The monetary companies sector is present process fast change. Digital banks, which function completely on-line with out the necessity for bodily branches, are coming to the forefront. Cellular banking and user-friendly banking functions have gotten more and more vital, giving customers versatile entry to monetary companies.

On this context, fashionable banking can’t be imagined with out versatile and dependable software program options. Software program platforms are the “core” of digital banks: they supply uninterrupted real-time transaction processing, making certain safety on buyer knowledge, simplification of connecting new companies, and seamless person expertise, amongst different issues.

Digital Banking Market Overview

The expansion of digital banking can also be confirmed by statistics. In line with Statista, in Germany alone, the digital banking market has reached a internet curiosity earnings of $71.33 billion in 2025. With a median annual development fee of 5.68% from 2025 to 2030, reaching $94.03 billion by the top of the last decade.

A rise of 11.3% in 2025 clearly demonstrates how quickly the market is growing below the affect of cell applied sciences and progressive fintech options. This surge isn’t occurring in isolation — as per Statista, the worldwide software program market has already crossed the $740 billion mark and is steadily climbing.

What Is Banking Software program Growth?

Banking software program improvement is the method of making digital options that assist banks and different monetary establishments work sooner, extra securely, and extra conveniently for his or her prospects.

It’s not nearly acquainted on-line banking platforms or cell apps, but additionally about advanced inner methods that handle transactions, analyze knowledge, guarantee safety, and automate processes.

The principle aim of growing banking software program is to make monetary organizations extra environment friendly, clear, and user-focused. Such options assist banks cut back transaction processing occasions, enhance service high quality, improve reliability, and adjust to rising regulatory necessities.

As well as, they typically function a basis for a variety of extra companies and integrations — from microtransactions and varied installment or cost assure choices to automated credit score options related to exterior marketplaces, resembling automobile gross sales platforms.

A particular position right here is performed by customized software program — options constructed for particular duties and processes. In contrast to off-the-shelf merchandise, customized methods could be tailor-made to a financial institution’s precise wants, simply built-in with different platforms, and rapidly tailored to altering market situations.

Because of this software program improvement in banking has change into a strategic course that helps monetary establishments not simply sustain with the occasions, however keep forward of the competitors.

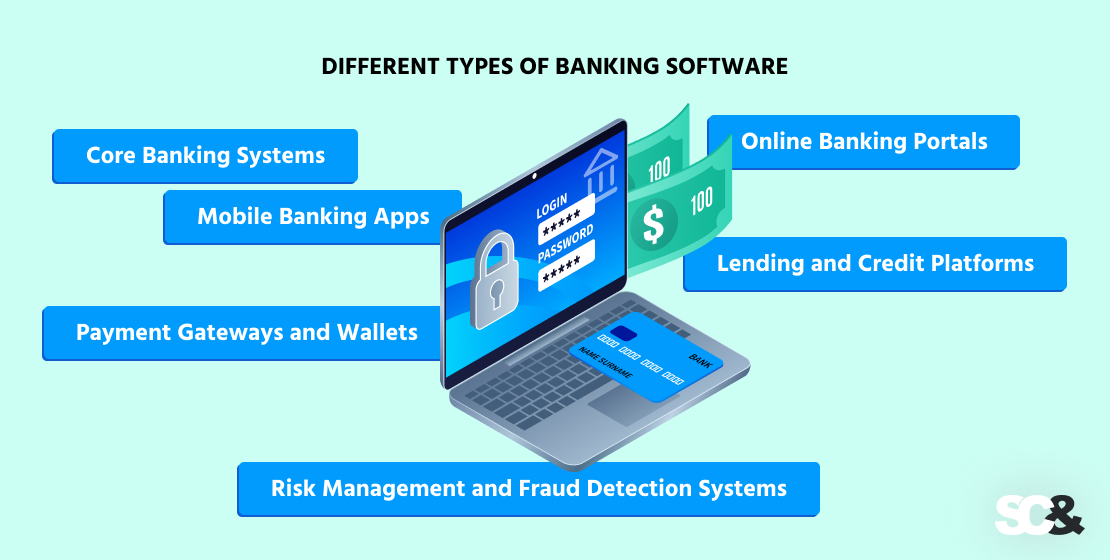

Completely different Varieties of Banking Software program

Trendy banks depend on a variety of digital instruments that work collectively to ship seamless monetary companies. From core methods that energy every day operations to customer-facing apps and superior safety modules, every kind of software program performs a particular position inside this ecosystem. Under, we’ll have a look at the principle kinds of banking software program that assist create such ecosystems.

