Over the previous decade, Bitcoin and different digital property have reworked from area of interest experiments into globally traded monetary devices.

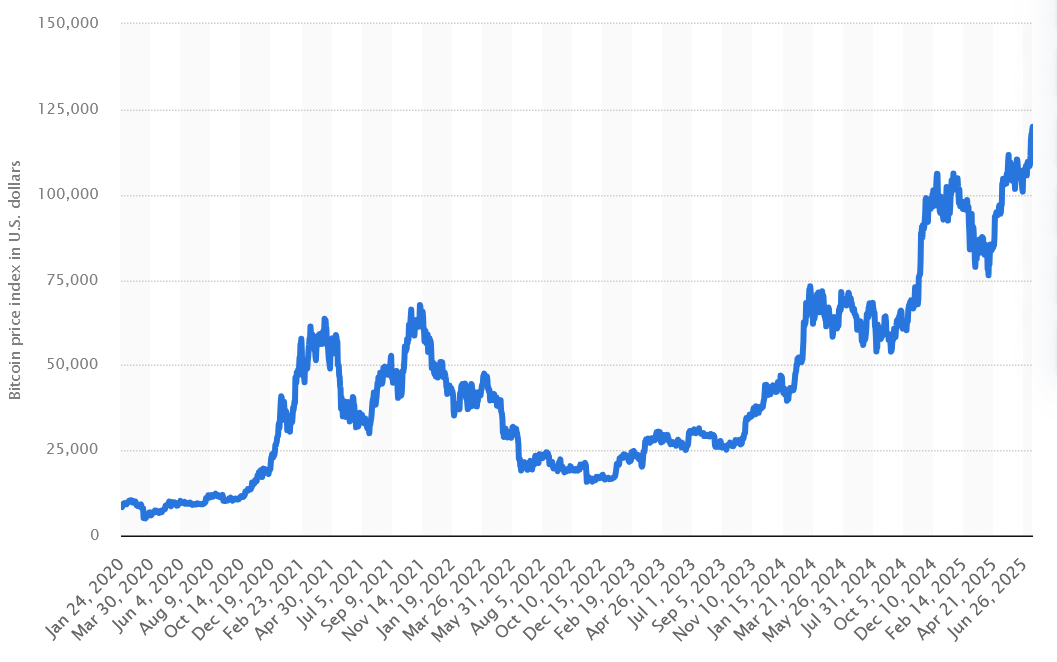

In line with Statista, Bitcoin reached an all-time excessive of over $68,000 in 2021, and the entire market capitalization of cryptocurrencies exceeded $1 trillion in 2024. Every single day, billions of {dollars} move by main crypto exchanges, making a fast-paced atmosphere stuffed with each dangers and alternatives.

Bitcoin (BTC) worth per day from January 24, 2020, to July 15, 2025

One of the environment friendly and low-risk methods to revenue from these market dynamics is thru crypto arbitrage buying and selling, which entails buying an asset at a less expensive worth on one trade and promoting it at the next worth on one other.

This methodology is named cross-exchange arbitrage, and it has grow to be more and more automated due to the rise of arbitrage buying and selling bots.

On this article, we’ll discover how these bots work, which buying and selling methods they depend on — from spatial arbitrage to triangular arbitrage — and how one can go from concept to launch with a custom-built arbitrage bot improvement course of.

What Is Crypto Arbitrage and Why Does It Matter?

Crypto arbitrage is a buying and selling method that entails taking advantage of worth discrepancies between the identical cryptocurrency on a number of buying and selling platforms and exchanges. In contrast to long-term investments or speculative buying and selling, arbitrage merchants depend on exact mathematical calculations and purpose to reduce threat by rapidly shopping for and promoting property.

On cryptocurrency exchanges, costs are shaped independently, based mostly on provide, demand, and buying and selling quantity on every particular platform. A easy instance: a dealer notices that on one trade, Ethereum is priced at $1,800, whereas on one other it’s $1,850.

They purchase the asset at a diminished worth and immediately resell it at the next worth, thereby securing a revenue. In a high-speed, automated atmosphere, this could occur inside seconds, particularly when a crypto arbitrage buying and selling bot is concerned. Even a $50 distinction represents an actual arbitrage alternative, particularly when the commerce is scaled up.

Main Varieties of Crypto Arbitrage

Crypto arbitrage isn’t only a single tactic — it’s a complete set of methods that merchants use relying on market circumstances and private objectives. Some are easy and nice for newcomers, whereas others are extra complicated however doubtlessly extra worthwhile.

Let’s break down the primary forms of arbitrage and see why cross-exchange arbitrage has grow to be one of the crucial widespread approaches right this moment.

1. Easy Arbitrage on One Trade

That is essentially the most simple methodology. The whole lot occurs inside a single crypto trade. For instance, you would possibly discover a worth distinction between ETH/USDT and BTC/ETH buying and selling pairs, and make a fast collection of trades to seize a revenue.

