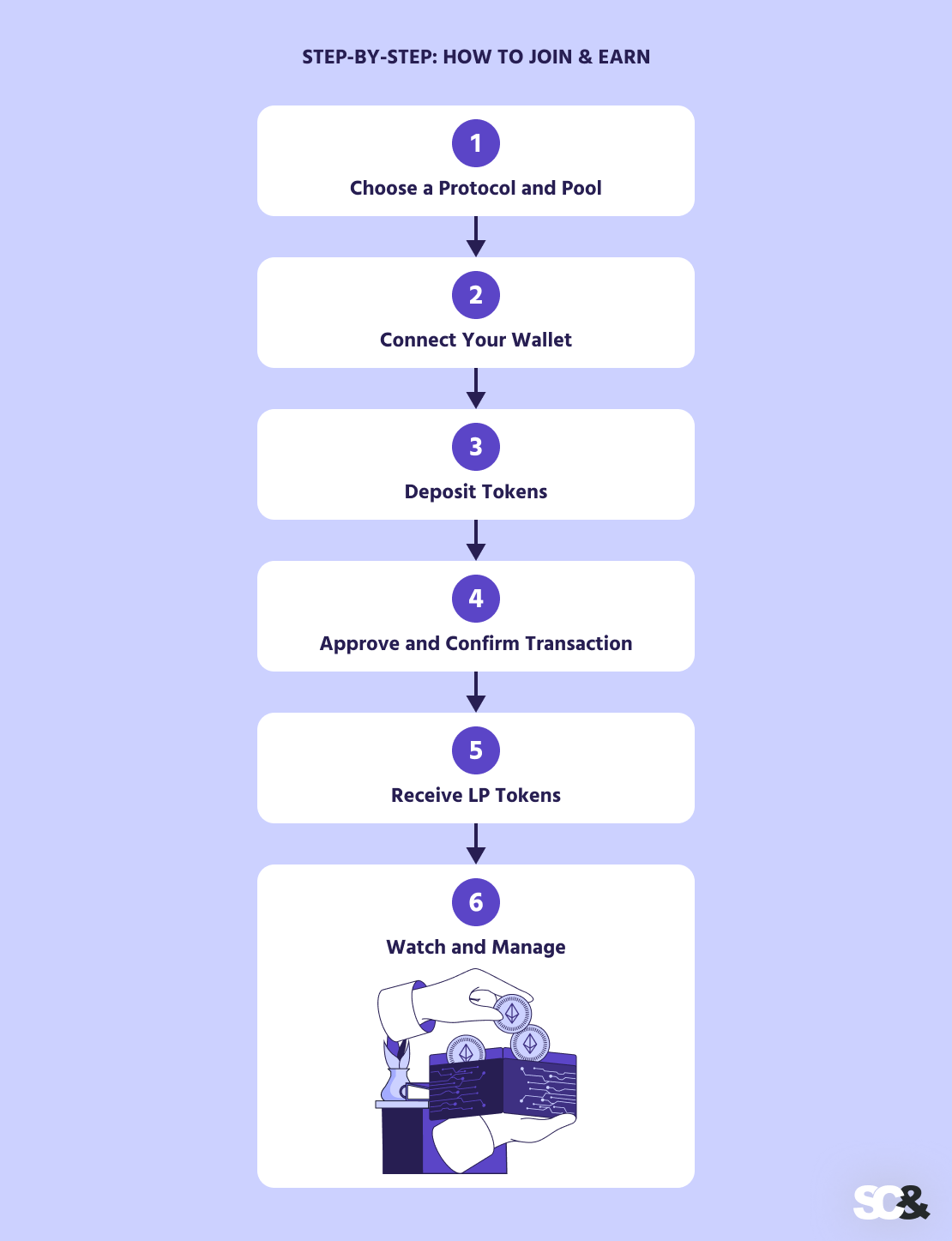

Step-by-Step: How one can Be part of & Earn

Frankly talking, becoming a member of a liquidity pool is simple, but it surely does require a fundamental understanding of how DeFi platforms work and taking some precautions to ensure the safety of your belongings.

By offering liquidity, you contribute to the protocol’s buying and selling ecosystem and, in flip, obtain a share of charges or further incentives.

- Select a Protocol and Pool: Begin by deciding on a good platform and a pool that goes consistent with your objectives, be it a stablecoin pair for decrease threat or a unstable pair for increased rewards.

- Join Your Pockets: Use a crypto pockets to hook up with the platform. Be certain that your pockets has sufficient of the tokens required for the pool.

- Deposit Tokens: Deposit the matching token quantities to the pool. Swimming pools typically require equal worth for each token (e.g., 1 ETH + 1,500 USDC), although sure swimming pools supply single-sided deposits.

- Approve and Verify Transaction: Approve the sensible contract to entry your tokens and make sure the transaction. This will likely contain paying a community charge (fuel).

- Obtain LP Tokens: As soon as your deposit is confirmed, you’ll obtain LP tokens representing your share of the pool. The tokens entitle you to a share of buying and selling charges and any rewards.

- Watch and Handle: Repeatedly examine your place for charges earned, impermanent loss, and reward distribution. Use analytics dashboards to comply with efficiency and determine when to withdraw or transfer funds.