Core Banking Techniques

Core banking methods are the center of a financial institution. They deal with key operations resembling opening and managing accounts, processing deposits and funds, monitoring transactions, and sustaining balances. These methods enable prospects to entry their funds from any department or on-line service, whereas enabling the financial institution to course of large volumes of transactions in actual time.

Cellular Banking Apps

Cellular banking apps have change into an on a regular basis instrument for hundreds of thousands of customers. They permit prospects to pay payments, switch cash, apply for loans, and handle their funds straight from their smartphones. For banks, these apps are greater than only a handy service channel — they assist increase buyer loyalty and improve the shopper expertise.

On-line Banking Portals

On-line banking portals supply performance just like cell banking apps however designed for browser entry. These are safe and dependable internet platforms the place prospects can handle their accounts, arrange automated funds, obtain statements, and use extra monetary companies.

Cost Gateways and Wallets

Cost gateways and digital wallets present safe and quick cost processing each domestically and internationally. They’re vital not just for banks but additionally for fintech firms and on-line retailers. Supporting a number of cost strategies and making certain excessive transaction pace straight impacts person comfort and belief.

Lending and Credit score Platforms

Lending and credit score platforms assist banks and microfinance organizations automate the lending course of — from credit score historical past checks to rate of interest calculations and digital contract signing.

Danger Administration and Fraud Detection Techniques

As digital transactions develop, so do cyber threats. Danger administration and fraud detection methods allow banks to determine suspicious transactions in actual time, stop fraud, and adjust to safety and compliance necessities. Due to machine studying and large knowledge processing, such methods are capable of acknowledge dangers prematurely and act sooner than attackers.

Trendy Banking Software program: Key Options

Trendy banking methods go far past customary on-line banking. Trendy banking software program brings collectively innovation, personalization, and adaptability to fulfill person expectations and market calls for. Under are the important thing options that outline the leaders within the trade.

Innovation and Technological Growth

The banking sector is actively adopting superior applied sciences — from synthetic intelligence and machine studying to cloud options and automation. These instruments assist analyze massive quantities of information in actual time, detect anomalies, stop fraud, and optimize inner processes.

Innovation allows banks to adapt to market adjustments extra rapidly, supply new companies, and enhance service high quality with out the necessity for a whole infrastructure overhaul.

Personalization and Enhanced Buyer Expertise

Clients more and more count on greater than customary banking operations — they need handy, personalised, and proactive interactions. Trendy banking software program makes it doable to research person habits and supply related services, from personalised mortgage affords to tailor-made notifications and monetary steerage.

Effectively-designed personalization has a direct affect on the shopper expertise, rising satisfaction and strengthening buyer loyalty.

Integration with Open Banking and APIs

Open APIs and open banking rules have gotten the usual for banking options. They permit monetary establishments to securely trade knowledge with fintech firms, third-party companies, and different banks.

This sort of integration opens the door to new enterprise fashions, simplifies the launch of extra companies, and improves the shopper expertise by providing a broader vary of options.

Assist for Cellular Apps and Banking Purposes

Cellular channels are one of many key components of recent banking. Cellular apps and banking functions give prospects 24/7 entry to companies, make interacting with the financial institution as handy as doable, and allow options that aren’t obtainable offline.

Customized Banking Software program vs Off-the-Shelf Options

The selection between customized improvement and ready-made options relies on the corporate’s enterprise technique, scale, and long-term objectives. To make this resolution simpler, let’s have a look at two frequent situations.

State of affairs 1: A Giant Financial institution with Distinctive Necessities

Giant monetary establishments typically work with a variety of merchandise, a big buyer base, and sophisticated inner processes. For them, it’s essential to make sure excessive system efficiency, compliance with trade safety requirements, and the flexibleness to scale additional.