There’s no want to maneuver funds between exchanges, so it’s sooner and safer. That mentioned, alternatives are restricted and require exact timing and calculation to make it worthwhile.

2. Cross-Trade Arbitrage — One of many Most Efficient Methods

This can be a go-to technique for each solo merchants and institutional gamers. The concept is straightforward: purchase a cryptocurrency the place it’s cheaper and concurrently promote it on one other platform the place it’s priced increased.

It turns into much more highly effective when executed throughout a number of exchanges, particularly when paired with automation. That’s the place cross-exchange arbitrage bots are available — they monitor costs in actual time and immediately execute trades, with none guide effort in your half.

3. Triangular Arbitrage — Superior however Rewarding

On the lookout for one thing extra subtle? Triangular arbitrage could be the kind you want. This technique occurs inside one cryptocurrency trade and entails buying and selling between three currencies to take advantage of worth mismatches.

For instance, you would possibly go from BTC to ETH, then ETH to USDT, and eventually USDT again to BTC — ideally ending with extra BTC than you began with. It sounds easy, however the execution requires pace and accuracy, which is why it’s typically dealt with by a crypto buying and selling bot.

How Arbitrage Bots Work: Step-by-Step

Arbitrage bots revenue from worth variations between marketplaces or exchanges for a similar asset. Right here’s how they operate:

1. Value Monitoring

The bot repeatedly scans a number of exchanges (e.g., Binance, Coinbase, Kraken) for a similar cryptocurrency (e.g., BTC, ETH). It tracks order books, commerce historical past, and liquidity to establish worth discrepancies.

2. Revenue Calculation

The bot calculates potential revenue after accounting for:

- Value unfold (the disparity between the acquisition and sale costs).

- Transaction charges (buying and selling, withdrawal, deposit charges).

- Community charges (also called gasoline charges for blockchain transactions).

- Slippage (worth modifications throughout execution).

If the web revenue exceeds a predefined threshold, the bot proceeds.

3. Computerized Commerce Execution

The bot buys the asset on the cheaper price on Trade A. Concurrently (or near-instantly), it sells on the increased worth on Trade B. Income are realized in stablecoins or one other most popular forex.

Varieties of Crypto Arbitrage Bots

Arbitrage bots automate the seek for worth variations within the crypto market, permitting merchants to revenue from market inefficiencies. On this block, we’ll break down the 4 essential forms of such bots. You’ll find out how every of them works, the place they’re used, and what options to contemplate when utilizing them.

1. Spot Arbitrage Bots

Spot arbitrage bots search for worth variations within the spot market (instantaneous trades). Instance: shopping for BTC on Binance at $30K and promoting on Kraken at $30.1K. Total, it’s quick, but it surely relies on liquidity and costs. Appropriate for newcomers as they don’t require working with derivatives.

2. Cross-Trade Arbitrage Bots

These bots make the most of worth discrepancies between completely different exchanges (e.g., BTC is cheaper on Bybit than on OKX). Right here, buying and selling requires quick transfers and accounting for withdrawal charges, whereas effectiveness relies on the pace of fund transfers between platforms.

3. Excessive-Frequency Buying and selling (HFT) Bots

HFT bots function on microscopic worth variations, executing a whole lot of trades per second. They usually require highly effective servers and direct connection to exchanges and are primarily accessible to skilled merchants and institutional gamers.

4. Hybrid Arbitrage Options

Hybrid bots mix a number of methods: spot, futures, triangular arbitrage (e.g., BTC → ETH → USDT → BTC). Usually, they’re complicated however versatile and permit maximizing earnings by concurrently using completely different arbitrage alternatives.

Find out how to Create a Crypto Arbitrage Bot from Scratch

It’s essential to confess that the efficient deployment of such a bot requires each technical experience and in-depth data of the cryptocurrency market. Under, we’ll focus on intimately the important thing levels of growing a crypto arbitrage bot.

1. Selecting the Technological Answer

There are a number of methods to create an arbitrage bot for a enterprise. You need to use ready-made SaaS platforms that provide fundamental performance with out the necessity for improvement. Nevertheless, these options are sometimes restricted in customization choices.

A extra promising choice is to request {custom} improvement. This can require the next funding, however provides you with a aggressive benefit by distinctive buying and selling algorithms.

2. Organizing Market Information

The effectiveness of an arbitrage bot straight relies on the standard of the information it receives. Crypto bots join on to the APIs of main exchanges, acquiring real-time details about costs and volumes. Particular consideration is given to information switch pace — even a millisecond delay can flip a commerce unprofitable.

Fashionable techniques use WebSocket applied sciences for fast worth updates. This takes under consideration all commissions and hidden prices, which lets you precisely calculate your revenue.

