Let’s begin from the guts: on the eve of 2025, the worth of private finance instruments, particularly in banking and monetary providers, is great. Private monetary software program has immensely influenced our on a regular basis routines.

On condition that the app is positioned in your smartphone, customers can simply monitor and management their spending proper on the spot, plan their funds, and have reminders about vital funds or procuring presents.

Moreover, private finance instruments provide rather more: customers can management bills, handle dangers, increase funds, expose credit and loans, and safe insurance coverage—on paper and digital instruments.

On this article, we’ll uncover the technical intricacies of the non-public finance app growth course of, and clear up the prices and challenges on the way in which.

Hop on our suggestions and additional info to information you alongside the way in which. Whether or not you select the skilled software program developer workforce or deal with this problem by yourself, with all the required info in your pocket the duty received’t be exhausting. Good luck on the way in which!

What’s a Private Finance App?

Private finance apps are like private caregivers that contribute to customers’ monetary and psychological well being. These are functions that will let you throw out all of the old-school units and help you with budgeting, spending, and funding data on paper and digital units.

In our extremely technological period, when each step is definitely processed within the digital area and assisted by AI and machine studying, the choice to develop a private finance app for your small business appears clear and logical.

Since there’s an enormous demand for private finance apps, let’s take a look at some stats to achieve a greater perspective on private finance app growth.

Based on the TEM journal examine ‘Private Finance Administration Utility’ of August 2024, fashionable households more and more want assist in aiding them monitor their earnings and every day bills, investing funds, planning budgets, and constructing and structuring their monetary methods.

The distant answer for taking full management over a shopper’s cash is a large step in the direction of monetary independence. It affords new alternatives for progress, each in private and enterprise domains, exhibiting up as a significant enhance in enterprise growth and conquering the market.

As for the Future Knowledge Stats, the projection of the worldwide private finance administration functions market is to develop from $1.23 billion in 2023 to $1.61 billion by 2030. Thus, creating private monetary software program shall be an excellent enterprise impetus.

Private Cash Administration Software program: Technology Traits in Constructing Private Finance Apps

The scientific analysis on private finance app growth within the Journal of Financial Training and Entrepreneurship Research reveals—there may be nice potential for scaling your private finance app growth enterprise amongst Gen Y.

Using private finance apps to trace expenditures, type household budgets, and carry monetary offers permits customers, particularly Millenials, to craft their private experiences by performing tens of duties concurrently, primarily based on their lively wants and a number of monetary calls for.

Following the paper ‘Fintech Evaluation of Private Finance App Utilization amongst Millennials’, knowledge safety and private privateness are the Millennials’ key issues whereas utilizing fintech apps. Their essential precedence is private knowledge safety and person privateness. For developer groups, an awesome deal shall be staking on enhancing and upgrading safety methods and privateness practices.

Who’re the following technology customers, Gen Z? For builders and companies, it’s helpful to see the stats on this gen’s motivation.

Contemplating the swift adjustments within the monetary panorama in recent times, fintech corporations and banks, together with private monetary planning software program and private finance app growth, Zoomers are extra lively customers of cellular applied sciences.

Based on the ‘Digital finance and the angle of Gen_Z cohort: a assessment’ examine, Gen-Z performs a vital function within the success of private monetary software program and makes up a substantial share of the shopper base for banks and fintechs.

Within the array of their priorities are inclusion, safety, and accessibility of monetary providers. Hereby, for enterprise homeowners, it means further issues to bear in mind whereas creating the non-public finance app.

As you see, along with Gen Y, Zoomers are one of many high client generations taking the lead in private finance app growth globally down the street.

Tech Characteristic Traits in Private Finance App Improvement

Now, to maintain monitor of the wants and priorities of potential prospects of your private finance app, will probably be a great level to see the tech traits round private monetary software program growth. This can provide help to to construct an answer that meets the calls for of future customers.