How SCAND Can Assist

In DeFi, one small coding mistake can quantity to very large losses. Bugs, safety vulnerabilities, or unaudited sensible contracts have already value the trade billions of {dollars}, which is why high quality sensible contract growth and audits are so essential.

At SCAND, we assist DeFi platforms, liquidity suppliers, and blockchain startups safe their techniques with end-to-end sensible contract growth, auditing, and testing. Our blockchain engineers and safety professionals totally vet each element of your contract — logic, efficiency, compliance — to ensure every thing works the best way you need it to earlier than deployment.

We don’t solely detect defects. Our workforce additionally rewrites your contracts to make them extra optimized, more cost effective to carry out (gas-efficient), and simpler to replace in the long term.

We stability automated and human testing to detect vulnerabilities, resembling reentrancy assaults, logic errors, or poor entry controls which can be normally attacked by hackers.

If you happen to’re creating your personal AMM, liquidity pool, or DeFi app, we are able to even create customized sensible contracts for you — from liquidity and dynamic charge administration to designing staking or token reward techniques.

Superior Methods & Ideas

After you could have mastered the fundamentals of liquidity provision, there are some superior methods you may experiment with to compound returns and restrict threat.

Certainly one of these methods is pool hopping and liquidity migration. Transferring funds from decrease quantity or lower-yielding swimming pools to extra performing ones can optimize returns, and a few platforms promote this with out cashing out.

Then, you should use the LP tokens as collateral to borrow different belongings. This lets you borrow whereas your tokens are nonetheless producing charges within the pool.

As an example, you would use borrowed tokens to spend money on one other pool or alternative with out eradicating your preliminary deposit — principally placing your cash to work in two locations directly.

One different is to make the most of Yearn or Convex crypto liquidity options. They routinely switch your funds from one pool to a different, declare rewards, and reinvest them with a view to maximize your whole yield.

It’s as if in case you have a sensible assistant that manages your liquidity so that you simply don’t have to manually monitor every thing.

It’s also possible to attempt cross-chain methods, the place you break up your capital over completely different blockchains. This manner, you get to entry swimming pools with higher rewards or decrease charges. Bridging belongings between chains does include some threat, nonetheless, so solely use trusted and safe bridges.

Lastly, skilled customers make use of hedging and rebalancing to guard their capital. For instance, you may break up your funding between stablecoin swimming pools (much less dangerous) and unstable swimming pools (extra rewarding).

Widespread Errors & Pitfalls to Keep away from

DeFi liquidity provision is worthwhile, but not risk-free. A majority of traders commit basic errors that may value them cash if they don’t take measures.

One of many best errors is ignoring fuel and transaction charges. Transaction charges on a community like Ethereum should not negligible and might eat into your earnings in case your funding is small.

One other entice is failing to account for impermanent loss. Even after incomes charges, token value volatility can decrease your web revenue. On this approach, it’s nice to concentrate on this threat and examine your pool frequently.

Others put all of their cash in new or dangerous swimming pools. This method is all the time reckless as a result of new or unaudited protocols can both get hacked or tokens can turn out to be nugatory in a single day.

Chasing very excessive returns with out consideration of the dangers can be prevalent. Excessive returns are sometimes preceded by excessive volatility or illiquid markets.

Lastly, not having a withdrawal technique may be detrimental to your positive aspects. Offering liquidity will not be “set and overlook.” It’s being conscious of when to withdraw your funds and when to switch them to extra promising alternatives to safeguard your funds.

Regularly Requested Questions (FAQs)

What’s a liquidity pool?

A liquidity pool is a set of crypto tokens which can be pooled and locked in a sensible contract, which individuals could commerce, lend, or borrow towards. If you happen to contribute tokens to the pool as a crypto liquidity supplier, you get a share of the buying and selling charges.

How do I earn from liquidity swimming pools?

Often, you might be rewarded for staking tokens in a pool. A small charge is taken every time a commerce is executed and shared with all LPs. Swimming pools additionally exist with added rewards, resembling governance tokens or bonus yield farming.

What’s impermanent loss?

Impermanent loss is when the worth of tokens within the pool adjustments after you deposit them. Such a change in value reduces your total return in the event you had simply stored the tokens. The loss stays everlasting solely if you money out your cash.

What are LP tokens?

Basically, LP tokens are your portion of the pool. They show you how to get your share of belongings and any withdrawal charges if you withdraw. You may even stake LP tokens in some swimming pools and get further rewards.

Which swimming pools are most secure for novices?

Often, the most secure swimming pools are the stablecoin swimming pools, resembling USDC/DAI or USDT/USDC. They’ve low volatility, minimal impermanent loss, and regular returns.

How do I select the most effective pool?

To begin with, have a look at whole worth locked, buying and selling quantity, charges, rewards, and threat. In apply, you may unfold your funds throughout completely different swimming pools, begin small, and use analytics instruments to look at efficiency.

Can I lose cash in a liquidity pool?

Sure. As with the whole crypto market typically, there are specific dangers. Concerning liquidity swimming pools, these embrace impermanent loss, token value swings, sensible contract defects, or mission failures.

How do I get began?

Getting began is fairly easy. Choose a trusted platform and pool, join your pockets, deposit your tokens, get LP tokens, and optionally stake them for further rewards.