3. Arbitrage Alternative Search Algorithm

The center of any arbitrage bot is its analytical module. It repeatedly compares costs for an identical property throughout completely different exchanges, figuring out even the smallest discrepancies.

Fashionable algorithms keep in mind not solely present costs but in addition the order guide depth, liquidity, and historic volatility. Earlier than executing a commerce, the system calculates the web revenue in spite of everything charges and determines the optimum commerce quantity.

You will need to perceive that almost all recognized alternatives final solely fractions of a second, so decision-making pace is crucial.

4. Commerce Execution Mechanism

As soon as a worthwhile alternative is recognized, the bot instantly strikes to execute the commerce. At this stage, system reliability is essential. Good bots have built-in threat management mechanisms — place measurement limits, stop-losses, and safety in opposition to technical failures.

Particular consideration is paid to managing balances — the system should rapidly redistribute funds between exchanges, sustaining the optimum asset ratio.

Follow exhibits that even a small benefit in execution pace (10-50 ms) can result in as much as 30% extra revenue in the long term.

5. Technique Testing and Optimization

Earlier than going stay, any technique undergoes thorough testing. Historic backtesting lets you test the algorithm’s efficiency on previous information. Subsequent comes the paper buying and selling section, the place the system operates with digital funds in actual market circumstances.

Solely after confirming steady profitability can buying and selling volumes be regularly elevated. You will need to perceive that the market is continually altering, so even profitable methods require common changes and parameter optimization.

6. Operation and Scaling

As soon as the system is stay, it requires fixed monitoring. Certified builders analyze efficiency, modify parameters, and develop the checklist of linked exchanges.

Fashionable options present detailed analytics for all trades, which permits for exact profitability analysis. As volumes develop, it’s value contemplating switching to devoted servers situated close to trade information facilities — this could present an extra pace benefit.

Challenges In Cross-Trade Arbitrage Bot Growth

Growing an arbitrage bot requires consideration of many technical and organizational elements. The desk under outlines the important thing options and challenges confronted by builders and customers of such techniques.

| Side | Challenges |

| The necessity for exact synchronization of costs between completely different exchanges. Excessive execution pace to make the most of arbitrage alternatives. | Excessive necessities for connection pace, community delays, and variations in APIs between exchanges. |

| Safety of API keys from unauthorized entry and misuse. | Vulnerabilities in storing and transmitting keys, the necessity for normal modifications, and the usage of safety strategies similar to two-factor authentication. |

| Correct dealing with of API errors, commerce cancellations, and minimizing slippage throughout commerce execution. | Difficulties in appropriately dealing with real-time errors and the affect of slippage on commerce effectivity. |

| Evaluating accessible open-source options and growing a {custom} answer based mostly on necessities. | Evaluating the safety, flexibility, and efficiency of open-source options, in addition to the price of {custom} improvement. |

| Making certain ample liquidity on each exchanges for executing arbitrage trades. | Dangers associated to inadequate liquidity, modifications in liquidity on the time of commerce execution. |

| Steady monitoring of the bot, market, and exchanges’ circumstances. Organising alerts for potential failures or worthwhile arbitrage alternatives. | Organising efficient monitoring and alert techniques, minimizing false triggers, and avoiding lacking vital occasions. |

| Compliance with authorized and regulatory necessities when conducting trades on completely different exchanges. | Authorized restrictions on the usage of bots and difficulties in figuring out the legality of operations on worldwide markets. |

| Threat evaluation and minimization associated to arbitrage trades, together with the potential for sudden modifications in crypto market circumstances. | Publicity to excessive dangers in case of market instability or errors in calculations. |

| Growth of a user-friendly interface for monitoring and managing the arbitrage bot. | Difficulties in creating an intuitive interface that’s helpful each for newcomers and skilled merchants. |

Challenges In Cross-Trade Arbitrage Bot Growth

Why Select SCAND for Cross-Trade Arbitrage Bot Growth

Our workforce makes a speciality of growing highly effective, distinctive options for crypto arbitrage. With years of expertise in fintech, we create clever buying and selling techniques that assure steady earnings.

We provide a personalised method, which incorporates the evaluation of your enterprise goals and the supply of the top product. Our bots present lightning-fast commerce execution, exact arbitrage alternative calculation, and dependable safety of your property.

To assist shoppers speed up improvement, we additionally supply a ready-made Bot Starter Equipment — a customizable basis for making environment friendly crypto buying and selling bots. It considerably reduces time to market and lets you give attention to technique and efficiency optimization from the beginning.

SCAND doesn’t simply develop software program — we create totally practical buying and selling instruments with adaptive algorithms that proceed to carry out successfully, even in extremely unstable market circumstances. We assist the challenge at each stage, from technique testing to post-sale assist and system scaling.

By selecting SCAND, you acquire a aggressive edge: a technological answer developed by professionals who perceive each the technical and monetary elements of crypto arbitrage.