In such circumstances, customized banking software program improvement is the optimum alternative. Tailored options enable banks to exactly adapt performance to their enterprise logic, combine new companies with out limitations, preserve a excessive degree of safety and compliance, and regularly evolve the system alongside the group. This can be a long-term funding that gives stability and a robust aggressive benefit.

State of affairs 2: A Fintech Startup or a Small Financial institution

Small firms and startups within the banking and monetary sector typically goal to enter the market rapidly, check their concepts, and maintain prices below management. For these wants, utilizing a ready-made banking software program resolution is often the smarter method.

This method has the advantages of fast implementation, a easy value construction, and a focus on product design, and bettering the shopper expertise. Off-the-shelf platforms match effectively for primary duties and could be prolonged or custom-made into your personal resolution as your organization grows and necessities change.

Methods to Select the Proper Choice

If growing a product that’s distinctive, adaptable, and contains your personal controls is the precedence, then take into account investing the time, cash, and energy in growing customized software program.

Alternatively, if attending to market quick and with minimal prices is the higher precedence, then beginning with one thing off-the-shelf or ready-made is one of the best step.

Banking Software program Growth Course of: Complete Information

The event of banking software program is a multi-stage and structured course of by which every section impacts the ultimate high quality, safety, and stability of the product. Cautious planning, a transparent sequence of actions, and a focus to element make it doable to construct options that meet fashionable market calls for and regulatory necessities.

Enterprise Evaluation, Objective Definition, and Know-how Stack Choice

Each banking software program challenge begins with analyzing enterprise necessities and setting clear targets. At this stage, the event staff defines the product’s core duties, essential options, person expectations, and regulatory constraints. This types the muse for all subsequent improvement work.

On the identical time, the challenge’s expertise stack is chosen. The selection of programming languages, frameworks, databases, and infrastructure instruments straight impacts efficiency, safety, and scalability. A correctly chosen expertise stack ensures secure system operation and simplifies additional improvement.

UI/UX and Buyer Expertise

Interface and person expertise play a vital position in banking, the place the comfort and reliability of digital companies straight affect buyer belief.

The design of digital companies ought to mix visible simplicity, intuitive interplay, and strict safety requirements. Buyer expertise has change into a aggressive benefit, making this stage of improvement simply as vital because the technical structure.

Software program Growth Course of: Agile, Waterfall, Hybrid

The event methodology that you just select will dictate the complete course of. The Waterfall mannequin (conventional methodology) could be efficient when necessities are fastened and work is accomplished inside strict deadlines.

With Agile, you may obtain flexibility, permitting groups to iterate and develop particulars as you’re employed, which many organisations will discover particularly useful when growing new digital companies.

Most organisations will undertake a hybrid method, offering a level of certainty whereas nonetheless enabling some flexibility to adapt as required. That is helpful with merchandise like banking options, the place strict safety and regulatory necessities exist, nevertheless it can be fast to develop a product.

Testing and QA of Banking Options

The standard and safety of banking options can’t be ensured with no rigorous method to testing. The product is examined at each stage of improvement to detect errors in each enterprise logic and structure. Particular consideration is paid to load testing, safety audits, and check automation, which ensures secure system efficiency below excessive transaction volumes.

Early and steady involvement of QA groups helps keep away from pricey fixes at later levels and ensures the product’s reliability at launch.

Deployment and Assist

As soon as improvement and testing are full, the product strikes into the deployment section. For banking methods, this requires particular consideration to fault tolerance, knowledge backups, safety, and strict launch procedures. Any mistake at this stage will probably have penalties, so implementation is fastidiously deliberate.

An equally vital a part of this stage is documentation. Within the banking trade, detailed documentation isn’t only a formality — it’s a important requirement. Banks count on each perform, integration, and workflow to be clearly described and supported with checks. In some circumstances, creating and validating documentation could even take longer than the event itself.

Subsequent comes help, which performs a task no much less vital than improvement itself: it ensures the graceful operation of digital companies, will increase their reliability, and strengthens person confidence.