As a result of rise in optimizing work and free time, the non-public apps area can also be remodeling to adjust to new traits:

- AI and machine studying

- Digital help bots and chatbots

- Open banking options integration

- Blockchain applied sciences

- Gamification

- Consumer-centric person interface

Forms of Private Finance Apps

Relating to managing your funds, there’s no one-size-fits-all answer. Private finance apps come in several kinds, every designed to cater to particular wants and targets.

On-line Cost Providers

Selecting to construct your app on this area brings alongside quite a lot of competing corporations. It’s smart for you customers to put money into creating this kind of private finance software program. In the meanwhile, banks nonetheless lack flexibility and mobility in processing funds, so you’ll be able to have a aggressive edge on this discipline.

On-line Banking

Deciding to construct this sort of private finance app may very well be a helpful alternative, particularly now as banks and monetary enterprises ship their providers within the digital discipline. It means private net and cellular finance apps will dominate the software program market.

Crypto Wallets and Crypto Platforms

As seen from the analysis, cryptocurrency is altering the monetary world on a worldwide scale. This fashion, some corporations and prospects desire making and having funds in cryptocurrencies. So, you received’t make a mistake by selecting the crypto pockets to create your private cash administration software program.

Insurance coverage Tech

This know-how contains digital insurance coverage corporations and a tech stack that includes AI, Blockchain, Huge Knowledge, and extra to supply shoppers improved insurance coverage providers.

The Greatest Apps on the Market to Observe

To catch a transparent visible understanding of what a private finance app is, take a look at a few of the top-notch gamers within the private finance software program discipline and take into account adopting their performance.

- Mint: That is the very best free app to trace your funds.

- Prism Finance: Pay Payments, Cash Tracker: This app extends the overall private finance app performance. You possibly can sync your app with a lot of billing suppliers.

- Spendee: Taking monitor of this software’s options is likely one of the greatest choices to handle your loved ones’s shared bills, as within the case of a family.

- EveryDollar: It is likely one of the most complete apps for budgeting and monitoring your spending.

Listed here are extra private finance software program apps to maintain your eye on:

- PocketGuard: Finances Tracker

- NerdWallet: Handle Your Cash

- Each Greenback: Finances Tracker

- GoodBudget: Finances and Finance

- Mobills: Finances Planner

- Finances Planner: Expense Tracker

Steps to Constructing a Private Finance App

Now, given there are many beneficial properties and income in your shopper or your software program firm when constructing private monetary software program, it’s time to get into the method of growth. Let’s unlock the complete potential of the step-by-step strategy to creating a private finance app.

1. Visualize Your App’s Client

Getting proper to the guts of your target market ensures you construct an efficient and user-centered private finance software. It is going to assist your shoppers attain their targets whereas defending their private knowledge. So, analysis the subject and element up the demography.

Additionally, focus in your person’s wants, habits, geography, and so forth. as quickly as you need to rating the bullseye and get outcomes from the discharge.

2. Dive into the Opponents’ Space

Subsequent, dive into the competitors space. What corporations are you competing with, and what private finance app options do they ship? This is a vital survey into essentially the most in-demand functionalities by your future customers, and in addition to suppose on which options you’ll be able to enhance and attain new heights within the area.

3. Outline the Most important Problem to Deal with

Then, analysis the optimum applied sciences to use in your private finance app. Think about the tech stack and databases making the UX extra regular and cozy.

4. Safety Precedence

As talked about, for essentially the most lively private finance app customers—Gen Y and Gen Z—privateness and private knowledge safety are a high precedence.

So, take into account selecting these practices to make your customers’ safety even higher:

- Apply two-factor authentication. It empowers person verification through two steps of identification, crafting a extra protected person expertise.

- Lower every session’s longevity to a sure time restrict.

- Implement Cost Card Business Knowledge Safety Normal and Common Knowledge Safety Regulation.

- Keep away from making your customers’ private info clearly visualized, particularly in public spots. No vivid shade palette and no catchy fonts are really helpful.

5. Select Your Private Finance App Fundamental Options

Provoke the event course of with the fundamental private finance app elements. Think about the next:

- Consumer authorization to defend customers from info leaks.

- The person profile so as to add and revise primary private data.

