In line with statistics, decentralized exchanges (DEXs) during the last 3-4 years have grow to be a significant a part of Decentralized Finance (DeFi).

PancakeSwap’s 24-hour buying and selling quantity, for instance, reaches $7.39 billion, Uniswap’s — $3.98 billion, and Fluid’s — $1.77 billion.

Nonetheless, regardless of all of the seeming profitability, the buying and selling course of on DEXs is characterised by fragmentation — not solely throughout buying and selling pairs and protocols but additionally throughout complete blockchain networks.

The identical asset can have considerably various costs on completely different chains, relying on liquidity, provide and demand imbalances, and transaction speeds.

In apply, it’s practically unimaginable to hold out asset shopping for and reselling manually as a result of costs change in seconds. For this reason many crypto merchants use cross-chain DEX arbitrage bots.

High DEXs Ranked by 24h Buying and selling Quantity, DefiLlama

What Is Cross‑Chain DEX Arbitrage?

Cross-chain DEX arbitrage consists of shopping for a token on one chain and promoting the identical token on a DEX on one other, all to capitalize on worth variations.

These gaps can come up primarily based on variations in liquidity, volumes, or how briskly the value is being up to date between networks.

For instance, suppose a token is priced at $98 on a DEX on Avalanche however $100 on a DEX on Ethereum. A dealer (or ideally a bot) should purchase the token on Avalanche at a cheaper price and promote it on Ethereum for a $2 revenue per token (after charges).

Arbitrage of this type maintains costs in equilibrium throughout blockchains, however the window of alternative usually shuts in a matter of seconds. That’s why utilizing bots to swap belongings turns into a necessity.

What Is a Cross‑Chain DEX Arbitrage Bot?

A cross-chain DEX arbitrage bot is an automatic program that observes token costs throughout a number of exchanges on completely different blockchains.

When it detects a worth disparity vital sufficient to cowl charges and slippage, it executes a collection of trades between them to reap the distinction.

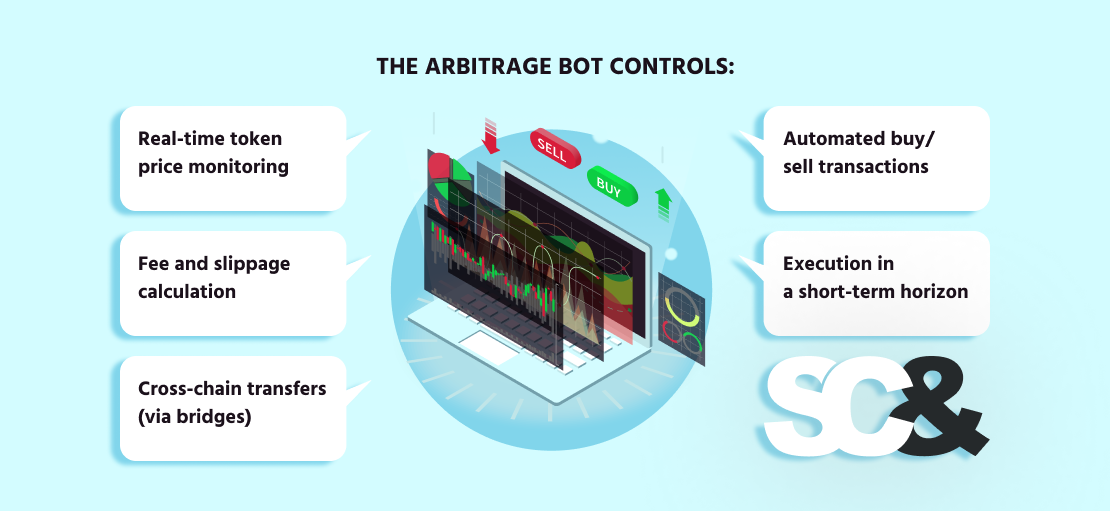

These bots are obligatory in cross-chain eventualities, the place guide execution can be too late and fully miss the chance. The arbitrage bot controls:

- Actual-time token worth monitoring

- Payment, slippage, and profitability calculation

- Cross-chain transfers (by way of bridges)

- Automated purchase/promote transactions

- Frontrun and backrun execution

Key Parts of a Cross‑Chain Arbitrage Bot

A cross-chain arbitrage bot all the time wants to incorporate a couple of elements to be able to detect worth dissimilarities and make trades in a well timed method.