Safety and Compliance within the Banking and Monetary Sector

Any knowledge breach or regulatory violation can result in critical fines, lack of buyer belief, and restrictions on enterprise actions. On this part, we’ll study the rationale behind the vital safety requirements that banks adhere to, in addition to the important thing laws that affect the trade.

Safety Requirements for Banks

Trendy banks deal with huge quantities of confidential data and course of hundreds of thousands of transactions each day. To make sure knowledge safety and decrease dangers, strict safety requirements are utilized, together with:

- Information encryption in any respect levels of processing and transmission

- Multi-factor authentication for each customers and workers

- Actual-time transaction monitoring methods

- Common audits and vulnerability testing

- Infrastructure segmentation to attenuate the affect of potential assaults

Laws (GDPR, PSD2, and Others)

The banking sector is topic to quite a few laws governing the storage, transmission, and use of information.

- GDPR (Basic Information Safety Regulation) — a European regulation that units strict guidelines for processing prospects’ private knowledge

- PSD2 (Cost Providers Directive 2) — an EU directive that introduces open banking rules and requires banks to work together securely with third-party companies by APIs

- PCI DSS (Cost Card Trade Information Safety Customary) — a global safety customary that applies to all organizations that retailer, course of, or transmit cardholder knowledge. It defines strict technical and organizational necessities for cost safety.

- Nationwide knowledge safety and monetary supervision legal guidelines, which can complement or strengthen worldwide laws

Compliance with these laws not solely reduces dangers but additionally builds buyer belief, positioning the financial institution as a dependable associate.

Influence on Customized Banking Software program Growth

For improvement groups and banks, adhering to safety and compliance requirements isn’t a separate step — it’s an integral a part of customized banking software program improvement from the very starting.

The system structure should be developed in accordance with security-by-design rules, and testing and replace processes should be structured to fulfill present and future regulatory necessities.

Integrating safety methods early within the improvement cycle helps cut back future prices, quickens product certification, and ensures resolution resilience in an ever-changing regulatory panorama.

Growth Value and Price range Components

The price of banking software program improvement relies on many variables — from the quantity of study to the variety of integrations and the complexity of the structure.

To obviously illustrate which components form the finances and the way they have an effect on the ultimate value, the desk under summarizes the important thing levels and components of banking software program improvement. This may provide help to perceive how challenge prices are fashioned and the place you may most precisely plan assets.

| Stage / Issue | Description | Influence on Price range | Instance of Influence |

| Evaluation and Planning | Necessities gathering, enterprise course of evaluation, documentation | Medium — relies on the depth of labor | Thorough evaluation can cut back improvement prices in a while |

| Design and UX | Designing interfaces for internet and cell apps | Medium | The extra advanced the person situations, the upper the hassle required |

| Growth and Testing | Core stage: programming, QA, DevOps | Excessive | Extra options and customized modules imply increased general prices |

| Integrations and Infrastructure | Connecting APIs, cost gateways, exterior companies | Medium–Excessive | Quite a few integrations improve each timelines and bills |

| Assist and Updates | Publish-release upkeep, enhancements, compliance updates | Ongoing, long-term | Usually 15–25% of the preliminary finances yearly |

| Measurement of Growth Staff | Quantity and {qualifications} of specialists | Direct affect | A bigger staff quickens improvement however will increase prices |

| Venture Complexity | Variety of options, degree of customization, general scale | Direct affect | Extra advanced options require extra time and assets |

| Variety of Integrations | Amount of third-party companies and methods to attach | Direct affect | Integrations with a number of banks or APIs elevate the whole value |

Price range Components

Selecting the Proper Growth Accomplice

Deciding on a dependable software program improvement associate is a key issue within the success of any banking challenge. Even essentially the most highly effective concept or essentially the most detailed technique will fail if the mistaken staff is tasked with its implementation. Due to this fact, choosing the proper associate is simply as vital as growing the product itself.

Why It’s Vital to Work with a Dependable Banking Software program Growth Firm

Tasks in banking software program improvement are advanced, extremely regulated, and demand precision. Partnering with a trusted banking software program improvement firm helps cut back the chance of failures, quickens approval and certification levels, and ensures the long-term stability of the product. A powerful associate not solely handles the technical facet but additionally contributes to shaping a sustainable digital technique.