- Earnings and expense administration to look at over cash transfers in actual time.

- Reminders and notifications about future and potential funds, statistics on funds and spending, and vital updates.

- Consumer registration and onboarding to make the app accessible solely to licensed customers through safe login registration.

Furthermore, you’ll be able to enrich your private finance app with add-up providers like AI chatbots, exterior financial institution accounts, calculations, barcode scanning, and rather more.

6. Choose Optimum Applied sciences and Databases

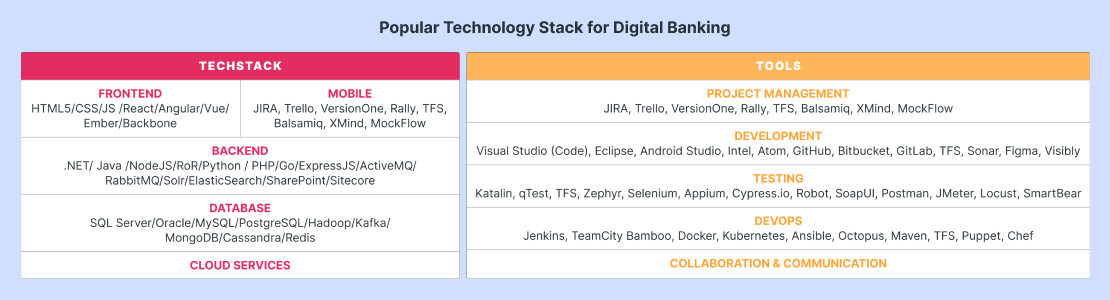

Speaking in regards to the tech stack, take into account related programming languages, databases, and frameworks which are suitable with particular programming languages utilized.

- Entrance-end utility applied sciences construct up a visible and tangible interplay with the person. Normally, this stack contains HTML, CSS, and JavaScript.

- The backend kinds the core construction of your app and is in control of optimum knowledge loading, knowledge safety, and the comfort of cash switch. It depends on languages like Ruby, C++, Python, Kotlin, or Node.js.

- Database options ought to be protected and reply promptly to person queries. Think about choices like MongoDB, Specific.js, Node.js, or Angular.

- If you’re constructing a rich-in-features private finance app, take into consideration together with API integrations.

7. Simple-to-Use UX

Applied sciences for utilizing a private finance app conveniently and safely are extremely vital. So, a responsive and easy-to-understand person expertise (UX), along with a easy person interface (UI), will drive your app to the highest.

Nevertheless, keep in mind about safety and keep away from extraordinarily vivid fonts and colours. The distinction in shades and colours ought to be your UI precedence.

Moreover, attempt to not overwhelm your customers with an excessive amount of info on one display screen and distribute info in a uniform manner.

8. Testing and High quality Assurance

That is the stage positively to not skip. Each time customers’ knowledge in your private finance app is misplaced or compromised, all of the earlier work goes in useless.

So, put your greatest efforts into testing and assuring high quality checks on all the event phases: safety testing, knowledge integrity, usability, practical and efficiency testing. Alternatively, rent an expert QA workforce.

When you could have checked all of the bugs and shortcomings, the applying could be revealed within the app shops.

Should-Have Options for a Private Finance App

Let’s take a look at the most well-liked private finance functions: Mint (free, with elective paid improve), NerdWallet (free), Buxfer (free, paid plans), Goodbudget (free, paid plans), Each Greenback, Mobills (free, with elective paid updates), with private finance apps bragging free variations—Prims, Spendee, and Finances Planner.

A few of these apps provide free trial variations, some don’t. But, for scaling and selling your private finance app, the likelihood for present and potential prospects to obtain your software program product shortly and with no further bills has a great potential.

Take the highest private finance app, Mint, which is free and has conquered the world on account of its no-expenses choice, simply with further non-binding updates. As with most private finance apps, it’s synchronized with the financial institution and is simple to make use of.