Arbitrage Logic

That is the core of the bot. It retains monitor of token costs on completely different DEXs (Ethereum, BSC) and figures out when a worth distinction is large enough to make a revenue after fuel charges, bridge charges, and slippage.

However to essentially keep forward, the bot also needs to take a look at a couple of much less apparent elements:

- Different bots: There might already be bots buying and selling on the identical DEXs. It’s helpful to trace their exercise as a result of they’ll have an effect on costs earlier than your bot does.

- Market makers: Some tokens are supported by market makers who’ve their very own buying and selling methods to maintain the market liquid. Realizing how they behave helps keep away from chasing deceptive alternatives.

- Buying and selling stats: Analyzing commerce quantity and exercise during the last 7–30 days can provide your bot a greater sense of which alternatives are price going after.

DEX Connections

To commerce on decentralized exchanges like Uniswap, PancakeSwap, or SushiSwap, your bot wants to attach on to the blockchain not simply by API, however through the use of a node.

Connecting by a blockchain node lets the bot learn knowledge straight from good contracts, which is quicker and extra dependable than most APIs. In some instances, it could even monitor the mempool, giving your bot an opportunity to identify worth modifications earlier than they occur on-chain.

Cross-Chain Bridge Assist

For the reason that bot works on completely different blockchains, it wants a option to transfer tokens between them. That’s the place bridges like Axelar, LayerZero, or Wormhole are available; they switch belongings from one chain to a different.

Blockchain Entry (RPC Nodes)

To get up-to-date blockchain knowledge and ship transactions, the buying and selling bot makes use of RPC endpoints, which characterize a form of gateway to every blockchain community.

Typically, this implies working your individual full nodes. Public RPC endpoints are sometimes sluggish, unreliable, or restricted in charge, which may trigger delays and missed alternatives.

By organising your individual blockchain infrastructure, you guarantee quick entry to on-chain knowledge, which is important not just for shortly sending trades but additionally for calculating profitability and reacting to market modifications in actual time.

Automation Engine

The backend of an arbitrage bot often has two elements, every doing a special job:

- Quick Layer – Buying and selling Core: That is the half that does all of the real-time work. It’s multithreaded, retains every thing in reminiscence, and reacts shortly to cost modifications. It checks costs, calculates potential earnings, and sends trades—quick. The objective right here is velocity, so the bot avoids delays and doesn’t wait on outdoors methods.

- Sluggish Layer – Knowledge & Administration: This half takes care of every thing that doesn’t must occur immediately. It shops commerce historical past, tracks stats, saves logs, and handles any user-facing options if wanted. It’s targeted on evaluation and long-term management, not velocity.

Pockets Administration

The bot wants crypto wallets on every blockchain to carry the tokens it trades. These wallets additionally pay for fuel charges, so it’s necessary to maintain them protected and funded.

Security and Danger Controls

To keep away from insufficient trades, the bot ought to have limits in place, for instance, how a lot slippage is okay, how a lot fuel it’s keen to pay, or what to do if one thing goes unsuitable with a bridge or commerce.

In lots of instances, the bot additionally makes use of its personal good contract to deal with trades or transfer tokens between blockchains. Nonetheless, since this contract holds funds and interacts with DEXs, it could grow to be a goal for hackers. That’s why it’s essential to audit the good contract and examine for vulnerabilities earlier than utilizing it.

Challenges and Dangers When Utilizing Arbitrage Bots

Operating a cross-chain arbitrage bot can appear to be incomes cash the straightforward method on decentralized exchanges, however it’s stuffed with a number of challenges.

To begin with, arbitrage alternatives don’t final lengthy — in some instances, only a few seconds. If the bot or the community is uncovered to latency or inefficiency, the value disparity might disappear earlier than the commerce is accomplished.

Gasoline fees are one other drawback. On some blockchains, transaction charges might bounce unexpectedly. If these charges are greater than what you anticipate your return on funding to be, then chances are you’ll lose cash as a substitute of constructing it.

And don’t overlook about competitors. There are many different bots on the market gunning for a similar goal, with higher sources and quicker set-ups. The fiercer the setting, the more durable it’s to win.

Finest Practices to Use Arbitrage Bots

Operating a cross-chain arbitrage bot might be rewarding, however it additionally takes care and a focus to do it proper.

To begin with, all the time take a look at your bot on testnets earlier than utilizing actual cash. This allows you to see the way it performs in actual blockchain situations, with out the chance. You may repair bugs, enhance your logic, and construct confidence earlier than going reside.

