Apple shares are down at market open right now after President Trump threatened new tariffs except the corporate begins constructing iPhones in the USA.

Not India, or anyplace else

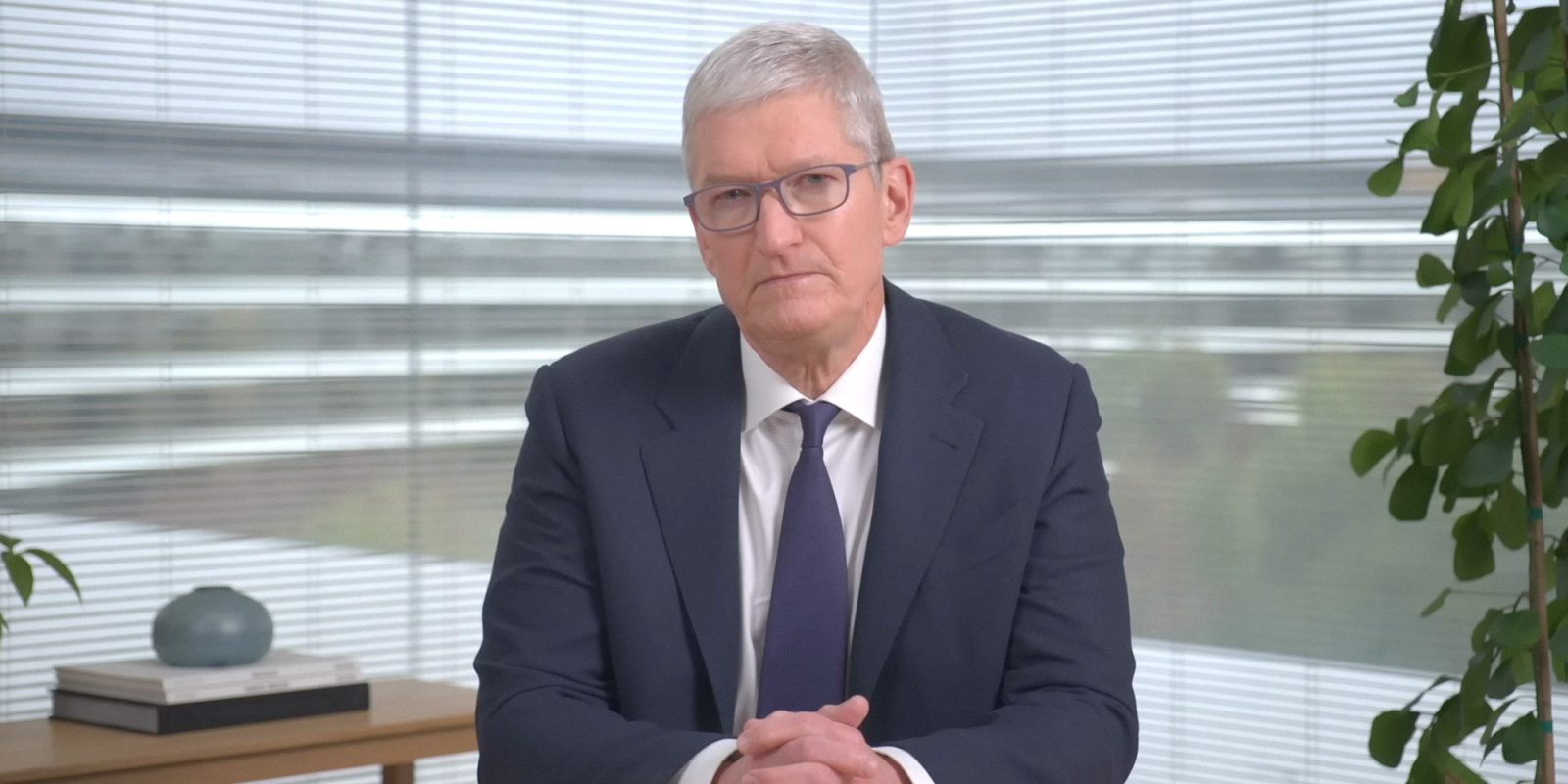

In a put up on TruthSocial, Trump stated he had “way back knowledgeable” Tim Prepare dinner that iPhones bought within the U.S. ought to be made domestically, “not India, or anyplace else”. He added that, if that doesn’t occur, Apple will face a 25% tariff.

The corporate has just lately shifted manufacturing to India, Vietnam, and Brazil, as a part of a broader effort to cut back its reliance on China.

Apple hasn’t responded to the assertion, however the market already has: AAPL opened down 2.5% this morning. The inventory is now hovering round $196, including to what had already been a foul week.

If Trump’s risk materializes, the influence received’t cease at Wall Road. A 25% tariff on imported iPhones would nearly definitely result in larger costs for customers within the U.S., with Apple both passing on the price or absorbing a major margin hit. Both state of affairs may dent profitability and squeeze the corporate from each ends.

Again on excessive alert

Throughout Apple’s latest quarterly earnings name on Might 1, 2025, CEO Tim Prepare dinner addressed issues about potential iPhone value will increase amid escalating U.S. tariffs.

On the time, he acknowledged that tariffs may add roughly $900 million to Apple’s prices within the upcoming quarter. Whereas Prepare dinner stated the corporate had been absorbing these prices, he didn’t rule out future value hikes.

Nevertheless, Prepare dinner famous that the scenario was fluid, and future commerce insurance policies may necessitate changes in pricing methods. Appears like we may be there.

Whether or not the risk turns into coverage stays to be seen. Throughout Trump’s first time period, Apple managed to keep away from the worst of his tariffs by behind-the-scenes negotiations. However this time, the tone feels totally different.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.