Beneath are essentially the most in-demand private finance app options constructed into a lot of the standard apps:

- Consumer registration and onboarding that make the app accessible just for licensed customers through safe login registration

- Account integration with a number of monetary providers

- Managing private funds

- Receiving a monetary standing report for a sure interval

- Insightful recommendation through AI chatbots

- Getting in depth bills and earnings reviews

- Foreign money converter

- Extraction of charts

- Moveable calculator

- Report technology and visualization by way of charts

- Barcode scanning preview

What’s extra, keep in mind in regards to the safety and knowledge privateness instruments as these will stay the best precedence in your customers. It’s a problem to bear in mind for a enterprise proprietor.

Most important Factors to Think about Whereas Constructing a Private Finance App

So, in creating a private monetary app, you should take into account the next factors to make sure your app’s success.

1. Mission Options

In case your buyer desires third-party APIs built-in, it’ll take longer to launch, and the tech stack will grow to be rather more advanced to guard customers’ private knowledge. It means a couple of programming language, enhanced synchronization, extra versatile screens, API integrations, and tailored UI.

2. Time to Market

The final equation is that the longer the undertaking growth time, the dearer will probably be. Within the case you’re restricted in time, put your eye on ready-to-go software program options. As an illustration, to profit from code reuse and easy assist, select the mixture of Python programming language and Django framework. Quite the opposite, if there’s loads of time forward to work in your private finance app, seize the chance to develop a extra features-packed app, utilizing the Java language and Spring framework.

3. Private Knowledge Safety

The purpose right here is to defend the non-public monetary software program system by way of protected libraries and frameworks immune to cyber threats and hacking assaults, that may even be suitable with business requirements like CBDP, and PCI DSS.

4. Product Structure

Now, when you or your shopper desires to take care of scalability and third-party integration capabilities on this private monetary instrument, will probably be extra worthwhile to wager on microservices structure. So, a programming language like Ruby is required to include into your private monetary software program stack—to deal with massive numbers of simultaneous customers.

Tech Stack and APIs for Private Finance Apps: Scalability Potential

As we embark on choosing the related software program applied sciences in your private finance app growth, have in mind essentially the most essential challenges in —safety and efficiency.

From this angle, right here’s the checklist of essentially the most related applied sciences in your private accounting app undertaking:

1. Entrance-end Applied sciences for Your Private Finance App

- React Native: Permits cross-platform app growth, permitting the identical code to run on each iOS and Android units. It reduces growth time and prices whereas sustaining excessive efficiency and a local feel and look.

- Databases: MongoDB, Specific.js, Node.js, Angular. For shoppers wanting a scalable cross-platform monetary app, they’d be an awesome alternative.

2. Again-Finish Applied sciences

- Python programming language is a well-liked know-how for simplicity and open-source frameworks like Django and Flask. This alternative offers your private finance app undertaking with flexibility and sturdy measures. The language can also be well-adapted to funding and AI trades.

- Java language comes up as a related alternative when you want an enhanced surroundings for the app. Its Spring framework backs up enterprise-level initiatives with scalability choices.

- Kotlin and Node.js are a great decide for creating real-time private finance apps (e.g., banking apps) leaving the likelihood for a lot of simultaneous connections.

3. Database Applied sciences

- SQL Databases (MySQL or PostgreSQL) will give your utility knowledge integrity and reliability, and empower the app with the likelihood to construction knowledge and transactions.

- NoSQL Databases. Quite the opposite, Cassandra and MongoDB databases will let you scale the performance of your private finance utility horizontally and alter it as wanted.

4. Cellular Improvement

- React Native: A go-to framework for constructing apps that work on each Androids and iPhones with one codebase.

- Flutter: Google’s toolkit for creating high-performance apps for cellular, net, and desktop, all from a single codebase with interesting designs.

- Ionic: A versatile, open-source framework utilizing net applied sciences (HTML, CSS, JavaScript) to make glossy, cross-platform apps.

5. APIs

As for the checklist of APIs to construct your private finance software program, will probably be primarily based on the geographic location of your accomplice financial institution and the technical complexity of your private finance utility.