Methods to Select the Proper Growth Accomplice for Lengthy-Time period Collaboration

Lengthy-term partnerships are particularly vital for banking initiatives, which not often finish with a single launch. When choosing the proper improvement associate, it’s price taking an in depth have a look at their popularity — learn consumer opinions, case research, and testimonials to grasp how they really work in actual initiatives.

Take a while to evaluation their portfolio to see if examples just like yours are represented downstream. Consider the standard, scale, and industries they’ve served. Technical and organizational interviews with key members will provide help to consider their abilities, communication model, and mindset.

Ensure that your approaches to challenge administration and communication align from the beginning — easy collaboration relies on it. And at last, focus on their imaginative and prescient for the product after launch.

Standards for Selecting a Software program Growth Accomplice

When trying to find a associate to develop banking options, a number of key components should be thought-about. That can assist you make your alternative, the desk under presents the principle standards to think about when evaluating potential companions. It explains why every issue is vital and what particular components to think about when selecting.

| Standards | Why It Issues | What to Look For |

| Trade Expertise | Exhibits understanding of laws, safety, and banking specifics. | Related initiatives, compliance information, confirmed monitor report. |

| Technical Experience | Ensures a stable, future-proof basis. | Trendy tech stack, open banking, API, cell improvement. |

| Communication | Retains timelines reasonable and builds belief. | Transparency on deadlines, pricing, and progress. |

| Safety & Compliance | Elementary for safeguarding knowledge and assembly laws. | Robust compliance practices, audit expertise, security-first focus. |

| Scalability | Permits the associate to develop with your enterprise. | Capability to scale groups, add modules, and help long-term development. |

Standards for Selecting a Software program Growth Accomplice

SCAND: Your Banking Software program Growth Accomplice

Selecting the best expertise associate is the important thing to efficiently delivering banking initiatives. SCAND is a trusted software program improvement firm with over 25 years of expertise constructing advanced and safe IT options for the monetary sector.

Experience in Monetary Software program Growth

SCAND has intensive expertise in monetary software program improvement, together with initiatives for banks, fintech firms, and cost methods.

Our staff has efficiently delivered cell functions, inner administration methods, analytics instruments, and integrations with varied cost gateways. We observe regulatory necessities, implement fashionable knowledge safety mechanisms, and design system architectures with scalability and fault tolerance in thoughts.

Our Banking Software program Growth Providers

We provide a full vary of banking software program improvement companies, together with:

- Customized banking software program improvement — from evaluation and design to help and scaling;

- Constructing banking functions and cell banking options with intuitive UX and strong safety;

- Integrations with exterior APIs, open banking methods, and cost platforms;

- Modernizing legacy methods and migrating to fashionable expertise stacks;

- Creating inner instruments to optimize processes and enhance knowledge administration.

Why SCAND Is the Proper Growth Accomplice for Your Banking Answer

Working with SCAND means partnering with a staff of skilled banking software program builders who perceive the specifics of the trade and know the right way to align expertise with enterprise objectives.

We construct partnerships based mostly on transparency, clear timelines, and a versatile improvement method, serving to our shoppers create options that meet fashionable market calls for and safety requirements.

Due to our expertise, reliability, and complete method, SCAND turns into the fitting improvement associate for firms trying to take their banking companies to the following degree.

Conclusion

In 2025, banking software program improvement is extra than simply implementing expertise — it’s a strategic instrument that defines the competitiveness of economic organizations. Trendy options assist banks enhance effectivity, improve the shopper expertise, guarantee knowledge safety and regulatory compliance, and adapt rapidly to a consistently evolving market.

To efficiently develop a banking resolution, it’s important to take a complete method to each stage — from enterprise evaluation and expertise choice to improvement, testing, integrations, and ongoing help.

Selecting the best improvement associate additionally performs a vital position, as they must be able to delivering the challenge at a excessive degree and supporting its development sooner or later.

SCAND has the expertise, experience, and staff to change into such a associate. We create dependable, scalable, and fashionable banking options, serving to shoppers efficiently innovate and obtain trade management.

Contact us to debate your challenge and begin growing a banking resolution that meets immediately’s necessities and tomorrow’s challenges.