As soon as your bot is reside, it’s necessary to focus solely on clearly worthwhile trades. Not each worth distinction is price chasing. Many are too small, and when you subtract fuel charges, bridge prices, and slippage, you would possibly find yourself dropping cash.

Earlier than sending actual trades, you may as well run your bot on mainnet in dry-run mode. On this mode, the bot calculates potential earnings and logs what it would have executed, however doesn’t really ship transactions to the blockchain. It is a helpful step to check your technique in actual market situations and see if it’s actually worthwhile.

Your bot additionally wants quick and dependable entry to the blockchains it really works with, and meaning constructing your individual infrastructure with devoted nodes. Public RPC endpoints are sometimes too sluggish or unreliable to compete with different bots. In case your knowledge is delayed even by a second, you would miss worthwhile trades.

And don’t rush into it with massive quantities. Begin small when you take a look at your bot with actual trades. As your bot proves itself and your funds grows, it’s necessary so as to add extra safety measures: set tighter limits, monitor exercise, and audit your good contract and infrastructure.

As soon as your bot begins exhibiting outcomes and shifting actual quantity, you’ll probably appeal to consideration, not simply from different merchants, however from hackers too. When you’re seen, assume at the very least ten persons are already watching what you’re doing. Higher to be prepared than remorse later.

Lastly, maintain bettering. The DeFi world modifications shortly, so replace your bot usually. Watch for brand new instruments, DEXs, and techniques which may provide you with an edge.

| Tip | Abstract |

| Check First | Use testnets to repair bugs and fine-tune earlier than risking actual funds. |

| Commerce Good | Solely go for clearly worthwhile trades after charges and slippage. |

| Dependable Entry | Use secure RPCs with backups to keep away from missed alternatives. |

| Begin Small | Start with small quantities, scale up as confidence grows. |

| Keep Up to date | Maintain bettering your bot as DeFi instruments and DEXs evolve. |

Construct vs. Purchase: Ought to You Code Your Personal or Use an Current Platform?

When deciding the right way to make a cross-chain arbitrage bot, one of many first questions to think about is whether or not you’ll make it your self or use an answer that already exists. There is no such thing as a a technique; it comes down solely to expertise, time, and your targets.

Construct Your Personal

Constructing your individual bot offers you full management. You may resolve the way it works, what chains and DEXs it connects to, the way it balances dangers, and if it must be aggressive or conservative.

When you’re eager about creating a brand new technique or gradual optimization over time, ranging from scratch is the path to take.

However assembling a bot additionally takes time and critical technical know-how. When you do it your self, you’ll want to know blockchain growth, good contracts, APIs, cross-chain bridges, fuel optimization, and extra. And when you’re busy coding, you would possibly miss actual buying and selling alternatives.

That’s the place a crypto buying and selling bot growth firm like SCAND may also help. With over 25 years of software program growth expertise and a deep precedence on blockchain options, we may also help you design, create, and refine a customized arbitrage bot that serves your technique and scales together with your wants.

Purchase or Customise

Utilizing an current platform is a a lot quicker option to get began. A lot of the software program available on the market comes pre-built with options similar to dashboards, monitoring trades, and alerts. You don’t must develop all of this from scratch, and also you’ll have the ability to take a look at precise trades sooner.

Nonetheless, these instruments are often much less versatile. You could not have the ability to regulate its elements to match your actual technique. Some platforms additionally cost charges or take a minimize of your earnings.

There’s additionally a center choice: begin with an open-source bot and customise it, for instance, utilizing the Bot Starter Package from SCAND. It offers you a working base to construct on, and you continue to get some flexibility with out ranging from zero.

Ceaselessly Requested Questions (FAQs)

Is arbitrage authorized?

Sure, crypto arbitrage is authorized in most jurisdictions. Nonetheless, all the time seek the advice of native legal guidelines and laws.

Do I would like loads of capital to begin?

Not essentially, however increased capital can cowl fuel prices and encourage extra worthwhile trades.

What’s the distinction between cross-chain and on-chain arbitrage?

On-chain arbitrage includes trades throughout the similar blockchain. Cross-chain arbitrage spans a number of blockchains and requires bridging belongings between them.

Can I nonetheless generate income with arbitrage bots in 2025?

Sure. Nevertheless it’s more durable than ever. The simple wins from 2020–2021 are largely gone. Immediately’s earnings usually depend upon quicker execution, entry to obscure chains, and smarter algorithms. You’re now competing in opposition to extremely optimized bots and institutional-grade methods.