Usually, the app’s customers are in control of unclosing their private info, which helps your finance app study the person’s knowledge and improve the productiveness of the software.

Value of Constructing a Private Finance App

If you perceive the know-how behind creating private monetary planning software program, the following step is to learn the way lengthy it takes to develop a private finance app.

The reply can’t be simple as there are numerous components to remember. The bills for the event of a private finance app normally begin from $37,500. This funds line can fluctuate between $25,000 and $50,000. The ultimate value of a private finance app will depend on:

- App performance and complexity of options

- What cellular platforms and units your app will operate on

- Third-party integration factors

- UI/UX integration

- Smartphone {hardware} options: GPS navigation, AR and NFC applied sciences, and extra

- Upkeep plan

Apps growth fluctuates relying on the workforce location, your private finance app tech stack concerned, its performance, and superior options included within the product on private monetary software program planning.

So, let’s see the charges per hour in several areas: USA – $70-150, Canada – $60-120, Western Europe – $65-130, United Kingdom – $45-100, Jap Europe – $30-65, India – $20-50.

Additionally, have in mind the potential for an MVP creation, if you wish to check solely the fundamental options of your private monetary software program product on first customers and get priceless suggestions with out losing assets on enriched app performance. The price of this product could range from $22,500 to $27,500.

Superior options to incorporate:

- Tailor-made alerts to fit your shopper or your undertaking wants ($30-100)

- Integrating the app with banks and monetary establishments ($200-300)

- Calculating money owed payoff ($50-150)

- Tax management ($100-150)

- Planning retirement instruments ($100-300)

- Funding evaluation instruments ($100-300)

As a rule, software program growth corporations embody contingency prices of their undertaking funds. Additionally, keep in mind in regards to the fixed upkeep and updating of the launched app within the lengthy view.

How Lengthy Does It Take to Construct a Private Finance App?

It’s clear sufficient that the time for constructing every function in a private finance app can range relying on the shopper calls for for the app, the options’ complexity, and the applied sciences concerned, however a decrease certain line for primary options is the next:

- Budgeting – 50-150 hours

- Monitoring the spending – 50-100 hrs

- Reminders on payments – 30-100 hrs

- Safety – 100-300 hrs

- Objective setting – 50-150 hrs

If we take a generalized time schedule, the pure app growth course of takes round 470 hours. But, within the case of constructing an MVP or a extremely upgraded options stack, a private finance app value will shift from 470 to 800 hours.

How you can Guarantee App Safety: Optimised Ideas for Private Finance Apps Safety

Maintaining your private finance app safe is tremendous vital, particularly in relation to defending delicate monetary data. We are able to divide the very best safety practices into blocks in accordance with performance:

- Consumer safety ideas: privateness and person consent, safe authentication and authorization.

- Safe design ideas.

- Practices of schooling on person safety: fixed safety schooling and coaching of customers. Compliance with regulatory requirements, ongoing updates and patch administration, testing, and auditing safety practices.

- Knowledge minimization and encryption, managing third-party dangers, protected storage, and transmission of knowledge.

- Monitoring and log administration, common safety assessments, and evaluations.

Last Phrase: SCAND’s Experience in Fintech App Improvement

Misplaced within the turbulent ocean of software program growth? Don’t know what to select? You could pay attention to the recommendation, and the non-public finance instruments and applied sciences supplied within the article. This can assist clear up your thoughts in regards to the means of your private finance app growth.

One other manner of creating a correct choice is to stay to long-standing professionals out there who adhere to high quality and person comfort. So, achieve priceless insights into SCAND’s full experience in private software program growth.

With a must construct a private finance app tailor-made to your organization’s calls for, a digital banking service, or a fintech fee answer, the corporate holds on to the highest software program growth requirements.

In a high-demand safety area like fintech software program growth providers, SCAND stands out from the group. SCAND’s progressive turn-key and custom-made options deliver people and company shoppers distinctive privateness safety and safety.

Furthermore, with 20+ years within the cellular and desktop growth area, we flip the usage of SCAND merchandise into a cushty and well-protected person expertise.